Global gold prices hit all-time high

Photo: Gold hits new high (Getty Images)

Photo: Gold hits new high (Getty Images)

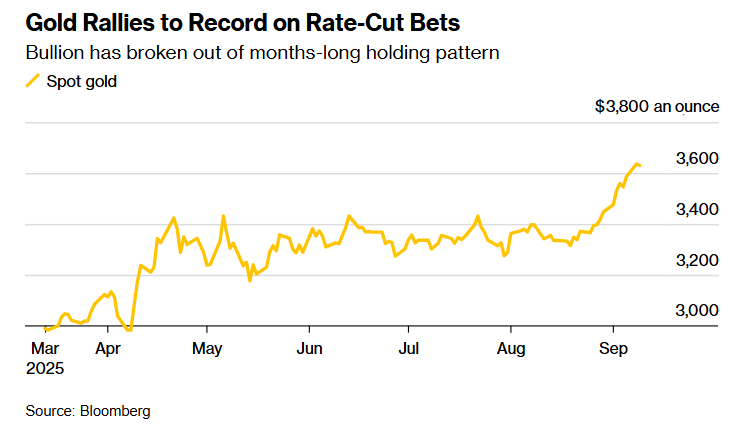

Gold reaches a new record high amid expectations of a US Federal Reserve rate cut, Bloomberg reports.

Quotes rose on Tuesday, September 9, by 0.3% to $3,647 per ounce, surpassing the previous day’s record high.

The price increase accelerated after weak US payrolls data was published, prompting traders to price in three Fed rate cuts this year, including a quarter-point cut as soon as the next meeting.

Reasons for rise

Gold has risen nearly 40% since the beginning of the year due to central bank purchases and expectations of rate cuts. Additional factors include heightened geopolitical tension and risks to the global economy caused by US President Donald Trump’s tariff policies.

The price was also supported by Trump’s statements targeting the Fed’s independence. This extended gold’s upward trend, which has continued for three consecutive years.

Analyst forecasts

Analysts predict further growth. Goldman Sachs stated that gold could approach $5,000 per ounce if investors redirect some investments from government bonds into the precious metal.

ETF funds began actively buying gold after the Jackson Hole conference, where Federal Reserve Chair Jerome Powell expressed readiness to ease policy. On Monday, ETF inflows were the largest in nearly three months.

Current market dynamics

Despite the rise, total ETF holdings of gold remain below the levels recorded during the Covid-19 pandemic and the beginning of Russia’s war against Ukraine. This indicates further growth potential.

Impact of macroeconomic data

The prospect of continued gold gains depends on the upcoming US employment data, to be published on Tuesday. Market attention is also focused on producer and consumer inflation figures, expected on Wednesday and Thursday.

Investors are also watching reactions to auctions of short- and long-term US Treasury bonds. These data points could affect gold price movements.

As previously reported, central bank and investor demand have strengthened gold’s position as a safe-haven asset.

Furthermore, gold first exceeded $3,500 per ounce in April this year. This occurred amid the trade war and Trump’s intentions to dismiss Federal Reserve Chair Jerome Powell.