Western sanctions block extraction and export of Russian LNG - Bloomberg

Sanctions effectively block the development of the Russian liquefied natural gas market (photo: Getty Images)

Sanctions effectively block the development of the Russian liquefied natural gas market (photo: Getty Images)

The US sanctions have nearly halted the extraction and export of Russian liquefied natural gas. Russia is preparing for a multi-year stagnation in this sector and is seeking ways to avoid restrictions, according to Bloomberg.

The economy of the Russian Federation has proven remarkably resilient to Western sanctions pressure. Two years after the invasion of Ukraine, the Russian economy continues to fund the costly war and support Russian President Vladimir Putin. However, despite this, there is an area in the Russian economy where a real problem has already emerged.

Painful sanctions

The Arctic LNG 2 project (LNG - liquefied natural gas. - Ed.), led by Novatek in the Kara Sea, is a key part of Moscow's plans to increase fuel exports and replenish the state budget.

The company has been ready for several months to supply liquefied natural gas to new markets, which is an alternative to the once-profitable trade between Russia and Europe through pipeline exports. However, the new massive operation worth $25 billion is effectively stalled by US sanctions. This is the first case of the US restrictions effectively working against the Russian energy complex.

Russia has long sought to increase its share in the global LNG market, but the war and subsequent sharp decline in overland exports to Europe have heightened the importance of these ambitions - by 2030, Moscow wants to triple LNG production, adding at least $35 billion to annual income.

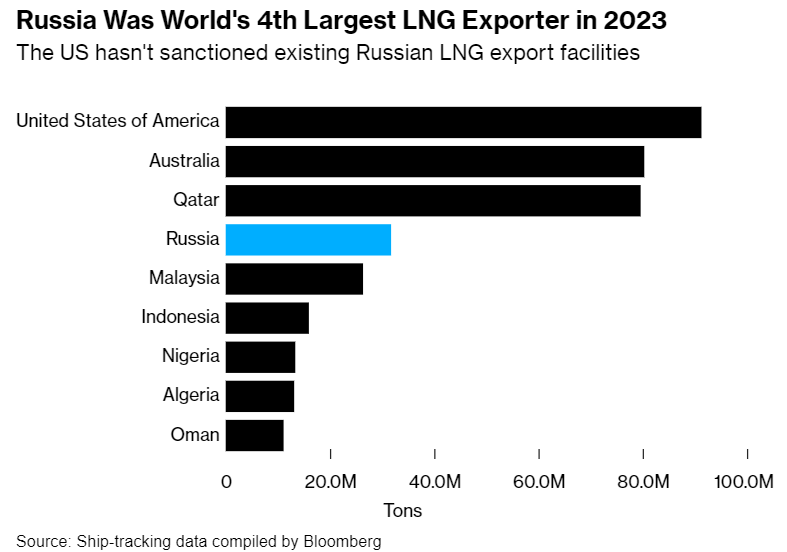

Thanks to its existing operations, Russia is currently the fourth largest exporter of liquefied natural gas in the world, but restrictions on the flagship Arctic LNG 2 project limit its aspirations to move further.

Moscow is even more concerned that sanctions have created a basis for any future Western efforts to restrict Kremlin gas revenues, targeting projects such as Yamal or Sakhalin-2 in the Far East, which still supply gas to customers in Europe and Asia.

Malte Humpert, founder of the Arctic Institute, noted that US sanctions work extremely well and blocked Arctic LNG 2 even before it began gas production and tanker delivery.

The Joe Biden administration imposed sanctions on the Arctic LNG 2 project in 2023. Buyers in China and India - countries that bought and traded Russian oil bypassing existing restrictions - refused to buy LNG even at a discount. And lawyers in Singapore and London refused to participate in the project.

In addition, Russian LNG transportation vessels worth hundreds of millions of dollars are stranded in dry docks in South Korea - no one can buy or lease them due to sanctions.

Unlike oil exports by Russia, which, despite price restrictions and other limitations, can be transported using a vast shadow fleet, LNG transportation is more complicated, mainly due to the more complex technology required for loading and transporting supercooled fuel.

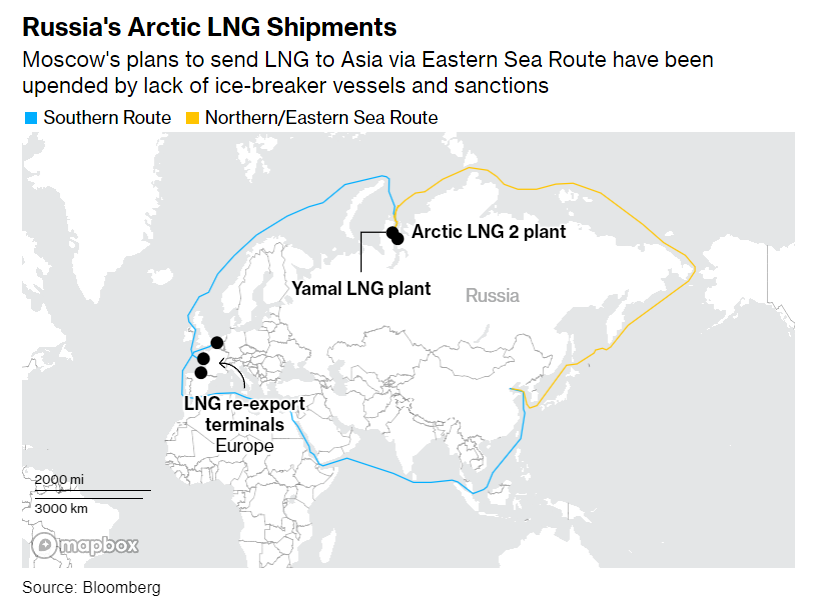

Bloomberg notes that the European Union currently still relies on Russian LNG and is reluctant to limit its import, but is already planning to introduce some of its sanctions. Europe does not directly ban the export of Russian fuel, but debates are ongoing in the EU discussing a ban on using EU ports for re-exporting Russian LNG to third countries.

Russian LNG production plants in the Arctic region are very remote, so the fuel is usually first delivered to Belgium or France for re-export to Asia or another European port. Limiting this practice will stretch the Russian fleet to its limits.

LNG dead in the water

The White House’s National Security Council began turning its attention to crippling Russia’s LNG expansion plans in 2023, about a year into the war, according to people with knowledge of the strategy. Officials there teamed up with the US State Department and Department of Defense to pick a target, eventually homing in on the Arctic LNG 2 project. They then brought it to the Treasury.

As part of a broader plan aimed at blocking Russia's development of any new energy projects that could bring significant revenues, the US wants to ensure that the Arctic enterprise will be dead in the water.

White House officials have significant reasons to target this project, which is co-owned by the Japanese government, Chinese state oil companies, and French TotalEnergies. Although this annoys important allies, freezing Arctic LNG 2 harms Moscow, causing only limited ripples in global natural gas markets. Equally important for the Biden administration as the elections approach is to restrain the consequences for American consumers.

Washington has other advantages in this project. Expensive specialized vessels are needed for LNG trade, which can be tracked using satellite data, making it almost impossible to create an alternative fleet. While there are about 7,500 oil tankers of various sizes in the world today, the entire LNG industry has about 700 vessels.

In addition, Arctic LNG 2 requires a unique type of vessel capable of sliding over thick ice. For the operation, 21 ice-class tankers were ordered, including ships owned by South Korean companies Hanwha Ocean Co. and Mitsui OSK. Currently, companies are trying to find new owners for these vessels. Russia can mobilize its resources, and LNG carriers are being built at the Zvezda shipyard, but even their construction is delayed due to US sanctions.

“The biggest single constraint on the development of Arctic LNG 2 is the availability of tankers. That’s the weak spot in the Russian overall strategy. The longer-term outlook is clouded by the fact that the primary mission, which was to develop LNG for East Asia across the Northern Sea Route, is at this moment not possible," said Tan Gustafson, a professor at Georgetown University who has been observing Russian fossil fuel expansion for decades.

Russia holds the world's largest share of natural gas, with about 20% of proven reserves, but it still needs to turn them into profits. New pipelines are not being built fast enough to redirect sales, so only liquefied natural gas remains, which even President Putin has identified as the fuel of the future.

The Kremlin's plans, with or without sanctions, is to export over 100 million tons of LNG per year by 2030, compared to about 31 million in 2023.

Arctic LNG 2 is not the first project to be constrained, as restrictions on the transfer of technology and equipment for hydrocarbon exploration introduced in 2014 have spurred the emergence of some local alternative projects.

However, even the Russian government is beginning to recognize the scale of the problem as sanctions accumulate and technologies are slowly reproduced. Figures in a document from the Ministry of Economy, published earlier this year and reviewed by Bloomberg, indicate that under a conservative scenario, production could effectively stagnate until 2027. This means that Arctic LNG 2 will not be able to quickly increase production volumes.

Pant finally started working

Meanwhile, none of the traders and analysts surveyed by Bloomberg expected the plant, which completed construction (and launched only one of three technological lines), to reach full capacity while sanctions remain in place.

Novatek, the company behind all this, insists otherwise. The founder of the enterprise, Leonid Mikhelson, the fourth richest person in Russia and a close ally of Putin, managed to complete the construction of the first phase of the Arctic LNG 2 project in 2023. This happened against the expectations of the industry, which expected a lack of technology to hinder its implementation. After the exit from the project of companies such as the French Technip Energies, new supply chains were created, and details and equipment were imported from machine-building plants in China.

“The fact that we have become a target of sanctions is a signal of how they assess our competencies,” Mikhelson said at the XVI Verona Eurasian Economic Forum in November, shortly after the project was sanctioned.

At the same time, now the founder of Novatek must deal with the potential departure of a larger number of foreign partners due to tightening restrictions, as well as seek new clients.

According to people familiar with the matter, Novatek has hired staff in China to try to boost its business, and in February sent officials to India. However, no specific deals have been made yet.

The next test will take place in the summer, when Novatek plans to send its first shipment of liquefied natural gas from Arctic LNG 2, using a regular icebreaker thin enough for use.

“There will be ad hoc voyages, but that’s really limited. Where does Russia go from here?" - said Gumpert from the Arctic Institute.

Sanctions against Russian liquefied gas

The European Union is already developing the 14th package of sanctions against Russia for its full-scale invasion of Ukraine. The new package will include restrictions on individuals and entities that help circumvent existing sanctions.

The EU seeks to block the Russian LNG supply chain and future revenues from projects such as Arctic LNG 2, the LNG terminal in Ust-Luga, and the Murmansk LNG.

Germany has proposed including a ban on the import of Russian LNG into EU countries in the package.

Italy has expressed readiness to support new sanctions against Russian LNG.

Meanwhile, Russia is preparing for stagnation in the liquefied natural gas sector due to Western sanctions.