Putin's war economy to face troubles in 2025 - Bloomberg

Photo: Putin and Nabiullina (Russian media)

Photo: Putin and Nabiullina (Russian media)

Putin's invasion of Ukraine spurred economic growth in Russia, driven by government stimulus. Nearly three years later, signs are emerging that it's time to pay the bill, Bloomberg reports.

According to the source, the combination of record-high interest rates and persistent inflation increasingly jeopardizes forecasts for 2025.

"A relatively good period for the Russian economy, which was based on previously accumulated resources, is over," said Oleg Vyugin, an economist and former top central bank official. According to him, high inflation is eating up all this short-term growth.

In addition, Russia faces sanctions, a recent weakening of its currency, uncertain prospects for oil prices, and the possibility that its largest trading partner, China, may not be able to overcome serious economic difficulties on its own.

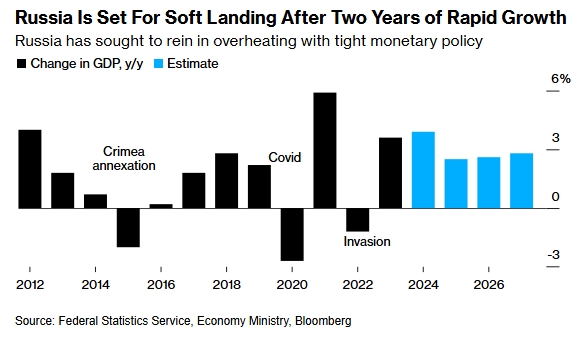

The Central Bank forecasts a sharp growth slow in 2025 to 0.5%, compared to the 3.5-4% projected last year, and inflation will only return to the target level of 4% in 2026.

Although the forecast from the Ministry of Economy is more optimistic, predicting a growth rate of 2.5% this year, Vladimir Putin stated last month that the economic cooling is part of the government's plan aimed at "stabilizing" inflation.

So far, the economy has managed to gain some momentum despite sanctions, as well as relatively high wages, which have helped to ease public discontent with the war.

High interest rates have failed to curb price growth, which has exceeded the target level by more than double. Nevertheless, in December, the Bank of Russia maintained the key interest rate at 21%, higher than right after the invasion.

The decision not to increase borrowing costs was made following increased criticism from the business community, which claimed that the bank's medicine for inflation had become more harmful than the disease itself and could trigger a wave of bankruptcies.

It will be "a year of belt-tightening," said Sofya Donets, an economist at T-Investments. According to Donets, a collapse in crude oil prices is one of the biggest risks for the economy in 2025. If the price drops further, the state will have to make sacrifices.

War

Another unknown is the war itself. Analysts at Promsvyazbank stated that a swift end to the conflict, promised by the incoming US President Donald Trump, could help strengthen the ruble and bring back foreign investors and export revenues to Russia.

A significant weakening of the ruble against the dollar and issues with cross-border payments caused by US sanctions threats are also contributing factors.

"The risk of a recession is also the highest in the last three years," Donets said. "In some quarters, growth may be negative next year. For now, our main forecast is still growth by the end of next year, slightly below 1%."

Meanwhile, Ukraine has halted the transit of natural gas through its territory. While the economic effect is likely to be minimal, according to various analysts' estimates, it could still cost Russia about 0.2-0.3% of GDP.