EU drains gas reserves at fastest rate since energy crisis - FT

Photo: Gas reserves in Europe are declining at the fastest rate in three years

Photo: Gas reserves in Europe are declining at the fastest rate in three years

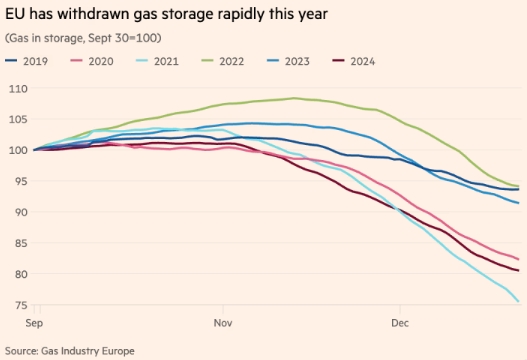

The European Union is depleting its gas storage reserves at the fastest rate since the energy crisis three years ago, driven by cold weather and reduced maritime imports, which have increased demand, the Financial Times reports.

According to the industry organization Gas Infrastructure Europe, the volume of gas in the bloc's storage facilities has decreased by approximately 19% since the end of September, when the gas markets' injection season ends, until mid-December.

In the previous two years, reductions during the same period were only in single digits, as higher-than-usual temperatures ensured relatively full storage during the winter heating season, and industry curbed demand due to high prices.

https://www.ft.com/

"This winter, Europe has had to rely much more on its underground storage than in the past two years to offset reduced imports of liquefied natural gas (LNG) and meet increased demand," said Natasha Fielding, Head of European gas pricing at Argus Media, a price reporting agency.

Europe has also faced greater competition for LNG imports from Asian buyers, attracted by prices lower than those in recent years. This has slowed imports and increased reliance on stored reserves.

The last time the continent's gas storage was depleted this rapidly was in mid-December 2021, when Russia began cutting pipeline gas supplies ahead of its full-scale invasion of Ukraine. EU storage levels are now at 75%, slightly above the 10-year average before Western European governments began reducing their dependence on Russian imports. Storage levels were close to 90% as of mid-December last year.

Low prices

Gas prices in Europe are currently about 90% lower than the peak of over €300 per megawatt-hour during the energy crisis in the summer of 2022. However, the depletion of reserves in the winter could make replenishing them more difficult and expensive next year. Traders are already pricing gas for delivery next summer higher than for delivery next winter, signaling increasing costs for refilling storage.

Under the European Commission's mandatory replenishment target, EU countries are required to fill their storage facilities to 90% capacity by early November, although some countries have set lower targets.

A significant portion of gas supplies now comes as LNG, which has become increasingly politicized recently. US President-elect Donald Trump warned the EU that it must commit to purchasing "large" quantities of American oil and gas or face tariffs. At the same time, Qatar threatened to halt LNG supplies if EU member states strictly enforce new legislation penalizing companies that fail to meet carbon emissions, human rights, and labor standards.

The US is the largest LNG supplier to the EU, and Qatar is the third-largest. Another factor driving the rapid depletion of reserves has been periods of cold weather in Europe, the so-called "Dunkelflaute" days - when neither solar panels nor wind turbines generate electricity - leading to increased demand for gas-powered electricity generation.

Anne-Sophie Corbeau, a research scholar at Columbia University's Center on Global Energy Policy, noted that industrial gas demand in nine northwestern European countries has "recovered from 2023 lows," increasing by 6% year-on-year from January to November.

Some countries have drained their reserves faster than others. In the Netherlands, stored gas volumes have decreased by 33% since the start of winter, while in France, the reduction has been 28%.

Russian gas flowing through Ukraine to Europe is also expected to cease by the end of next year when the transit agreement expires. This route accounts for about 5% of the EU's gas imports.

"There don't seem to be significant concerns" about the potential cessation of Russian gas supplies via Ukraine, said Andreas Guth, Secretary General of the industry organization Eurogas.

According to meteorologists, Europe is forecast to face its coldest winter since Russia's invasion of Ukraine. This could lead to rising energy prices as the continent depletes its gas reserves faster than usual.