Sanctions wreck Russia's energy, Trump's peace overtures won't help – Reuters

Photo: Russia is losing markets (Getty Images)

Photo: Russia is losing markets (Getty Images)

US President Donald Trump is actively engaged in negotiations to resolve Russia's war against Ukraine. However, even a successful conclusion of his diplomatic mission is unlikely to affect global oil and gas markets, according to Reuters.

According to a piece by columnist Ron Bousso, since 2022 Russia has faced multiple Western sanctions that have dealt a heavy blow to its oil and gas sector. Moscow's revenues have fallen sharply, while the global energy market has shifted.

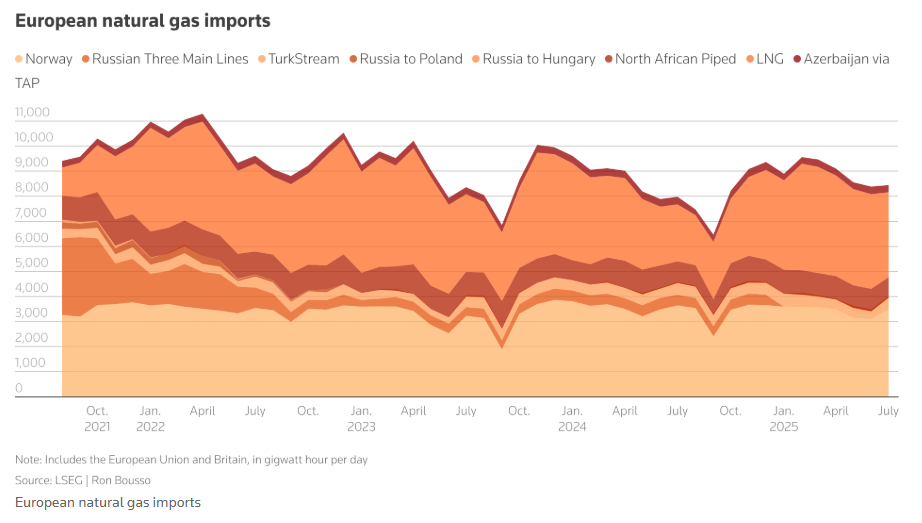

The share of Russian gas in EU imports dropped from 45% in 2021 to 18%, while the share of oil fell from 30% to 3%. The European Union plans to completely phase out Russian energy by 2027.

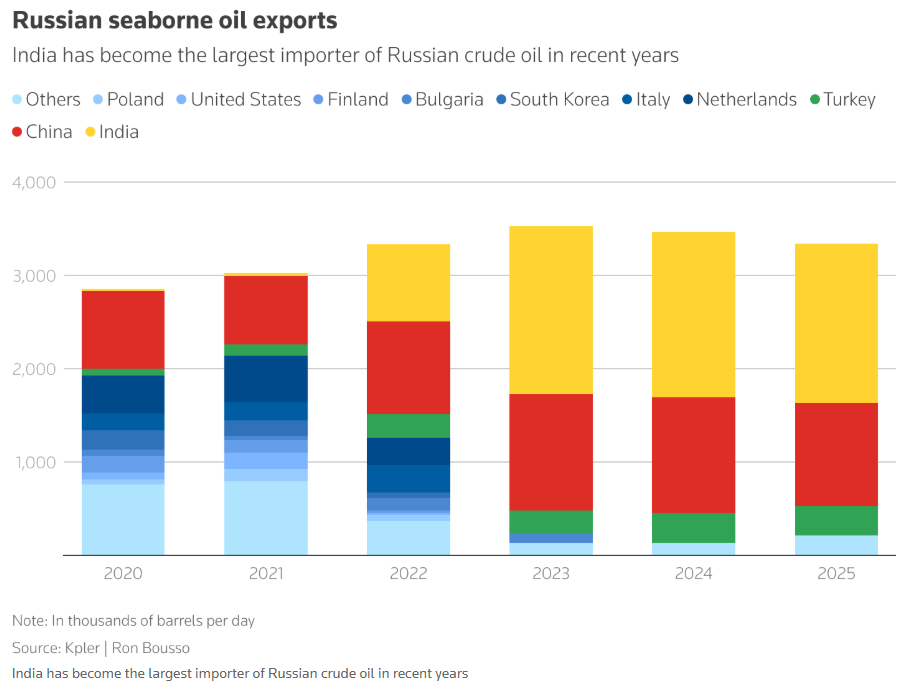

At the same time, India has increased its purchases of Russian oil to 38% of total imports, up from 16% in 2021. China and Türkiye have also significantly ramped up supplies.

Low chances for peace and energy fallout

A comprehensive peace deal in Ukraine remains unlikely. Trump is pushing for a broad settlement, but his approach has sparked divisions between the United States, Ukraine, and Europe.

Even in the event of a temporary ceasefire, Europe is not expected to resume purchases of Russian oil and gas as long as Putin remains in power. Before the war, the EU accounted for nearly half of Russia’s oil exports and 75% of its gas.

The Trump administration could relax some sanctions unilaterally. However, such a move would likely face resistance in Congress without a broader peace agreement.

Possible scenarios and sanctions policy

The more likely outcome is that Trump fails to reach a deal. In that case, the US could toughen sanctions, particularly targeting buyers of Russian oil.

Trump has already delayed the introduction of "secondary sanctions" against China, citing successful talks with Putin. India, however, has already faced tariffs — in August Trump raised duties on Indian goods to 50% over its purchases of Russian oil.

Still, India's reduced imports are being offset by growing supplies to China, preventing a shock to the global market.

China as the key player

The decisive factor remains China, which views its relationship with Moscow as strategic. Beijing has no plans to significantly cut imports of Russian oil.

Chinese and Russian companies have built an extensive network of shipments using tankers and insurers, allowing them to bypass Western sanctions.

The average US tariff rate on Chinese goods has already reached 55%. New restrictions could hit American consumers and trigger retaliation from Beijing, such as limits on rare earth exports.

Resilient market

Global energy markets currently show strong resilience. The International Energy Agency forecasts an oil surplus of 1.76 million barrels per day in 2025 and 3 million barrels in 2026.

The liquefied natural gas market is also expanding rapidly, with new capacity coming online in the United States, Qatar, Canada, and other countries. By 2030, global LNG production could reach 800 million tons annually.

Even if Trump ramps up pressure on Russia, it is unlikely to significantly disrupt global supplies. The peace process in Ukraine remains a key factor for politics, but not for energy, Reuters notes.

As a reminder, on August 18 US President Donald Trump held talks with Ukrainian President Volodymyr Zelenskyy and European leaders. Trump said it would become clear within weeks whether Russia’s war against Ukraine would come to an end.

French President Emmanuel Macron urged stronger sanctions against Russia if Moscow's negotiations fail.