6 best apps for managing your finances

6 apps for competent money management (photo: Freepik)

6 apps for competent money management (photo: Freepik)

Financial freedom begins with a mindful approach to money. Modern technologies make this process easier by offering convenient apps for budget planning, reports Engadget.

Quicken Simplifi

Quicken Simplifi stands out for its simplicity and ease of use. The app features a clean interface with a main page displaying key data: balance, net worth, expenses, upcoming payments, spending plan, expense categories, and achievements. The visualizations are neat and clear; adapting to the interface takes just one day.

Among its advantages is inviting a partner or financial advisor to co-manage an account. It also offers unique features, such as marking expected returns and setting up partial recurring purchases from the same vendor.

Budgeting in the app is intuitive: you confirm regular income, set up recurring payments (for bills and subscriptions), and add spending goals. The app displays income after bills, allowing for better spending planning. Budgets are suggested based on an average of the last six months.

However, there are some drawbacks. Users must manually input property data, there is no option to register via Apple or Google, and there is no free trial period. However, a 30-day money-back guarantee is offered.

Photo: App Quicken Simplifi

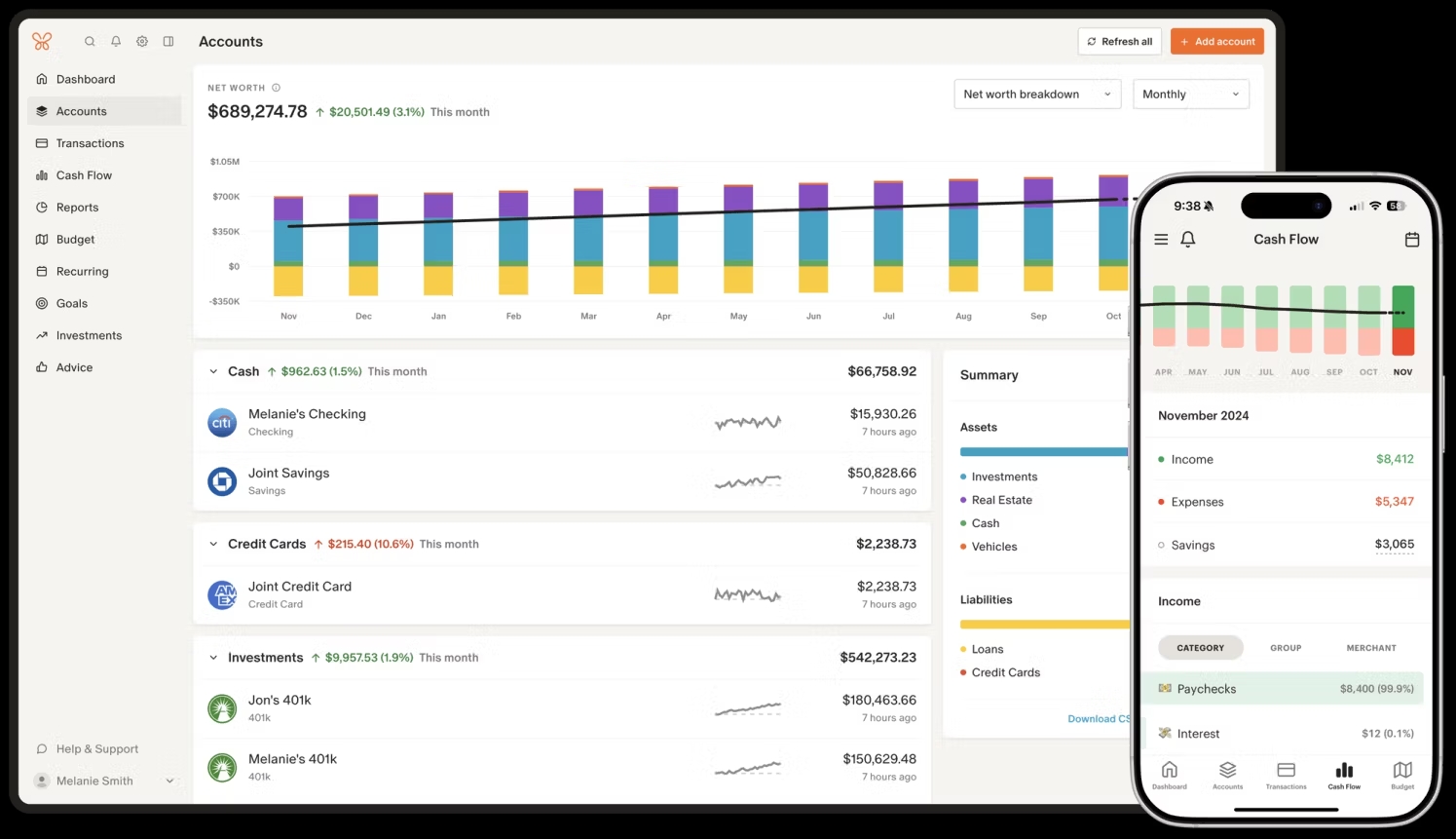

Monarch Money

Monarch Money is a budgeting app known for its detailed features and valuable tools despite having a more complex interface compared to competitors. Setting it up may take longer, especially when adjusting expense categories or adding rules, but the results are impressive.

The budget displays detailed data by category, offers forecasts for months or years, and allows users to configure recurring expenses with various parameters.

Recent updates have enhanced the app by introducing features such as automatic vehicle value updates and detailed charts based on categories or tags. The mobile version includes a dashboard displaying information on net worth, transactions, income and expenses, investments, and set goals.

Monarch also integrates with Apple Card, Apple Cash, and savings accounts via iOS 17.4, enabling automatic synchronization of these accounts. Unique features include joint management with a partner and a beta feature for tracking investment transactions.

Photo: App Monarch Money

NerdWallet

NerdWallet is a free budgeting app that provides access to its features without requiring a subscription, though its interface prominently displays ads.

The app stands out for its simplicity and convenience, showcasing key metrics like cash flow, net worth, and credit score. Weekly analytical reports help track spending and compare it to the previous month.

Its budgeting approach is based on the popular 50/30/20 rule, dividing the budget into needs, wants, and savings/debt repayment. However, the app has limited options for customizing expense categories, though developers promise to add this feature in the future.

Setting up the app takes more time than it does for competitors. This is due to two-factor authentication when adding accounts and the need to provide personal information for credit score monitoring.

The app also struggles with accurately identifying regular income, often misclassifying one-time payments as income. This requires manual adjustments.

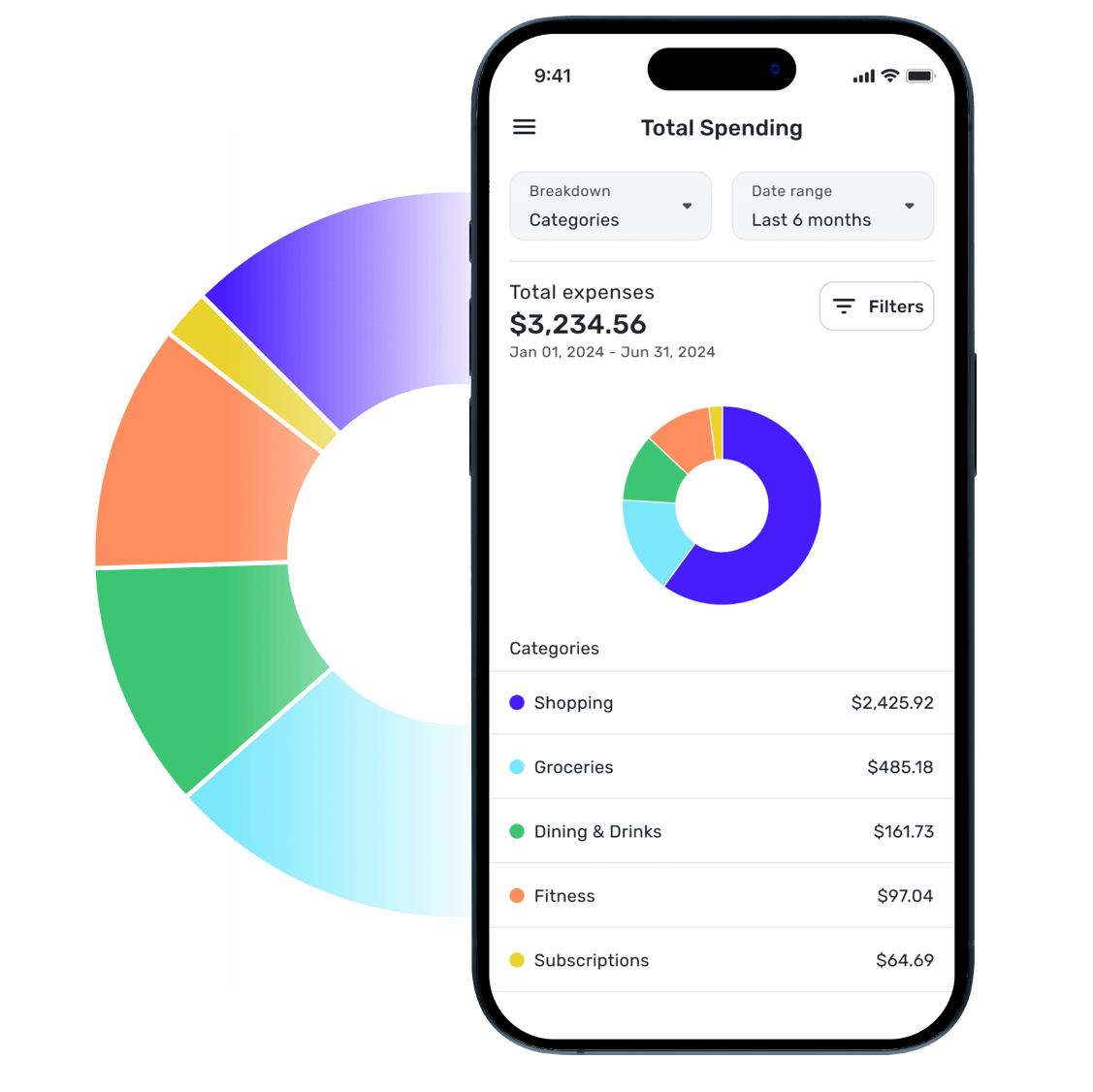

Copilot Money

Copilot Money is a sleek and well-designed budgeting app currently exclusive to iOS and Mac. Developers, however, have promised future versions for Android and the web. The app's vibrant interface uses colors, emojis, and graphs to simplify budget, investment, and debt analysis. It particularly excels at visualizing recurring monthly expenses.

Key features include:

- Automatic expense categorization powered by AI, which improves over time;

- Integration with Amazon for transaction tracking;

- Manual review of new transactions to detect fraud and analyze spending habits.

The app continues to evolve, adding features like forecasting, cash flow analysis, and comparing expenses and investments with other users. Copilot offers new users two free months and has a relatively affordable subscription plan: $7.92 per month or $95 annually.

_1.png)

Photo: App Copilot Money

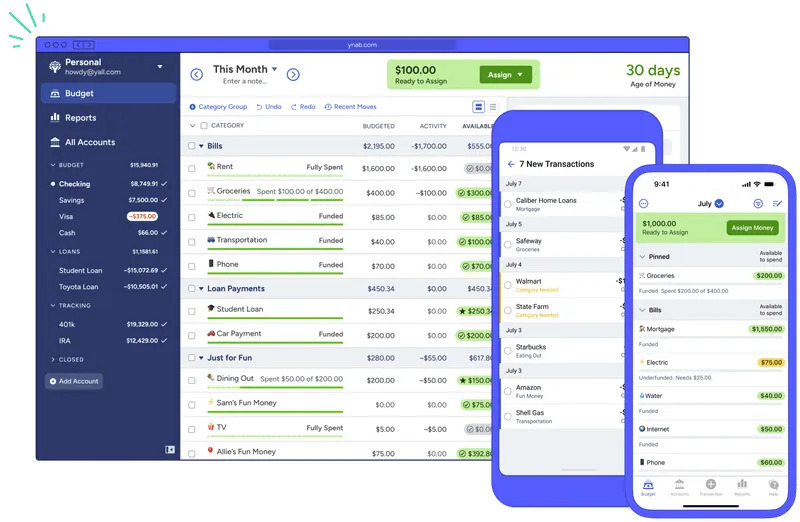

YNAB

YNAB (You Need a Budget) is a budgeting app based on the zero-based budgeting method. It requires users to assign every dollar earned to a specific purpose. This approach is similar to the envelope budgeting system, where funds are allocated to categories such as rent, utilities, gifts, or unexpected expenses like car repairs.

Key features of YNAB include:

- Working only with money currently available in accounts, excluding future income

- Avoiding financial forecasting and focusing solely on the current budget

- Requiring users to create a new budget every month and track all transactions meticulously

The app demands more effort and time to learn compared to most competitors. To assist with this, it offers video tutorials and guides.

YNAB’s approach is especially beneficial for individuals with limited savings or those looking to improve their financial habits. However, it might feel overly complex for users with less stringent goals.

Photo: App YNAB

PocketGuard

PocketGuard is one of the few budgeting apps available, but its free version has notable limitations. For instance, users can connect only two bank accounts without upgrading.

The premium version, PocketGuard Plus, offers expanded functionality with three payment options: $7.99 per month, $34.99 per year, or a $79.99 lifetime license. The latter is convenient for users who prefer a one-time payment.

The app displays essential financial metrics, including net worth, assets and debts, net income, total monthly expenses, upcoming bills, the date of the next income, goals, and debt repayment plans.

One of PocketGuard’s standout features is its "after bills" approach. Users input their regular expenses, and the app calculates the remaining funds, suggesting that amount as the budget. It also effectively visualizes paid and pending bills.

However, PocketGuard has its drawbacks. The interface is not very polished — its "Bills" tab appears cluttered and lacks aggregated totals for categories like cash or investments.

Additionally, the app occasionally malfunctions, such as prompting users to update when no updates are available. The web version simply mirrors the mobile interface without optimizing it for larger screens, making it less user-friendly.