Gold prices hit record highs amid US political crisis

Photo: gold bars (Getty Images)

Photo: gold bars (Getty Images)

The price of gold has reached a new all-time high, surpassing $3,800 per ounce, amid fears of a possible US government shutdown and uncertainty surrounding the Federal Reserve’s monetary policy, according to Bloomberg.

On Tuesday, the price of gold briefly climbed to $3,839.52 per ounce, marking the highest level in trading history.

The surge followed a failed meeting between congressional leaders and President Trump on Monday, September 29, which ended without an agreement on short-term government funding. The impasse fueled fears of a potential government shutdown and heightened economic uncertainty, key factors for investors.

Executives at major mining companies such as Newmont Corp. and Barrick Mining Corp. also contributed to market volatility through recent leadership changes, adding another layer of uncertainty.

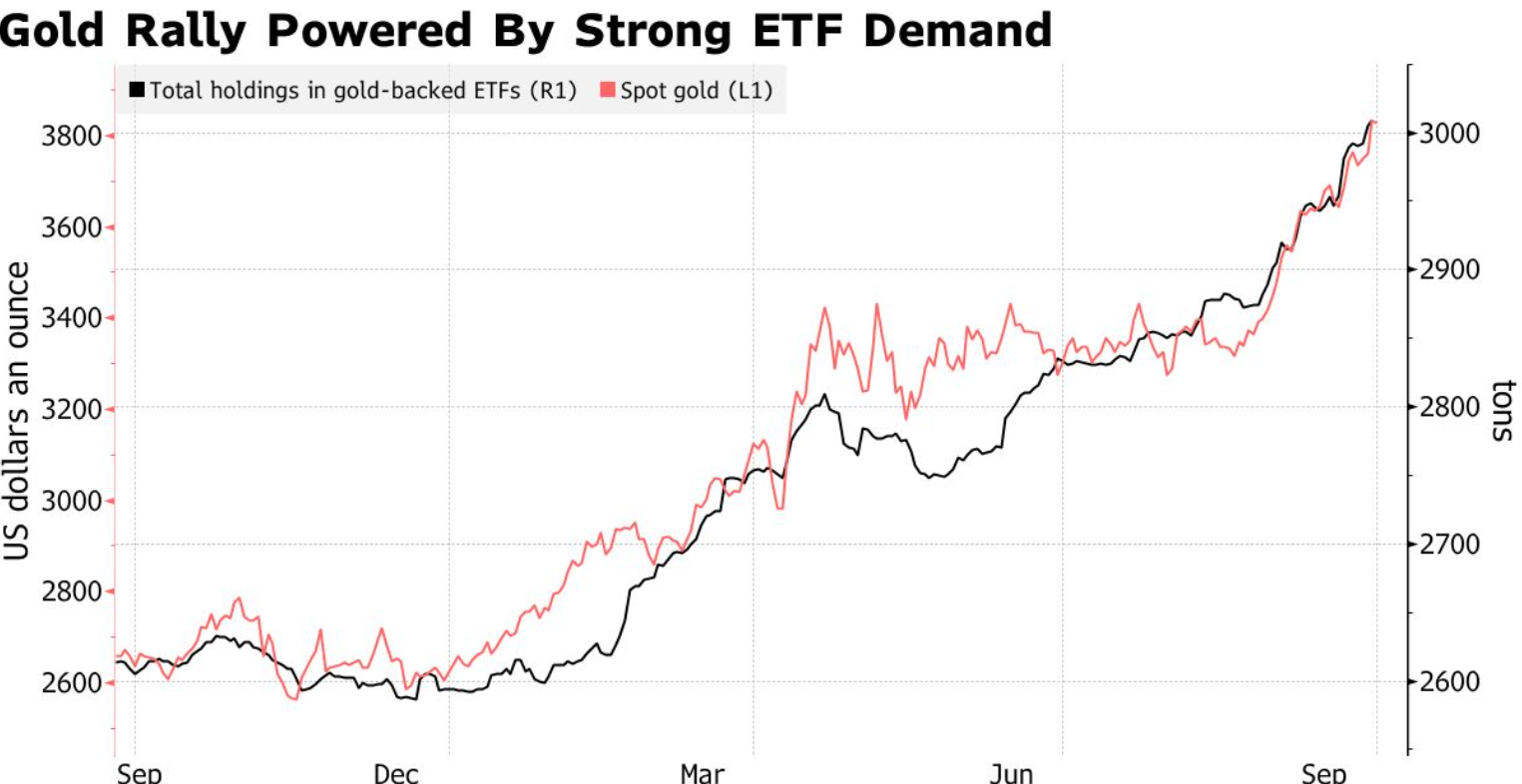

Notably, gold has already risen more than 45% this year, driven by strong demand from central banks and investors seeking safe-haven assets.

US Treasury bonds also rose on Monday, partly due to concerns over a potential government shutdown. Lower yields on government securities generally benefit precious metals, which offer no interest, while a weaker dollar makes dollar-denominated gold cheaper for most global buyers.

As of now, spot gold is trading around $3,837.28 per ounce, while silver and platinum have slightly corrected after reaching multi-year highs. Since the beginning of 2025, silver prices have surged by 62%, and platinum by 76%.

Investors are actively moving funds into gold-backed exchange-traded funds (ETFs), fueling demand and keeping metal lease rates at elevated levels.

Outlook for precious metals

According to the CME FedWatch Tool, investors currently see a 90% probability of a 25-basis-point rate cut in October, with another 75% chance of an additional cut in December.

Analysts note that strong demand from central banks and investors has reinforced gold’s role as a safe-haven asset.

Overall, gold has risen by about 40% since the start of the year, supported by geopolitical tensions and growing risks to the global economy linked to US President Donald Trump’s tariff policies.