Drop of gas in sea of politics. Situation in EU after Russian transit halt via Ukraine

Gas transit through Ukraine is stopped: what are the consequences (photo: Getty Images)

Gas transit through Ukraine is stopped: what are the consequences (photo: Getty Images)

The suspension of Russian gas transit through Ukraine two weeks ago did not create problems for either the Ukrainian side or the EU. Is there a risk of gas shortage and what is happening with prices read in the RBC-Ukraine article.

Contents

- Gas storage facilities are emptying faster

- Slovakia and Hungary admit they will survive without transit

- Ukraine needs to start importing gas by spring

- Naftogaz will be able to resume gas imports in the coming days

The transit of Russian gas through Ukraine stopped on January 1, 2025. As a result, the EU market lost 5% of its gas - about 14-15 billion cubic meters have been transiting through Ukraine over the past two years.

According to the latest data, gas reserves in storage facilities in Europe and Ukraine allow us to get through the winter without any risks, even though gas is being used more actively this season than in the past. Only Transnistria, which is experiencing a shortage of gas, has faced problems. However, the situation there is not hopeless — the official Chisinau offers to help the separatist region. In addition, Russia can continue supplying gas there through Türkiye.

By the second decade of January, according to Bloomberg, the EU's storage capacity had dropped to almost 70%, while last year it was 86% at the same time. This is one of the lowest levels in the last few years.

Gas storage facilities are emptying faster

There are several reasons for the increase in gas consumption. First, the weather is colder than last year. Fewer sunny days reduce the potential for solar generation. Secondly, in a number of EU countries, industrial production increased by almost 6% in 2024, according to the FT. Accordingly, gas consumption has also increased.

However, the situation with the EU's gas reserves for the winter period does not cause any particular concern, said Volodymyr Omelchenko, Director of Energy Programs at the Razumkov Center. In his opinion, the reduction in reserves is fully justified and not abnormal. In addition, the EU can increase the supply of liquefied gas, so no shortage should be expected.

“Yes, it is true that gas reserves in underground gas storage facilities in Europe are now somewhat lower than the average for the last five years at this time, but higher than in the 2018 season. There are no problems with this so far. In the EU, gas consumption has decreased since 2022, but opportunities to receive LNG (liquefied natural gas - ed.) from the world's leading gas-producing countries - Qatar, the United States, Norway, and others - have increased,” Omelchenko said in a comment to RBC-Ukraine.

Hennadii Riabtsev, director of the Psychea Center, also sees no reason to worry about gas reserves in the EU. “Storage facilities are filled with gas to use later. So far, there has been a stable trend of 0.4% per day (of reserves utilization - ed.). Currently, the occupancy rate is about 70%. But given the weather conditions, I mean the low temperature, this is quite normal,” Riabtsev told the agency. He believes that gas reserves in the EU are guaranteed to last for two months of possible cold weather.

The persistence of relatively low gas prices confirms that there are no negative consequences of the termination of transit through Ukraine. There have been no serious fluctuations in the stock exchanges recently. Riabtsev believes that this was predictable.

“Quotes can be affected by something sudden: either an accident or a boycott. And the termination of transit was known back in July, as there were no applications for reserving GTS capacities for the next year,” the expert noted.

Moreover, in December, when it became clear that there would be no continuation of transit, the gas price in the EU was even decreasing. “At the end of December, the temperature changed, went down, the volume of extraction increased, and prices returned to the level of early December. Now it's about 530 euros per 1,000 cubic meters,” Riabtsev explained.

The EU confirmed that Ukraine's decision to stop gas transit did not affect either the energy security of the countries in the region or consumer prices in the market.

European Commission spokesperson Anna-Kaisa Itkonen said last week that an emergency coordination group on gas met to assess the consequences of the end of the transit agreement, and it concluded that there are no problems or concerns about the security of supply for the European Union after the end of transit. As for prices, the markets have already taken this into account, and we have not seen any price spikes in the new year, she adds.

Slovakia and Hungary admit they will survive without transit

Slovakia and Hungary, which had been pushing for the preservation of transit until the last day, have not suffered from the lack of gas. However, they will have to increase the cost of purchasing gas. Both countries, which are used to cheap Russian energy resources, are understandably not happy about this situation. The heads of government in Bratislava and Budapest did not miss the opportunity to once again politicize this issue by blaming Ukraine.

Prime Ministers of Hungary and Slovakia Viktor Orbán and Robert Fico (Photo: Getty Images)

Prime Ministers of Hungary and Slovakia Viktor Orbán and Robert Fico (Photo: Getty Images)

At the end of last year, Prime Ministers Robert Fico and Viktor Orbán repeatedly tried to force Ukraine to continue gas transit. Sometimes, they even resorted to threats of cutting off electricity supplies and stopping aid to Ukrainian refugees.

Volodymyr Zelenskyy even offered Fico to compensate for the increase in gas purchases, which is about 500 million euros. But the offer was not accepted. As Zelenskyy later stated, Fico arrogantly refused. The President of Ukraine viewed the Slovak Prime Minister's behavior as playing along with Moscow.

“But the real problem is that he bet on Moscow, not on his own country, not on a united Europe, and certainly not on common sense. From the beginning, it was a losing bet...It was an obvious mistake for Fico to believe that his shadowy schemes with Moscow could go on indefinitely,” Zelenskyy said.

In early January, Fico admitted that without transit, there would be no problems with gas. Russia promised him that they would find a way to maintain supplies via bypass routes, in particular through the Turkish Stream. But on January 13, he asked Zelenskyy for a meeting in Slovakia near the border with Ukraine to continue negotiations on gas transit. Zelenskyy did not hesitate to respond, and just a couple of hours later, he agreed to the meeting. “Ok. Come to Kyiv on Friday,” the Ukrainian President wrote on the X.

Hungarian Foreign Minister Péter Szijjártó said that the security of energy supplies in the country would be ensured by diversifying gas supply routes.

Ukraine needs to start importing gas by spring

However, while the EU sees no risks for the winter, there are concerns about preparations for the next heating season. Bloomberg writes that while there is no risk of a gas shortage in the near term, rapid storage depletion could make it difficult to build up stocks ahead of the next heating season and could risk affecting short-term prices.

And this risk is not only in the EU. Ukraine entered the heating season with minimal gas reserves. As of mid-October, there were about 12.2 billion cubic meters in the UGS facilities. There is no more recent official data. A year earlier, by mid-October, there was almost a third more gas in the UGS facilities - 16 billion cubic meters.

This season, gas consumption has increased as thermal generation switched to it. In addition, gas consumption for domestic distribution increased after transit was suspended.

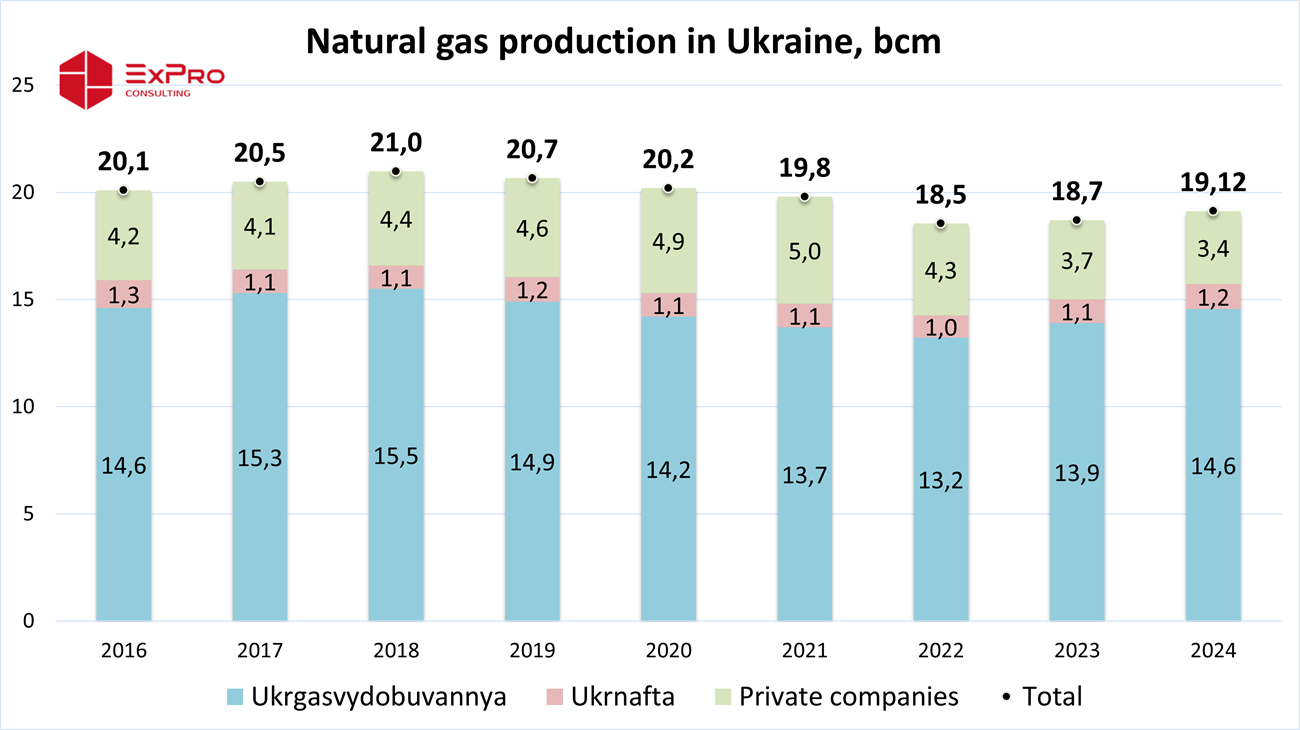

The recovery of gas production is slower than it could be. Last year, according to ExPro estimates, the growth was only 2.2%.

Dynamics of gas production in Ukraine (Graphics: ExPro)

State-owned companies increased production, while private companies began to produce less. This was due to the loss of the license for production at the Sakhalin field. Gas has not been produced there for more than a year, which is a loss of about 400 million cubic meters.

During the heating season of 2023-2024, about 6.7 billion cubic meters of gas were used from storage facilities. In the current one, the volume of withdrawals will be higher.

However, according to the latest analysis of the situation, there are no threats of gas shortages this fall and winter, a government source told RBC-Ukraine. “But to prepare for the next one, we need to start active gas imports now,” the source said.

According to the former head of the Gas Transmission System Operator of Ukraine, Serhii Makohon, with the existing gas reserves and without imports, Ukraine will come out of this winter with almost empty gas storage facilities. “Thus, in the spring and summer of 2025, 2.8-3.3 billion cubic meters will need to be imported to create gas reserves at the level of the current year,” he said.

Ukraine's Naftogaz will be able to resume gas imports in the coming days

In the summer, when prices were low, the Ukrainian Naftogaz company did not import gas. Purchases began only in September. However, at the end of last year, imports had to be stopped due to the threat of gas arrest to enforce an arbitration award in favor of the Italian company IUGAS. Ukraine's Ukrtransgaz temporarily took over gas purchases. However, it has limited capacity to do so, primarily financially.

Naftogaz has applied for payment to the Italians, but the issuance of a permit to transfer money was somewhat delayed due to the approval of the issue between the Cabinet of Ministers and the National Bank. According to the agency, on January 13, the National Bank of Ukraine permitted the payment, and on January 14, Naftogaz will be able to comply with the arbitration decision and pay IUGAS about $50 million, thereby returning the opportunity to continue gas imports.

But the cost of gas purchases will increase. If, in the summer, it costs up to $300 per thousand cubic meters in the EU, now the price is above $500.

As for the gas itself, the EU will have enough of it. At the end of last year, the European Commission offered the US to further increase LNG supplies to compensate for the loss of the Russian resource. This proposal is beneficial for the United States, which wants to replace Russia in the European energy market. Thus, Ukraine's gas supply may depend only on the availability of financial resources.

Sources: EC officials, Bloomberg, ExPro, comments of experts, and sources of the agency.