Ukraine's dollar bonds rise after Trump's victory – Bloomberg

Photo: Trump's victory caused a rise in Ukraine's bonds

Photo: Trump's victory caused a rise in Ukraine's bonds

Ukrainian dollar bonds have risen as Donald Trump's promises to accelerate the end of the war with Russia have come into focus after his re-election as US president, according to Bloomberg.

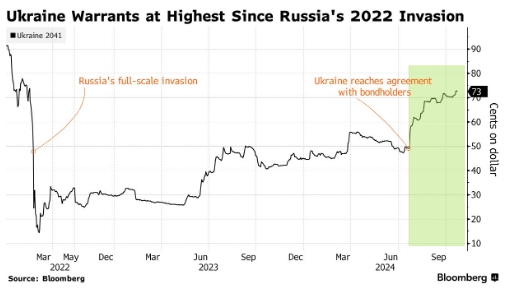

The country's GDP warrants, a type of debt security with payments tied to economic growth, traded above 73.6 cents on the dollar, marking the highest level since Russia’s full-scale invasion in 2022, when these securities plunged to less than 15 cents.

Fund managers had already begun purchasing Ukrainian dollar bonds in recent weeks as Trump’s presidency started to appear more likely. Today, these bonds have been among the best performers in emerging markets in terms of percentage growth.

"Bonds are reflecting the probability that the war could end sooner, rather than focusing on what shape that deal would look like," said Thys Louw, a portfolio manager at Ninety One UK Ltd.

The rise in Ukrainian bonds stood out among emerging markets, where currencies and stocks largely sold off on the prospect that Trump might reintroduce trade tariffs. Eastern European currencies were particularly affected, with the forint trading at its lowest level since late 2022.

Key obstacles

According to Bloomberg, significant obstacles remain in bringing Russia to the negotiating table with Ukraine. Russian forces are making advances in a grinding war, and the prospect of finding common ground for peace talks remains remote. Ukrainian President Volodymyr Zelenskyy has vowed to continue fighting, though his military relies heavily on US support.

Zelenskyy stated that Trump’s "peace through strength" approach to global relations could help end the conflict, adding that Ukraine expects "continued strong bipartisan support" from the US.

During a September debate with Vice President Kamala Harris, Trump expressed his desire to end hostilities, suggesting that the leaders of the two countries would meet and reach an agreement.

"I want the war to stop," Trump said when asked twice if he wanted Ukraine to win. "That is a war that’s dying to be settled. I will get it settled before I even become president."

So far, both countries have maintained demands for ending the war on their terms: Ukraine’s President has refused any territorial concessions to Russia, while Russian President Vladimir Putin has refused to abandon plans to annex four Ukrainian regions, which Moscow claimed in 2022. In July, Putin remarked that Russia takes Trump's statements seriously that Trump has proposals to end the war quickly.

However, according to Ukrainian investment firm Dragon Capital, it remains unclear what immediate leverage Trump would have over Russia to halt its advances precisely as it has begun to gain ground. "Achieving a genuine ceasefire may therefore become a longer-than-expected process," the report noted.

Trump’s presidential victory also led to a rise in the dollar against major currencies, with European assets showing the opposite reaction. Investors have suggested that a Trump win would be the worst outcome for European markets due to his plans to restrict US imports.