Gulf states to quickly replace Russian oil after Trump sanctions — Reuters

Photo: No one will remember Russian oil in a few months (Getty Images)

Photo: No one will remember Russian oil in a few months (Getty Images)

Three Persian Gulf countries have excess oil production capacity. In a few months, they will be able to replace Russian raw materials, Reuters reports.

In June, Russia exported 4.7 million barrels of crude oil per day, which is about 4.5% of global demand, as well as 2.5 million barrels of petroleum products per day.

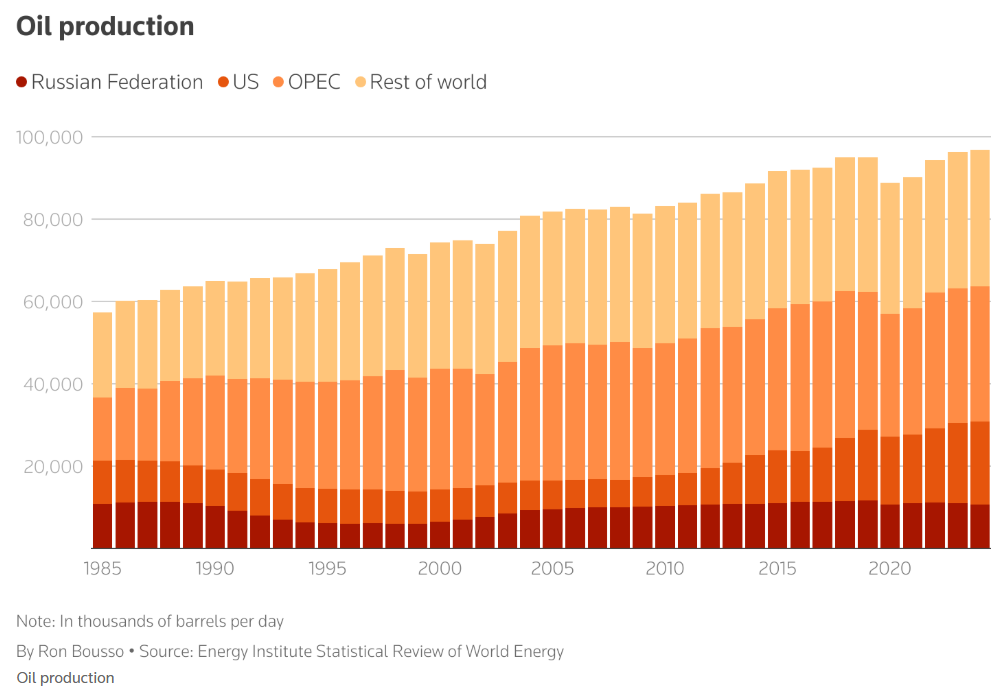

According to the International Energy Agency, global oil demand is expected to grow by 700,000 barrels per day in 2025, the lowest figure since 2009, while supplies are forecast to rise sharply by 2.1 million barrels per day to 105.1 million barrels per day this year.

The increase in supply in recent months has been mainly due to increased production by the OPEC+ oil-producing group, led by Saudi Arabia. In April, the group began cutting production by 2.2 million barrels per day and increased the production quota for the United Arab Emirates by 300,000 barrels per day.

The increase in OPEC+ production has naturally led to a reduction in the group's spare production capacity, but as of June, Saudi Arabia still had 2.3 million barrels per day of production at its disposal, which it could bring online within 90 days, while the UAE and Kuwait had spare capacity of 900,000 and 600,000 barrels per day, respectively.

"This means that the three Gulf producers could ramp up output relatively quickly in the event of a sudden supply disruption," Reuters says.

Buyers of Russian oil

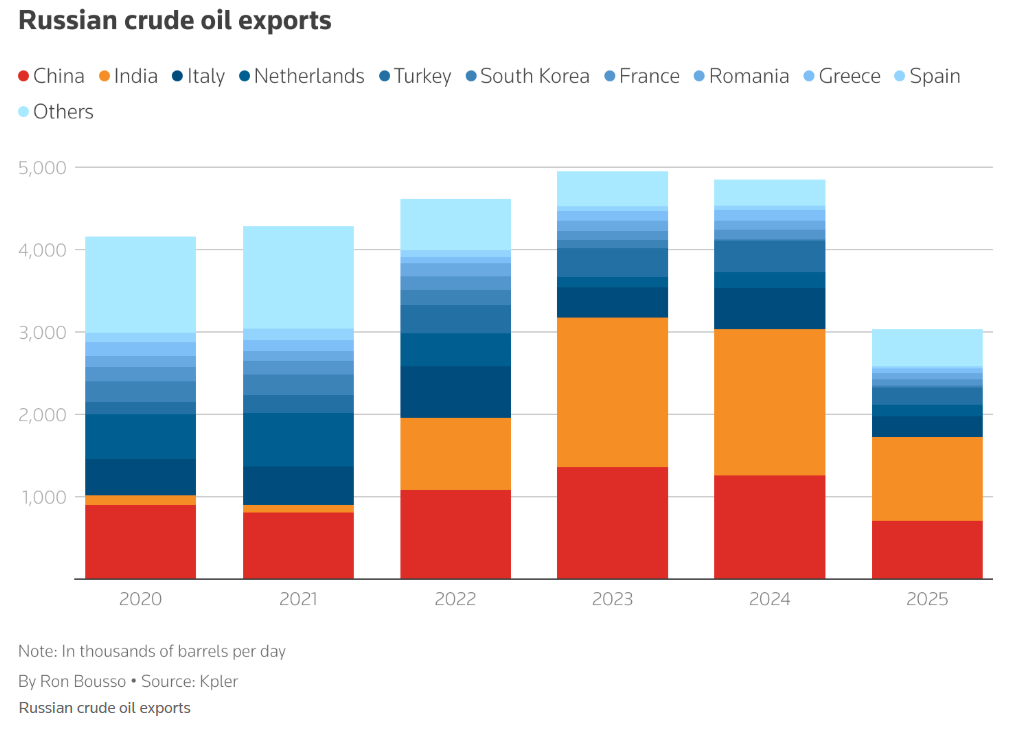

One of Russia's key consumers, India, the largest importer of Russian oil delivered by sea in June with a volume of 1.5 million barrels per day, is currently engaged in tense trade negotiations with the United States.

Therefore, New Delhi is unlikely to want to exacerbate trade tensions with Washington and may therefore move away from Moscow in favor of new, albeit undoubtedly more expensive, energy sources, writes Reuters.

On the other hand, China, which imported about 2 million barrels of Russian oil per day by pipeline and sea in June, is unlikely to change its procurement patterns, as it already faces several levels of US tariffs and considers its ties with Moscow to be strategic, the agency believes.

However, the Kremlin's finances will still be hit, even if India stops buying Russian oil, as China will most likely be able to buy it even cheaper, the publication says.

Trump's sanctions

US President Donald Trump unexpectedly shortened the deadline for Moscow to end the war against Ukraine. Instead of 50 days, as previously stated, he gave 10-12 days to reach an agreement, otherwise he promised to impose secondary sanctions against Russian oil exports. The new sanctions provide for a 100% duty on buyers.

Trump has previously backed down from threats under pressure from the markets. However, he has also followed through on many statements, such as the air strike on Iranian nuclear facilities in June.