Global market confidence wanes due to discouraging macroeconomic news

The activity in the financial markets has subsided due to the vacation season (photo: facebook.com/NYSE)

The activity in the financial markets has subsided due to the vacation season (photo: facebook.com/NYSE)

Weekly overview of financial markets from the Head of Corporate Research at ICU Group, Olexander Martynenko.

The vacation season has reached its peak, so the activity in the financial markets has noticeably subdued. The same market participants who continue to operate had few reasons last week to increase their asset purchases. Instead, there were plenty of reasons for concern.

Once again, credit ratings became a source of unpleasant surprises. A week earlier, the lowering of the U.S. government debt credit rating by the Fitch credit agency sent shivers through the markets. This time, Moody's Agency lowered the ratings of ten small and medium-sized U.S. banks and placed the ratings of six major American banks under review with the possibility of downgrades. As a consequence, there were sell-offs in the banking sector and beyond.

The key event of the past week was the release of U.S. inflation data for July, which evoked mixed feelings among investors. On one hand, the growth of the U.S. consumer price index turned out to be slightly lower than expected, although many had feared unpleasant surprises. On the other hand, inflation acceleration still occurred. Moreover, the core component of the index, which excludes changes in energy and food prices and is mostly relied upon by the Federal Reserve System, although somewhat slowed down, remains at an excessively high level of 4.7%. Thus, the initial rally of relief subsided on the day the data was published. Towards the end of the week, it became apparent that producer prices did not meet expectations for a slowdown and remained at the same annual level of 2.4%, which the markets did not appreciate.

The overall sentiment was dampened by weak results of the U.S. 30-year bond auction: due to insufficient demand, the Treasury had to increase the yields of the new issuance above market levels to 4.189%. This indicated expectations of further credit cost increases and led to upward movements in other yields. Yields on ten-year bonds ended the week 12 basis points higher.

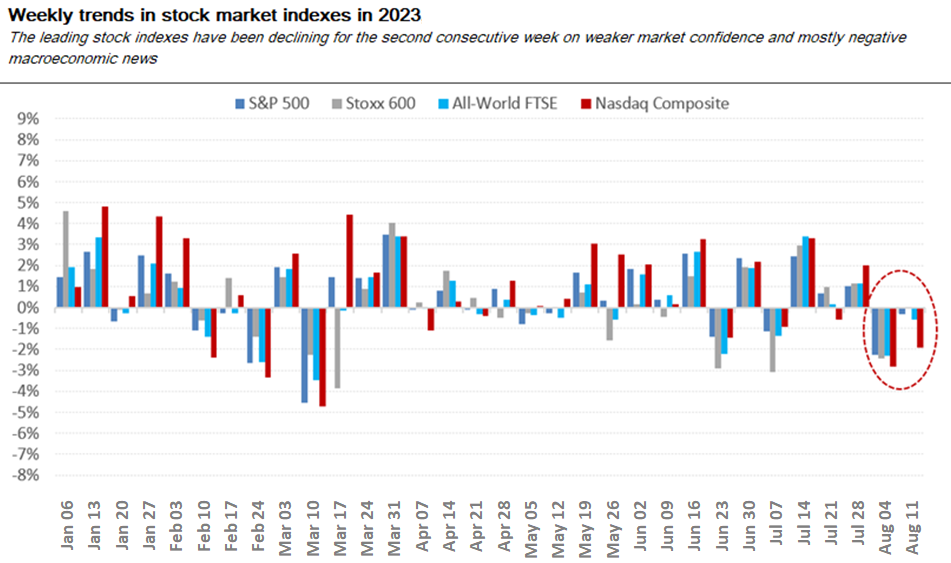

U.S. stock indexes were down for the second consecutive week, with the S&P 500 declining by 0.3%. The technology-focused Nasdaq Composite index, in particular, suffered a decline of 1.9%. Many observers attribute this to the detrimental impact of rising bond yields. However, even more rapid yield growth did not seriously impede the surge in tech stock prices in previous months. Rather, the owners of these stocks seem to have found sufficient reasons to reduce their positions (at least partially) and lock in profits.

Source: Bloomberg, ICU

Source: Bloomberg, ICU

Finally, the significant disappointment of the week stemmed from poor macro news from China. Consumer prices in the country decreased in July, once again indicating the precarious state of consumer demand and triggering deflation. Chinese producer prices also fell last month for the second time, which was reflected in weak figures for external trade – a year-on-year decline of 14.5% in Chinese exports and 12.4% in imports for July.

An increasing number of analysts are now talking about the exhaustion of the Chinese recovery effect following the lifting of COVID-19 restrictions, which were heavily bet upon earlier in the year. Simultaneously, hopes for new robust stimulus packages currently remain mere aspirations; the authorities cannot afford to burden the already heavily leveraged economy with more debt. Consequently, China's weakened economy is becoming an even greater global concern. The steep drop in Asian market stocks significantly contributed to the global stock index decline of the previous week.