Gold hits new records as dollar falls, becomes top safe-haven asset

Photo: Gold could rise to $4,000 (Getty Images)

Photo: Gold could rise to $4,000 (Getty Images)

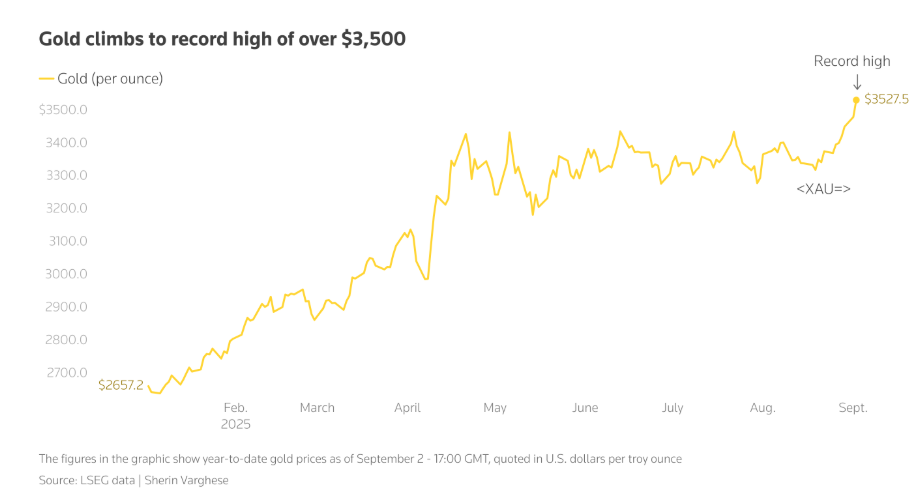

Gold has risen more than 34% since the start of the year, with demand from central banks and investors strengthening its position as a safe-haven asset, Reuters reports.

Price growth and analysts' forecasts

The latest surge in gold prices has been driven by expectations of US rate cuts, doubts about the independence of the Federal Reserve, and strong demand from investors and central banks. Analysts predict that gold could reach new records in the coming weeks.

Spot gold reached a high of $3,527.5 per ounce on September 2. Experts expect a range of $3,600–$3,900 in the near term and do not rule out $4,000 per ounce by 2026 if economic and geopolitical uncertainty persists.

Long-term trends

Since the beginning of the year, gold has increased by more than 34%. The forecasted average price for 2025 rose from $2,756 to $3,220 per ounce between January and July, according to Reuters surveys.

Markets now expect a Fed rate cut as early as September following statements by Chair Jerome Powell on rising employment risks, which have further strengthened gold’s role as a safe-haven asset.

Role of dollar and political risks

“Supportive for gold is the bearish dollar outlook underpinned by expectations of Fed cuts, investors distancing from US assets, and tariff-related economic uncertainty,” said Ricardo Evangelista, Senior analyst at ActivTrades.

The dollar has fallen nearly 11% since January, when Donald Trump returned to the White House. A weaker dollar makes gold, priced in US dollars, cheaper for holders of other currencies.

Trump’s criticism of Powell and attempts to remove Fed Board member Lisa Cook have fueled doubts about the Fed’s independence, further boosting gold purchases.

Central banks and global demand

“The most bullish wildcard is... potential interference with the US Federal Reserve and concerns about the dollar’s status as a safe-haven,” said Julius Baer analyst Carsten Menke.

Geopolitical tensions in the Middle East and between Russia and Ukraine, along with active central bank purchases, especially in developing countries, have increased interest in gold. China’s central bank, for example, increased its gold reserves for the ninth consecutive month in July.

According to the World Gold Council, central banks plan to increase gold’s share in reserves and reduce dollar assets over the next five years.

“The combination of a rising gold price and central bank accumulation means that gold shares of reserves have risen steeply for some central banks,” said Michael Hsueh, Deutsche Bank's precious metals analyst.

As previously reported, in April 2025, gold exceeded $3,500 per ounce for the first time, amid trade tensions and Trump’s plans to fire Fed Chair Jerome Powell.

Concerns about the US economy at the time caused the dollar to fall to a three-year low against major currencies.