China boosts Russian oil imports as India cuts back

Photo: China has become the main buyer of Russian oil (Getty Images)

Photo: China has become the main buyer of Russian oil (Getty Images)

Against the backdrop of US sanctions, China has become the key buyer of Russian oil, while India has cut its imports nearly threefold, according to Bloomberg.

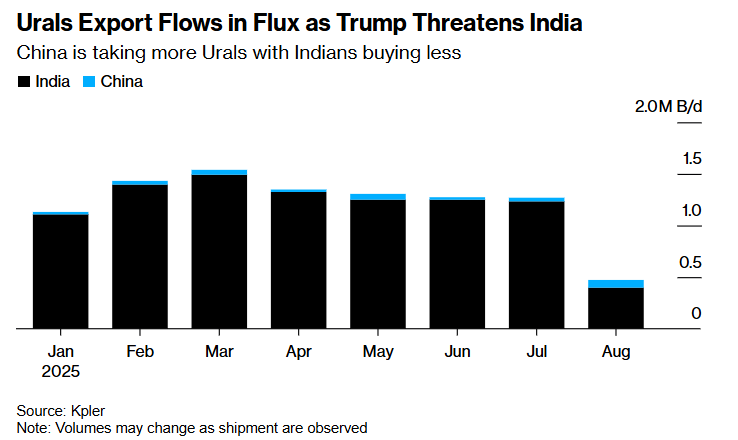

Chinese refiners have increased purchases of Russian Urals crude, taking advantage of a sharp drop in imports from India. According to Kpler data, Urals shipments to China reached nearly 75,000 barrels per day in August, double the average since the start of the year.

At the same time, exports to India fell to 400,000 barrels per day from 1.18 million previously. Experts note that Chinese refineries are in a stronger position to buy Russian oil compared to Indian companies.

US pressure and global reactions

The US has increased trade pressure on India by imposing additional tariffs on Indian imports. President Donald Trump said Washington will hold off on raising tariffs against China, citing progress in talks with Vladimir Putin.

This difference in approach has opened the door for Chinese firms to step up purchases of Russian crude. At the same time, the White House labeled India's oil buying as "opportunistic and deeply corrosive."

Oil flows and prices

According to Energy Aspects, Chinese refiners have already booked 10 to 15 cargoes of Urals for October and November, above normal levels. The grade is trading at a $1 premium to Brent, keeping it competitive.

Two Russian tankers are now waiting to unload off China’s coast — the Georgy Maslov and the Zenith — each carrying about 1 million barrels.

India loses ground

Indian refiners have so far stayed on the sidelines, holding back on new purchases. Analysts warn that excess Russian supply could force further discounts in search of buyers.

Without Chinese buying, Russia could face steep price declines for Urals. For now, China is the main factor stabilizing Moscow's exports.

Market impact

Despite US diplomacy aimed at ending the war in Ukraine, global oil and gas markets are unlikely to shift significantly. Sanctions and supply realignment have already transformed energy flows, with Europe largely cutting out Russian resources.

The International Energy Agency projects oil supply will outstrip demand by 1.76 million barrels a day in 2025 and by 3 million in 2026, limiting the impact of short-term disruptions linked to Russian exports.

White House trade adviser Peter Navarro recently said India has become a hub for refining cheap Russian crude, which is then exported as fuel to Europe, Africa and Asia. Revenues, he noted, are flowing to politically connected energy oligarchs and into Putin's war budget.

China, meanwhile, sees its ties with Moscow as strategic. Beijing has no intention of cutting Russian oil imports. Chinese and Russian firms have built a shipping and insurance network designed to sidestep Western sanctions.