Peace through strength: How Trump can force Putin to end Ukraine war and start negotiations

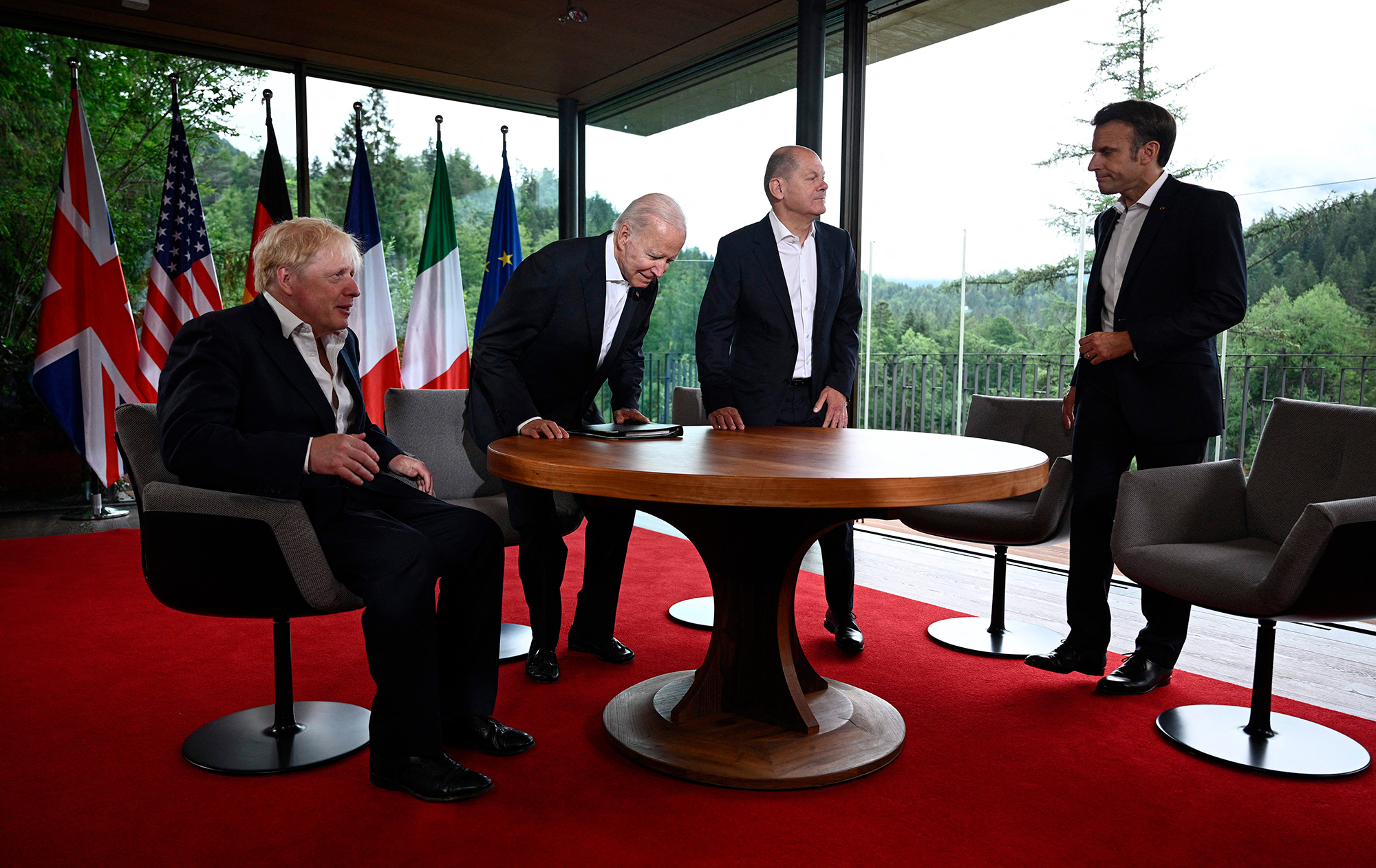

Trump has leverages to force Putin to negotiate an end to the war (photo: GettyImages)

Trump has leverages to force Putin to negotiate an end to the war (photo: GettyImages)

Donald Trump and his team claim they plan to end Putin's war against Ukraine. The new US President's administration has already voiced a series of threats and measures they may implement against Russia.

Contents:

US President Donald Trump, long before his inauguration, repeatedly promised to put an end to Russia's war against Ukraine in short terms. Trump's and his team's statements after entering the White House show that he is not backing down from this rhetoric.

After his inauguration, Trump said that Putin was destroying Russia and therefore must make a deal. The very next day, January 22, his statement became even more ultimatum-like: "... I am going to do Russia, whose economy is collapsing, and Putin a very big FAVOR. Make a deal now and stop this senseless war! OTHERWISE, IT WILL ONLY GET WORSE," wrote the US President on the social network Truth Social.

The situation on the front line seems to be pushing Ukrainian leadership toward negotiations to end the war. It is likely that President Volodymyr Zelenskyy very convincingly conveyed this willingness to Donald Trump during their meeting in Paris. Ultimately, when asked whether a peace agreement would be reached by January next year, the US leader responded at the Davos summit: "That’s a question for Russia. Ukraine is ready to make a deal."

For almost three years of war, the Kremlin has talked about its alleged readiness to negotiate while demonstrating the opposite. All variations of "peace" conditions previously put forward by Moscow resembled coercion into capitulation. Moreover, there are no guarantees that even this would make Russia stop rather than put forth another dozen unrealistic demands.

Now the situation may change: things are not going smoothly for Putin, and the US has a new administration with a more determined attitude toward ending the Russian-Ukrainian war.

Pressure points

Russia holds strategic initiative across all frontlines. The occupying army achieves gradual but systematic advancements daily. These gains come at a tremendous cost in casualties, but Moscow manages to replenish its losses and even form new units by luring contractors with increasingly higher payments.

Russia continues to produce new, albeit not highly sophisticated, weapons, UAVs, and missiles while restoring old armored vehicles that have long been gathering dust in storage. If the current pace of advancement is maintained, the aggressor has a chance to occupy the entire Donetsk region by the end of the year.

"Putin sees that the Russian army continues to advance. Why, in his view, should negotiations begin if they are managing – albeit slowly and with heavy losses – to make progress? He hopes to negotiate from a more successful position and believes that the internal political situation in Ukraine will become more complicated for Volodymyr Zelenskyy. Putin is doing everything he can to contribute to that instability. Ultimately, Putin simply despises negotiations as such," said Ivan Preobrazhensky, a Russian political analyst in opposition who fled the country in 2014, in an interview with RBC-Ukraine.

It remains unclear whether Putin fully comprehends Russia's actual economic situation and prospects (photo: GettyImages)

On the other hand, cracks in Russia's economy have become apparent due to and as a consequence of the war: high inflation, a continuous increase in the key interest rate, and consequently, expensive loans. There is also a labor shortage in the civilian sector since a significant portion of the population is engaged in the war and the defense industry. Furthermore, the war consumes about 40% of the federal budget.

"Russia's economy is overheated because it has switched to a military footing. Its defense-industrial complex is heavily indebted and on the verge of bankruptcy. Banks are in a very difficult situation. Russia lacks workers, leading to excessive wage growth, not only in the military sector but across the economy as a whole. Gazprom is also on the brink of bankruptcy. Currently, Russia's main export commodity is oil. But even there, they are facing price problems," adds Preobrazhensky.

Essentially, there are two perspectives on Russia's position, and it is unclear which worldview Putin adheres to. Numerous economic forecasts predict that 2025 will not bring any improvement to Russia's economy, and if it faces new external shocks, the situation could worsen.

Trump's team has repeatedly stated their intent to achieve peace through strength. While it is still unclear what specific plan lies behind this idea, Russia currently has numerous pressure points the US could exploit.

"Putin doesn't need to be forced to sit down for negotiations to end the war – he's ready and will do it. The situation in Russia's economy, the frontlines, and the massive casualties are already pushing him toward negotiations. Trump's leverage is necessary to convince Putin to abandon his previous conditions. And Trump has that leverage," believes Abbas Gallyamov, an opposition political analyst who emigrated from Russia.

One such tool is the continued military support for Ukraine, at least at the current level or even higher, including long-range weapons. This would further increase the cost of the war for the Kremlin, says Gallyamov.

Another approach, highlighted by Preobrazhensky, is creating instability zones for Russia in regions where it has strategic interests, similar to the methods previously employed by Putin. This includes Africa, where resource extraction, particularly gold, enriches Russia's treasury, as well as Libya, Syria, Central Asia, the Caucasus, the Far East, and Iran.

A third lever is restrictive and economic measures. Trump has already threatened Putin with high tariffs, duties, and additional sanctions if a peace agreement is not reached soon.

Significant opportunities for increased pressure on Russia remain, says Vladyslav Vlasiuk, Advisor and Presidential Commissioner for Sanctions Policy.

"This includes tariff restrictions – increasing duties on Russian metals, fertilizers, and other goods. Strengthening secondary sanctions against companies helping Russia circumvent restrictions, blocking new banks, confiscating assets, and limiting access to critical technologies should also be part of the strategy. Further sanctions are a key lever for compelling the Kremlin to engage in fair negotiations," Vlasuk enumerates.

However, according to the Ukrainian advisor, the priority should be reducing Russia's oil and gas revenues by countering the shadow fleet, tightening price cap controls, and increasing the cost of extraction. The oil industry is a pillar of Russia's economy and a key source of war funding.

Russia’s shadow fleet

The US and its allies have already attempted to exert pressure on Russian oil. At the end of 2022, the EU and the UK ceased purchasing seaborne oil from Russia. Exceptions were made for Hungary and Slovakia, which receive oil via pipeline. At the same time, the EU, G7 countries, and Australia agreed on a price cap for Russian seaborne oil exports to third countries, set at $60 per barrel. Western companies are prohibited from providing transportation or insurance services if the oil is transported at a price above this cap.

However, Moscow still found loopholes for importing crude oil into European countries for which exceptions were made in the anti-Russian sanctions. From there, companies associated with Russia resell either refined oil products processed at local refineries or even crude oil itself worldwide. Furthermore, Russia created a shadow fleet to bypass restrictions and offset the loss of the Western market by redirecting energy supplies eastward, primarily to China and India.

Western sanctions against Russian oil exports have proven insufficient (photo: GettyImages)

Russia’s shadow fleet consists of old tankers that transport oil without adhering to the established price cap and are not insured by Western companies. These tankers are registered both in Russia and other jurisdictions. According to the Defense Intelligence of Ukraine in an interview with RBC-Ukraine, most shadow fleet tankers are registered under the flags of Panama, Gabon, the Cook Islands, Liberia, the Marshall Islands, and others. Their owners are registered in China, India, the Marshall Islands, the Seychelles, the UAE, Greece, and other countries. Managing companies are located in the UAE, Greece, China, Türkiye, and the Seychelles, among other places.

These vessels frequently change registration and names to make identification difficult. They transfer oil to other tankers in offshore zones, attempt to conceal their routes, and deactivate the Automatic Identification System (AIS) on certain parts of their journeys. To obscure the Russian origin of the oil, tankers often mix it with other types.

There is not only a supply of such oil but also a demand for it. According to the Defense Intelligence of Ukraine, some countries are interested in importing Russian oil for processing and exporting as finished oil products to foreign markets. These include China, India, and Türkiye. The sale of oil products made from Russian oil is not subject to the ban.

"As of now, the Russian shadow fleet comprises up to 1,000 predominantly outdated vessels (with a combined deadweight of over 100 million tons) engaged in the export of oil and oil products. In 2023, there were about 600 such vessels. Since the introduction of the price cap on Russian oil in December 2022, Russia has spent over $10 billion purchasing tankers for its shadow fleet. These vessels account for approximately 70% of Russia's seaborne crude oil and oil product exports," the Defense Intelligence of Ukraine reports.

At the beginning of January, during Joe Biden's presidency, the US introduced new sanctions against Russia’s shadow fleet, targeting 183 tankers transporting Russian oil, Gazpromneft, and several insurance companies servicing them. Considering that Trump did not repeal these sanctions after taking office, it is reasonable to assume that this package of measures was coordinated between the former and current presidential teams.

According to CSIS and Bloomberg estimates, out of the 3.5 million barrels transported by Russia per day in 2024, 1.5 million were carried by sanctioned tankers. Major buyers, India and China, stopped accepting vessels subject to restrictions, fearing secondary sanctions.

As a result of the sanctions, in the short term, Russian oil exports are expected to decrease by 15%, according to the Defense Intelligence of Ukraine. Furthermore, Moscow will have to increase the discount on its oil for buyers and revise its production targets downward. However, there is still work to be done in this direction, as US sanctions have affected only part of Russia’s entire shadow fleet. To shut down this scheme, it is necessary to develop a mechanism to track the real routes of shadow vessels, introduce sectoral sanctions, block the assets of companies operating these tankers, and prohibit them from entering ports, territorial waters, and international straits.

Another radical measure could be one of Trump's threats: imposing high tariffs and additional sanctions on all Russian exports to the US and other countries. Given that the trade volume between the United States and Russia is not very large, losing the American market would not be a significant challenge for the Kremlin.

However, if the White House can influence other countries to stop buying Russian goods or raw materials, it could become a colossal problem for Moscow. Hypothetically, if some Indian or Chinese companies purchase Russian oil, the US could impose a 20% tariff or other sanctions on them. However, it is currently difficult to say how realistic this restriction might be.

Colossus on oil legs

Another approach is to increase the global supply of oil, thereby reducing its price. This strategy could also benefit the United States. One of Trump's key campaign promises was to ramp up the extraction of "black gold," also known as the "drill, baby, drill" strategy. However, it is unlikely that the US alone could significantly drive down global oil prices, at least in the short term. Cooperation with other "players" is necessary to either increase production or maintain it at high levels.

"Trump can coordinate with Saudi Arabia and crash global oil prices. Putin's army is essentially a mercenary force. People are not fighting for ideology, homeland, or Putin but for money. If that money starts to run out, what will Putin do?" notes Gallyamov.

Trump has established relatively good relations with the Saudis. In his first week after the inauguration, the new US President held a phone conversation with Saudi Crown Prince Mohammed bin Salman. Trump has publicly stated at least twice that he would demand Saudi Arabia lower oil prices to push Russia toward ending the war. He has made a similar appeal to OPEC. The US has previously employed a similar strategy to pressure the Soviet Union before its collapse.

"If prices go down, the war between Russia and Ukraine will end immediately," the US President is convinced.

In December, Saudi Arabia began moving in this direction. The kingdom decided to abandon the agreed OPEC price of $100 per barrel and, instead of supporting a stable price, increased production to maintain its market share.

A potential price point that could be painful for Russia, mentioned by Trump during his campaign, is $40 per barrel. The current cap of $60 has caused losses but remains comfortable for Moscow. Keith Kellogg, the US special envoy for Ukraine, recently mentioned another target of $45 per barrel, which he called "the breakeven point" for Russian oil companies.

.jpg)

Putin shows readiness to talk with Trump (photo: 2019, GettyImages)

Reducing oil prices, even without imposing additional sanctions, would significantly decrease Russia's revenues, undermine the country's defense industry, and impact the living standards of most Russians. Furthermore, a price collapse could hurt Russia even if its shadow fleet continues operating.

"Trump's general attitude toward Putin is quite positive and loyal. Why would Putin want to quarrel with him given all the current and potential problems? If they clash, Trump could increase arms supplies to Ukraine, lower oil prices, and, to spite Russia, even push Ukraine into NATO," Gallyamov speculates.

Given recent public gestures from the Kremlin toward Trump, it seems Putin is ready to communicate with the new US administration. Recently, the American President stated that his administration had already held "very serious" discussions with Moscow regarding the war in Ukraine.

Despite the measures taken, the previous US administration failed to significantly weaken Russia through sanctions. Each restrictive measure introduced by the Biden Administration was cautious and gradual, fearing how Russia would respond. The three previous years of the large-scale war demonstrated that caution does not work with the current Russian regime. Russia, and Putin in particular, only respond to the language of strength. To force the Kremlin to make concessions, it is enough to have the necessary set of pressure levers and the determination to use them when necessary. Trump's administration appears to possess both the levers and the resolve.