Sleeping giant: Europe's lagging defense industry and what it means for Ukraine

Ursula von der Leyen and a German soldier with a Puma infantry fighting vehicle in the background (photo: Getty Images)

Ursula von der Leyen and a German soldier with a Puma infantry fighting vehicle in the background (photo: Getty Images)

Can the European Union replace US weapon supplies to Ukraine? Why is Europe's arms production growing so slowly, and what role can Ukraine play in the European defense industry? Read the article by RBC-Ukraine to find out more about this.

Contents

- Insufficient capacities

- European defense industry and US - risk of blockage

- Reason Europe is so slow in increasing arms production

- Future plans of European Union

- It's not just about money

- Ukraine as Europe's savior

After three years of large-scale war, and despite tremendous efforts to develop its own defense industry, Ukraine remains critically dependent on foreign arms supplies.

"33-34% of all weapons in Ukraine today are domestically produced, out of 100% of what we need per year. This is significant growth because it used to be less than 10%. Around 30% comes from Europe, and more than 30%, close to 40%, comes from the United States," Ukrainian President Volodymyr Zelenskyy said on January 15.

This dependency could become critical for Ukraine in the near future - especially during negotiations to end the war if the new US President, Donald Trump, decides to exert excessive pressure on Moscow and Kyiv. Not to mention that Trump's team, in general, has a skeptical stance on providing weapons to Ukraine.

This issue doesn't only concern Ukraine. As RBC-Ukraine previously reported, several countries do not rule out a direct Russian attack on NATO's European members within a few years.

As Trump consistently emphasizes, European countries must balance trade with the US, or he will impose trade tariffs. Furthermore, within NATO, European alliance members must spend significantly more on defense - 5% of GDP. If this doesn't happen, the US leader has threatened not to defend Europe in the event of Russian aggression.

Even if such a scenario seems unlikely, the US itself has finite weapon reserves and needs to replenish its stockpiles - replacing the weapons that were sent to Ukraine during Biden's presidency.

Therefore, the European defense industry faces a dual challenge: rearming Europe itself and replenishing its arsenals while continuing arms supplies to Ukraine. On February 8, European Commission President Ursula von der Leyen stated that Europe needs a defense surge.

"The new political cycle marks the beginning of a new era in European defense. After three years of Putin’s war, we have increased our military production, but it’s not enough. We must do more," the European Commission President said at a press conference in Poland.

The goals are ambitious and clear, but achieving them won't be easy.

Insufficient capacities

According to President Zelenskyy, Ukraine's European partners could increase their arms production by two to three times, but they have yet to take such steps.

Only 20-25% of the weapons Ukraine receives from the European Union are actually produced in EU member states. The rest are purchased from abroad. These figures were revealed by the new European Commissioner for Defense and Space, Andrius Kubilius, in December of last year.

The current capacity of Europe's defense industry is frankly surprising - and not in a good way. Here are some illustrative examples of European defense production capabilities.

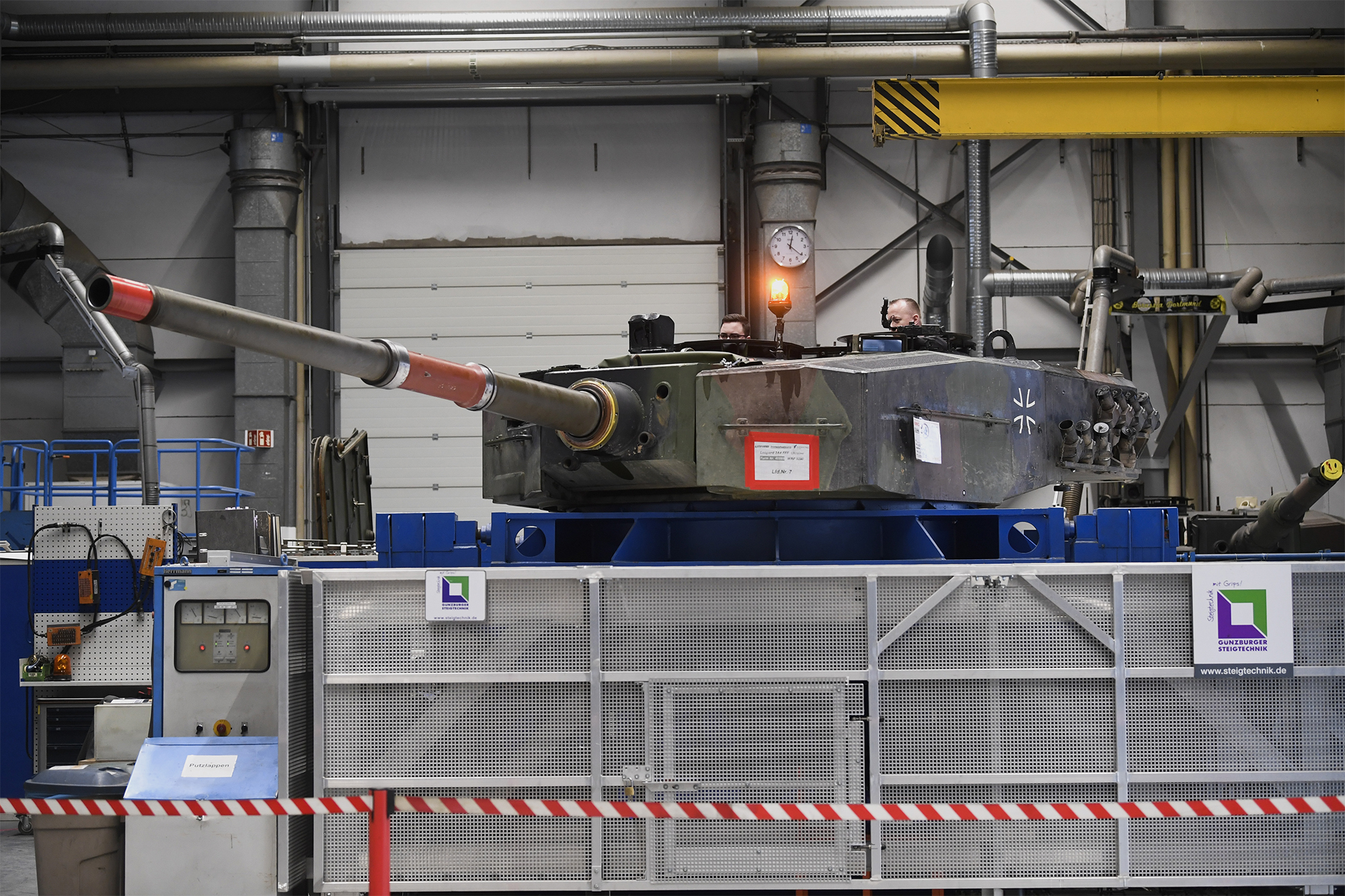

Germany, Europe's largest economy, can produce only 40 to 50 Leopard 2A8 tanks per year, according to Ralf Ketzel, CEO of KMW, the tank manufacturer, in an interview with ARD. In the early 1990s, the company could produce one tank per day (about 365 annually). Demand for German tanks remains high; Hungary and Norway, for example, have placed orders for several dozen units. However, production capacity is insufficient, and it takes approximately two years from order placement to delivery of a single tank.

Assembling the Leopard-2 tank (photo: Getty Images)

In spring 2024, France was producing six Caesar self-propelled howitzers per month. By November, the Ministry of Defense reported an increase to 12 units per month - 144 per year. These are official figures from the Danish Ministry of Defense, which ordered them for Ukraine. Although the production cycle was halved, it still takes 15 months to produce one howitzer.

Perhaps the most illustrative case is the promised delivery of one million 155-mm artillery shells to Ukraine by March 2024. The ammunition eventually arrived - but only in November.

"When we promised to reach a production level of one million shells per year by spring, we didn't know what the actual production capacity was - and it was not as large as we thought. Now we have that production capacity," explained Josep Borrell, the EU's chief diplomat, in an interview with European Pravda in November of last year.

By 2025, around two million shells will be produced in EU countries - a number that does not even cover Ukraine's needs, let alone replenish Europe's stockpiles.

For Ukraine, the situation is further complicated by the fact that the EU budget cannot directly purchase weapons or invest in their production outside the European Union, which could have been a temporary solution until new production facilities were established within the EU. This is only possible through funds from the separate European Peace Facility or frozen Russian assets. However, these funds are limited. According to the European Defense Commissioner Andrius Kubilius, Ukraine will receive around 30 billion euros from the EU in 2025 and will decide for itself how much to allocate for weapons procurement.

European defense industry and US - risk of blockage

Europe's defense industry is generally quite self-sufficient, although the degree of autonomy varies by country, said Taras Yemchura, Head of the Defense Policy Sector at the BRDO Office for Effective Regulation, in an interview with RBC-Ukraine.

"France has historically sought strategic independence and tried to produce the full spectrum of weapons on its own. However, this approach is extremely expensive. Most other European states rely on military-technical cooperation since very few types of weapons can be developed solely by one country nowadays," Yemchura explained.

Even the US involved over 20 countries in the F-35 fighter jet project, he noted. Such developments are too costly even for the world's wealthiest nation.

"Therefore, the defense industries of NATO countries, including the US, form an interdependent ecosystem. In my opinion, this cooperation will continue," Yemchura added.

F-35 during military training in Estonia (Photo: Getty Images)

At the same time, Europe is a significant market for American arms manufacturers. According to the Stockholm International Peace Research Institute, from 2019 to 2023, about 55% of Europe's total arms imports came from the US, primarily combat aircraft, helicopters, and air defense systems.

Roman Bezsmertny, a politician and ambassador extraordinary and plenipotentiary, believes that the EU has enough leverage to negotiate with the US President on arms issues and other aspects of bilateral trade by offering concessions in certain areas.

"There are numerous ways to resolve the trade balance issue, including changes in consumption structure and appropriate measures by the European Central Bank and the US Federal Reserve. It's not a reason for the uproar Donald Trump is causing, but it's typical of his style," Bezsmertny said in an interview with RBC-Ukraine's YouTube channel.

Reason Europe is so slow in increasing arms production

The defense industry in the European Union faces several long-standing issues. For a prolonged period, EU countries reduced defense spending, particularly during the decade from 2008 to 2018.

"If we compare the EU's defense spending to that of the US or China, it's clear that Europe has long been less willing to invest in its own defense," Yemchura told RBC-Ukraine.

This becomes especially evident when looking not at the entire defense budget but at investments in procuring new weapons systems and R&D (research and development).

According to the European Commission, between 2006 and 2022, the investment deficit in this sphere amounted to €425 billion in 2024 constant prices. As a result, no new defense enterprises were opened. Existing ones operated far below full capacity. Moreover, a significant portion of EU defense products was, and still is, exported to third countries under long-term contracts.

Shell production (photo: Getty Images)

Everything changed, albeit not immediately, after Russia's aggression against Ukraine in Crimea and Donbas, followed by the full-scale invasion. According to the European Defense Agency, since 2018, spending on procuring new weapons systems and R&D has steadily increased. In 2023, it reached a record 26% of defense budgets or over €100 billion in absolute figures. This is three times more than in 2014.

But it's still not enough. In 2023, the US spent €129 billion on defense research and development, while EU countries combined allocated only €11 billion.

"But if we look at the trend, today's Europe is far ahead of its past self. The current growth rates indicate that the European defense industry is gaining momentum," Yemchura asserted. "This is a large, inertial process governed by market laws, but it is already clear that Europe is moving in the right direction."

The understanding that much work remains ahead is present within the EU itself.

"Still, such an increase is insufficient and will not offset past underinvestment having generated capability and industrial gaps. It is therefore essential to discuss with Member States how these gaps can be addressed," the European Commission said in response to RBC-Ukraine's request.

In addition, there are issues related to the availability of skilled personnel, the preservation of the engineering tradition, and access to certain critical resources.

Future plans of European Union

The EU is aware of these problems and is attempting to resolve them, but progress remains slow. Only in the spring of 2024 did the European Commission develop a Defense Industry Development Strategy. This strategy includes increasing the procurement of equipment and weapons within the EU. In addition, it plans to designate flagship defense projects and ensure defense companies have access to financing.

In the current structure of the European Commission, a separate Commissioner for Defense and Space has been appointed - Lithuania's representative, Andrius Kubilius. His task is to coordinate the implementation of the strategy.

By March, the European Commission plans to present a "White Paper" on the future of European defense. This document is expected to form the basis for member states to make the necessary decisions at the EU's scheduled summit in June.

An important milestone in this regard was the informal meeting of EU leaders on February 3 in Brussels, dedicated to defense issues.

"In fact, this meeting indicates the implementation of completely new approaches to the development of Europe's defense industry. There was a completely new phrase: 'Ukraine will receive help for as long as it is needed and in the form Ukraine requires.' In other words, the new European leadership understands the current situation. Moreover, they no longer talk about 'if' but rather about solving the first, second, third, and fourth issues," noted Roman Bezsmertny.

The EU also plans to strengthen cooperation with NATO members that are not part of the EU, including the US, Canada, the UK, and Norway. As the European Commission responded to RBC-Ukraine, strengthening European defense will make NATO stronger.

Commander of the US Armed Forces in Europe Christopher Cavoli at the NATO Defense Ministers' Summit in October last year (photo: Getty Images)

A greater emphasis is also being placed on coordinating the efforts of various member states. One of the EU's goals is to support member states in fulfilling their national and international commitments, particularly those made to NATO.

"To ensure coordination, staff-to-staff exchanges with NATO International Staff are organized on a regular basis, in particular, to identify issues that will require further clarifications or intervention. Enhanced cooperation with NATO on defense industrial matters is ensured through a dedicated structured dialogue started in 2024," the European Commission noted in response to RBС-Ukraine.

Last year, European Commission President Ursula von der Leyen stated that €500 billion needed to be invested in the European defense industry over the coming years. Andrius Kubilius was less ambitious, calling in December for approximately €100 billion to be allocated for defense in the EU's next seven-year budget.

However, finding such an amount is challenging, especially in the face of a potential trade war with the US, which could severely impact European economies. One way to secure funding would be to increase budget deficits in EU member states. The problem is that the EU's budget rules do not allow countries to excessively increase their deficits. According to Politico, von der Leyen plans to allow deficit increases as an exception specifically for defense spending.

In the context of private arms manufacturers, several other options are being considered:

- Issuance of joint debt obligations or preferential loans for defense companies from the European Investment Bank.

- Loans from private banks.

This is a general concept, but there are many disagreements regarding the details.

Firstly, where to procure equipment for new defense enterprises. Procurement within the EU would have a more significant impact, as smaller subcontractors would develop alongside large enterprises. However, this would slow down the expansion of defense capacities. France supports this approach.

Poland, the Netherlands, and Germany advocate purchasing equipment outside the EU. Although part of the funds would naturally flow out of the EU, new defense capacities could be created more quickly.

Another point of contention is how to involve non-EU countries such as the United Kingdom, Norway, Canada, and the US. On the one hand, developing a more autonomous European defense industry would reduce dependence on Trump's whims. On the other hand, involving the US in new defense projects is a way to appease the new Head of the White House.

It's not just about money

The arms market significantly differs from any other. From the outside, it may seem like a typical competitive market with many suppliers and numerous buyer countries. However, the reality at the micro level is quite different.

"In a company producing arms, there is usually only one client - the government. Likewise, the government often has only one supplier for many categories because it's more efficient to standardize logistics, maintenance, and capability lifecycles under a single platform for decades," explained Taras Yemchura.

This makes the defense industry unique, where cooperation between the state and industry is key. The most significant incentive for defense investments is clear and long-term government policy.

"Multi-year defense budgets, stable orders, and support through government programs create the necessary foundation for development. For the private sector, additional incentives include tax breaks, public-private partnerships, and export facilitation," Yemchura emphasized.

Andrius Kubilius (photo: Getty Images)

For both the public and private sectors, transparent planning is essential, enabling not only the production of modern weapons but also their effective maintenance and integration over many years. There's no simple recipe; everything is simultaneously straightforward and complex.

In theory, expenses could be planned in advance, guaranteeing at least some contracts. However, the situation remains highly dynamic. Technologies change, warfare evolves, and what was relevant six months ago may lose value due to new enemy advancements.

"In my opinion, the biggest incentive will be regular, open, and honest dialogue between the customer and supplier, as well as adherence to agreements by both parties," Yemchura concluded.

Ukraine as Europe's savior

Surprisingly, in this situation, Europe may be saved by Ukraine. Just as the Defense Forces destroy Russian troops on the battlefield to prevent them from attacking EU countries, Ukrainian enterprises in the defense sector have already become an important part of Europe's defense industry.

Two important factors bring Ukraine closer to the EU in the military-industrial sphere. The first is Ukraine's experience in conducting modern warfare. The second is the desire of Ukrainian defense companies to scale up, which is quite difficult to achieve without regular exports and sustained access to financing.

If the EU has funds but lacks production capacity, Ukraine often faces the opposite situation - capacity has emerged, especially in the private sector, but the state does not always have the funds. According to the government project ZBROYARI, Ukrainian manufacturers are capable of producing three times more weapons and military equipment than the budget can purchase.

The solution lies in the direct procurement of Ukrainian weapons by European partners for the needs of Ukraine`s Defense Forces. Denmark was the first to propose this approach, and later a number of other countries joined in. Last year, under the "Danish model," the Defense Forces received weapons worth nearly 538 million euros.

In the future, this could involve the transfer of technologies and licensed production of Ukrainian weapons abroad or trilateral agreements, where part of the production goes to the partner country, and the rest remains in Ukraine.

There is already an understanding of what to do, but the bureaucratic processes in the EU may delay even the best initiatives for years. Of course, each country is trying to do what it can within its capabilities and budgets. However, in the current turbulent situation, delays threaten fatal consequences.

Sources: data from the Stockholm International Peace Research Institute (SIPRI), the European Defense Agency, statements from Ukrainian President Volodymyr Zelenskyy, European Commission President Ursula von der Leyen, European Commissioner for Defense and Space Andrius Kubilius, materials from ARD, European Pravda, Politico, Financial Times, the European Commission's response to RBC-Ukraine's request, and comments from Taras Yemchura, Head of the Defense Policy Sector at the BRDO Office for Effective Regulation.