Kremlin bids farewell to frozen assets worth $300 billion - Reuters

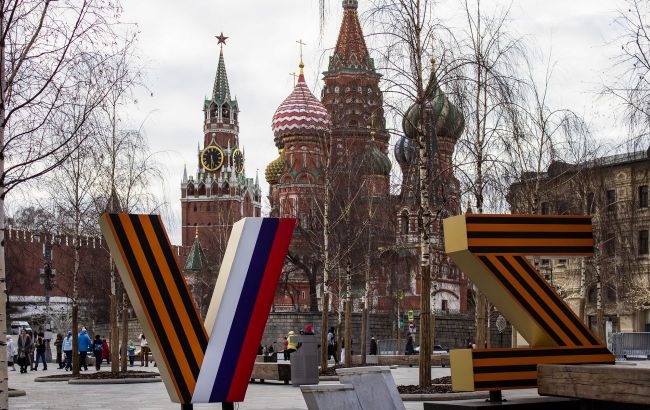

Moscow says goodbye to $300 billion in assets (Getty Images)

Moscow says goodbye to $300 billion in assets (Getty Images)

Russian authorities are inclined to believe that the $300 billion in reserves frozen after the invasion of Ukraine are almost lost, but are ready to file a lawsuit and take decisive measures in response, according to Reuters.

"Deep down, everyone has already said goodbye to the reserves. There will certainly be (a legal process). It is a kind of ritual," says one of the agency's sources familiar with the views of the Russian government and central bank.

A second source said that Russia had "bid farewell" to the assets, confident that European capitals would succumb to US pressure.

The third agreed that Russia is unlikely to prevent the confiscation, but will threaten retaliatory measures, such as confiscation of Western assets that end up in Russia and severance of diplomatic relations with foreign countries considered unfriendly.

No risks for Western countries during asset confiscation

Credit rating agencies Moody's and S&P Global have said that countries whose sovereign bonds have been bought by Russia will not be considered in default if Western governments decide to confiscate Russia's $300 billion in frozen reserves.

The Russian central bank argues that France, Germany, the UK, and other sovereign states would allegedly be in default if bonds owned by Russia were confiscated and therefore Russia would not receive due payments, a source told Reuters.

But Moody's said its interpretation was different.

"Our ratings do not typically reflect holder-specific considerations hence we would not treat the scenario as a default for these countries," Torsten Nestmann, senior vice president of Moody's Investors Service, says in response to a Reuters inquiry.

Frank Gill, head of EMEA sovereign ratings at S&P Global, also told Reuters that this is unlikely to be considered a default because interest payments are made through a paying agent that will continue to pay them to other creditors.

The majority of Russia's frozen reserves are held in cash and sovereign bonds of France, Germany, the United Kingdom, Austria, and Canada.

The interpretation of the rating agencies may allay fears about the risk of default. Some European officials also fear that any confiscation of assets could set a disturbing precedent that would lead to other countries demanding compensation for past military actions by Western countries.

Transfer of Russian assets to Ukraine

Earlier it became known that the United States proposed to the G7 countries to confiscate $300 billion of frozen Russian assets in favor of Ukraine. The plan is to be approved by the second anniversary of Russia's invasion of Ukraine.

On January 3, Prime Minister Denys Shmyhal said that the United States, the European Union, and other countries were close to resolving the issue of using Russian assets frozen in the West to rebuild Ukraine.