G7 could slash Russia's oil Revenues by half — Reuters

Photo: Russia will lose half of its oil sales revenue (Getty Images)

Photo: Russia will lose half of its oil sales revenue (Getty Images)

The G7 countries want to maximize pressure on Russian oil exports. The plan includes increasing production in Saudi Arabia and the UAE and reducing purchases of Russian oil in India and Türkiye, Reuters reports.

As agency commentator Hugo Dixon notes, if rich democracies act decisively, they could reduce Moscow's oil revenues by up to $80 billion a year.

This would be a serious blow to the Kremlin's weakening economy and could even force Vladimir Putin to end the war against Ukraine, the agency says.

G7 goals in oil strategy against Russia

G7 finance ministers, who will meet at the International Monetary Fund and World Bank in Washington, already have a list of measures to devastate Moscow's military budget. It includes additional tariffs on countries that buy Russian oil, as the US has done with India.

However, squeezing Russian oil exports could be counterproductive if other producers do not fill the gap. Otherwise, supply constraints will lead to higher global oil prices, which will hit the economies of Western countries. Moscow's revenues may not even decline, as higher prices will offset the reduction in volume.

Agreement with Persian Gulf

The best plan depends on whether other countries, especially the Persian Gulf states, can be persuaded to increase oil production. At the same time, the G7 needs to convince major buyers of Russian oil, such as India, to buy less Russian oil and more Saudi and Emirati oil.

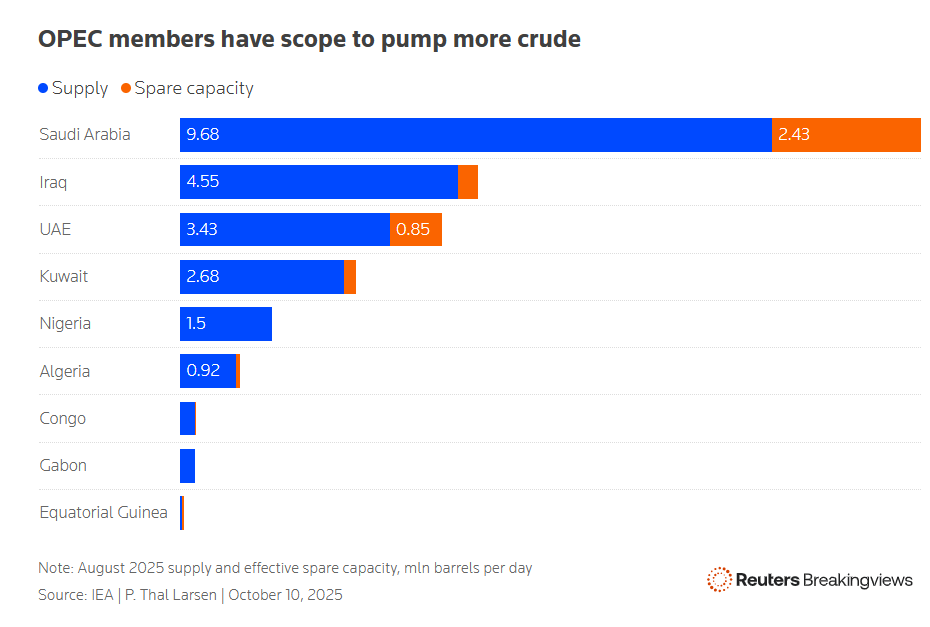

Saudi Arabia could increase production by 2.43 million barrels per day, and the UAE by 0.85 million barrels, according to the International Energy Agency. The kingdoms are ready to increase production: their costs are low, and their oil reserves could last for decades. At the same time, Saudi Arabia has expensive projects outside the oil sector, which increases the budget deficit.

The problem is that a sharp increase in supply could lower global prices. To stimulate increased production, the G7 needs to ensure that oil prices do not fall. This is possible if the market is supplied with volumes of oil that replace Russian supplies.

Agreement with India and Türkiye

The Persian Gulf agreement will only work in conjunction with the India-Türkiye agreement. China is the largest buyer of Russian oil, but given its strong alliance with Moscow, it is impossible to stop this flow. It is more promising to work with New Delhi and Ankara.

India has imported about 1.9 million barrels of Russian oil and oil products in recent months, and Türkiye has imported 0.9 million barrels. The G7 must show these countries the benefits of reducing purchases from Russia and increasing supplies from the Persian Gulf. Lowering the price cap on Russian oil will allow India and Türkiye to save billions of dollars.

If India cuts Russian purchases by 75% and receives a discount of $20 per barrel, the savings will amount to $3.5 billion per year. Türkiye will receive similar benefits. The European Union must stop the remaining 0.2 million barrels of imports from Russia. Together, the reductions in India, Türkiye, and the EU will offset supplies from the Persian Gulf.

Consequences for Russia

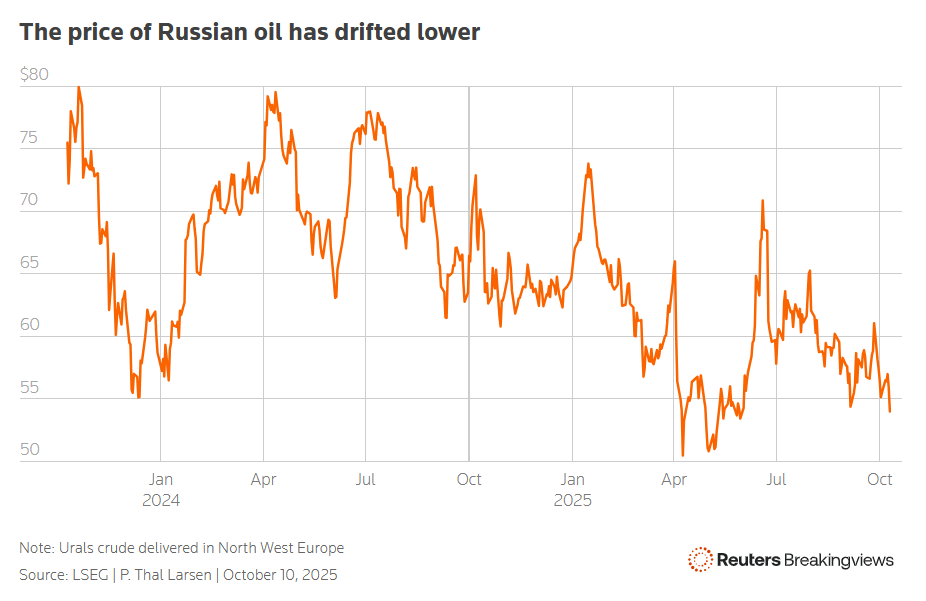

If Russia can only sell 5 million barrels at $40 instead of 7.3 million barrels at $56, it will lose half of its export revenues. Losses for the year could amount to $76 billion.

Implementing such a complex agreement will require negotiations with the Persian Gulf, India, and Türkiye. But financial incentives could make it attractive to all participants. This strategy will prove extremely disadvantageous for Moscow and could significantly reduce its military resources.

US Treasury Secretary Scott Bessent said that Washington expects India to increase its imports of American oil and reduce its purchases from Russia.

In August-October, Ukraine sharply increased its long-range strikes on Russian oil refineries, depriving the Kremlin of approximately 1 million barrels of oil processing per day.