China's invasion of Taiwan could cost global economy $10 trillion - Bloomberg

Xi Jinping (Getty Images)

Xi Jinping (Getty Images)

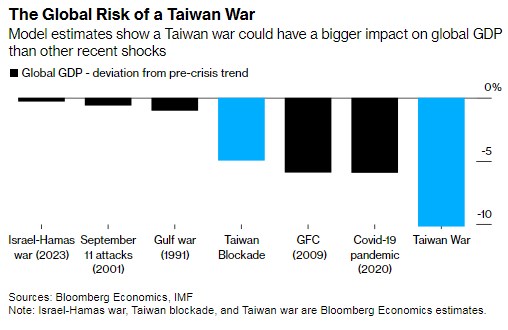

China's military invasion of Taiwan will cost the global economy $10 trillion. This corresponds to about 10% of global GDP, dwarfing the impact of Russia's war against Ukraine, the COVID pandemic, and the global financial crisis, according to Bloomberg.

According to the agency, China's growing economic and military power, Taiwan's growing sense of national identity, and the difficult relationship between Beijing and Washington mean that the conditions for a crisis are there. Given that the relationship between the two sides of the strait is on the ballot, Taiwan's January 13 elections will be a potential flashpoint.

At the same time, few believe that a Chinese invasion is highly likely. The People's Liberation Army is not concentrating troops along the coast. Reports of corruption in the Chinese army cast doubt on President Xi Jinping's ability to conduct a successful campaign. U.S. officials say that tensions eased somewhat at the November summit between President Joe Biden and Xi Jinping, who promised to take steps to attract foreign investors.

Nevertheless, the outbreak of Russia's war against Ukraine and the Israeli-Gaza conflict are a reminder of how protracted tensions can escalate into conflict. Everyone from Wall Street investors to military planners and many businesses that rely on Taiwanese semiconductors is already trying to hedge against the risk.

National security experts at the Pentagon, think tanks in the United States and Japan, and global consulting firms are considering scenarios ranging from a Chinese maritime "quarantine" of Taiwan to a Chinese takeover of Taiwan's outlying islands and a full-scale Chinese invasion.

Jude Blanchette, a China expert at the Center for Strategic and International Studies, says that interest in the Taiwan crisis among the multinationals he advises has soared since Russia invaded Ukraine in 2022. According to him, this topic comes up in 95% of conversations.

Russia's invasion of Ukraine and the semiconductor shortage as the world reopened after the COVID lockdown gives a small glimpse of what is at stake for the global economy. The consequences of a war in the Taiwan Strait would be much more significant.

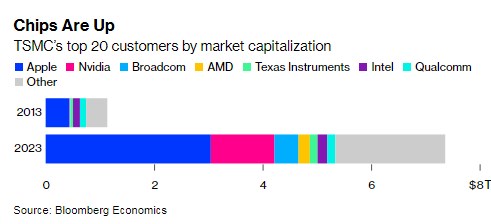

Taiwan produces most of the world's advanced logic semiconductors, as well as many chips. Globally, 5.6% of total value added comes from sectors that use chips as direct inputs - almost $6 trillion. The total market capitalization of the 20 largest customers of the chip manufacturing giant Taiwan Semiconductor Company is about $7.4 trillion. The Taiwan Strait is one of the busiest sea lanes in the world.

Modeling the price of the crisis

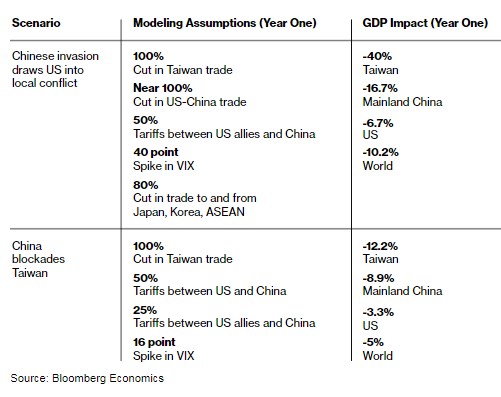

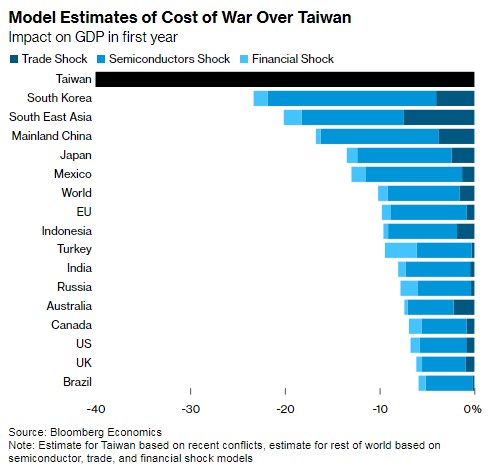

Bloomberg Economics modeled two scenarios: a Chinese invasion that draws the United States into a local conflict and a blockade that cuts Taiwan off from trade with the rest of the world. A set of models is used to estimate the impact on GDP, taking into account the impact on semiconductor supplies, disruptions in regional shipping, trade sanctions and tariffs, and financial markets.

For the main players, other major economies, and the world as a whole, the biggest blow will be the lack of semiconductors. Laptop, tablet, and smartphone production lines, where high-quality Taiwanese chips are an indispensable "golden screw," will come to a standstill. The automotive and other industries that use lower-end chips will also be hit hard.

Barriers to trade and a significant risk shock to financial markets would increase costs.

In case of war:

- Taiwan's economy would be destroyed. Based on recent conflicts, Bloomberg Economics estimates a 40% hit to GDP. The population and industrial base centered on the coast will increase human and economic losses.

- Due to the breakdown of relations with major trading partners and lack of access to advanced semiconductors, China's GDP will fall by 16.7%.

- In the United States, which is further away from the center of events but still has a lot at stake (for example, due to Apple's dependence on the Asian electronics supply chain), GDP will decline by 6.7%.

- Globally, GDP will decline by 10.2%, with South Korea, Japan, and other East Asian countries suffering the most.

The key assumption in this scenario is that the United States will be able to enlist the support of its allies to impose coordinated and tough economic sanctions against China.

U.S. officials say that China's reaction to then-U.S. House Speaker Nancy Pelosi's visit to Taipei in August 2022 helped convince other G7 countries that the risk of conflict was real. Beijing perceived this as a change in the status quo that made Xi Jinping look weak, especially after local commentators suggested that China could prevent the landing in Taipei.

The fallout from Pelosi's visit, during which China conducted large-scale naval exercises seen as a blockade drill, helped solidify the diplomatic response for concerted action, U.S. officials say.

"China's rhetoric and the People's Liberation Army's response to Pelosi's visit has triggered a wave of quiet corporate contingency and scenario planning," says Rick Waters, managing director of the China practice at Eurasia Group and a former senior China policy official at the State Department.

Bloomberg Economics also modeled what a year-long blockade of Taiwan by mainland China would mean for the global economy:

- For Taiwan, a small open economy that thrives on trade, GDP will decline by 12.2% in the first year.

- For China, the United States, and the world as a whole, GDP in the first year would decline by 8.9%, 3.3%, and 5%, respectively.

The reason for the lower impact compared to the military scenario is that while the global economy still loses access to all of Taiwan's benefits, other shocks-including tariffs between the United States and its allies and China, disruption of Asian shipping, and financial market impacts-are lessened.

Earlier, Taiwan tightened sanctions against Russia to halt arms production. Ukraine's plight has aroused widespread public sympathy in Taiwan because of what many see as a parallel between what is happening in the European country and what could happen if China ever uses force to bring an island it calls its territory under Chinese control.