Who pushes Ukraine to keep Russian gas transit to Europe and what to expect next

Discussions on gas supplies through Ukraine to the EU have stalled (photo: Getty Images)

Discussions on gas supplies through Ukraine to the EU have stalled (photo: Getty Images)

Kyiv does not confirm that the process of discussing the issue of continuing gas supplies through Ukraine is in any way moving forward. On the contrary, informed sources in the government say that it stopped several months ago. Read more in the RBC-Ukraine's article.

The Ukrainian side has no information about any progress in the discussion of gas supplies through Ukraine to Europe. Any reports about this may now appear to push Kyiv to agree to gas transit to Europe after 2025 as soon as possible.

RBC-Ukraine was told about this by several sources who are somehow involved in consultations on this topic with Azerbaijan and partners in the EU.

On October 31, Bloomberg reported on the possible signing of contracts between European gas buyers in Slovakia, Hungary, and Azerbaijan, citing knowledgeable sources.

“Under the commercial agreement, Azerbaijan’s state energy company Socar would deliver gas to Sudzha on the Russian-Ukrainian border. Hungary’s MVM Zrt. and Slovakia’s Slovensky Plynarensky Priemysel AS would then take over and bring it to Europe,” the agency says.

Thus, legally, it will no longer be Azerbaijani gas that will be transited through Ukraine, but Hungarian and Slovak gas. The volume of transit can be 12-14 billion cubic meters per year.

But Azerbaijan cannot provide such a volume of gas on its own - it will have to supplement the flow, most likely with Russian gas. “Everyone understands that Azerbaijan does not have 12-14 billion cubic meters of gas available. All their exports to the EU are now 13 billion (via Türkiye - ed.). That is, it will be the same Russian gas, but disguised as Azerbaijani gas under the documents,” says Serhii Makohon, former head of the GTS Operator.

RBC-Ukraine's interlocutors said that reports about the possibility of signing any contracts for gas transit through Ukraine now look like an attempt to make wishful thinking. “It looks like a duck at the moment,” says one of the sources.

Another source called the information a deliberate misinformation to once again draw attention to the topic and somehow intensify its discussion. After all, signing contracts for the purchase of gas before understanding the ways and conditions of its transportation is at least unwise. And Ukraine has not yet given any conditions, or even consent to this.

The Slovakian state-owned company SPP denied reports of its intention to sign a contract for the transit of Azerbaijani gas through Ukraine. "We regularly discuss the topic with our partners, but the information about the upcoming conclusion of a gas supply contract with the participation of SPP is not true,” the company says.

Slovakia as a buyer and Russia as a seller are primarily interested in continuing gas supplies through Ukraine. Apart from Slovakia, Hungary and Austria may potentially be interested. The fact that other countries besides Slovakia are interested in transit gas is evidenced by the fact that the volume of possible transit could be up to 14 billion cubic meters. At the same time, Slovakia itself, according to various estimates, needs only 2-4 billion cubic meters per year.

There is no official confirmation that Hungary is willing to transit gas through Ukraine. According to Prime Minister Péter Szijjártó, in 2024 Hungary will buy 6.7 billion cubic meters of gas from Russia at a competitive price and is quite satisfied with the contract signed in 2021. The supplies bypass Ukraine. But if the opportunity to buy gas through Ukraine arises, Budapest is unlikely to refuse it.

According to experts with whom RBC-Ukraine spoke, Germany, which previously received Russian gas through Ukraine and Nord Stream, may be among the potential buyers of Russian gas under the Azerbaijani brand.

To date, the Ukrainian side has not rejected the potential possibility of gas supplies through its territory but has set conditions, which RBC-Ukraine wrote about in detail in October.

Naftogaz offered Slovakia and Azerbaijan to replace transit with re-exports. This scheme involves European companies buying gas from Azerbaijan to store in Ukrainian underground storage facilities and then selling it on the European market. But at the same time, gas buyers must somehow secure agreements with Russia on the security of supplies through the territory of Ukraine.

This proposal, according to RBC-Ukraine, has not aroused interest among any of the parties concerned. Volodymyr Omelchenko, director of energy programs at the Razumkov Center, citing his sources close to the Slovak government, says that Bratislava and Baku have lost interest in the issue of gas supplies through Ukraine, as they do not want to take risks when supplying gas through a country at war. “Currently, Ukraine and Gazprom are taking these risks. But if gas is purchased on the eastern border (of Ukraine - ed.), these risks will be borne by the buyers,” he says in a commentary to RBC-Ukraine. In such a situation, transit insurance will increase significantly.

“As far as I know, there is nothing new on the topic of gas supplies now. On the contrary, the issue of continuing transit, no matter what form it takes, has become even more complicated because of security risks. Azerbaijan has cooled down on this topic and has not raised it at all for at least 3 months. There is no activity in Slovakia either. They believe that it is not profitable for them, as the risks may fall on their company,” Omelchenko says.

According to him, the EU is now looking for ways to diversify gas supplies through LNG, and this issue is a priority for them.

The start of Azerbaijani gas supplies, regardless of its origin, is also complicated by the latest decision of the European Parliament on Azerbaijan. On October 10, MEPs in their resolution condemned the human rights situation in Azerbaijan and called on the EU to end its gas dependence on Baku.

"Citing Azerbaijan’s continuous human rights abuses and fears that increased gas imports from Azerbaijan to the EU might be compensated in turn by Baku importing Russian gas, MEPs call for the EU’s dependency on gas exports from Azerbaijan to end,” the European Parliament says.

Continued gas supplies through Ukraine may encourage Germany to raise the issue of resuming the operation of Nord Stream 2, Makohon says. “Don't you see any risks that Azerbaijani gas could soon be supplied through Nord Stream 2? There is only one line with a capacity of 27.5 billion cubic meters. Why, if the Slovaks can do it, then the Germans cannot?” says the former head of the GTSOU.

Currently, Nord Stream 2 has been under US sanctions since 2020 (NDAA 2020), but they expire at the end of 2024 and have not yet been extended.

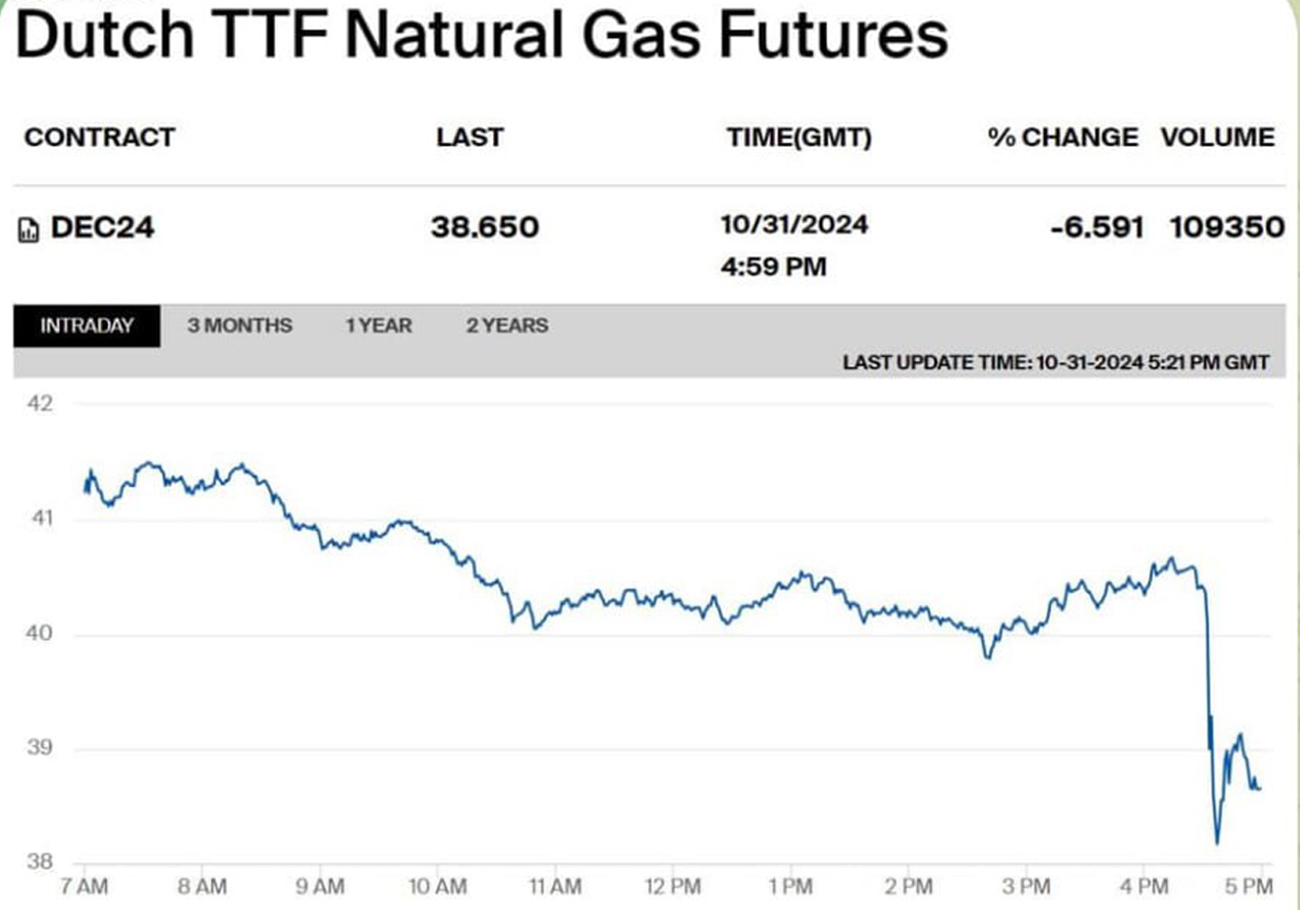

In addition, traders can also play on the expectation of agreements on the continuation of gas supplies. After the information about the imminent signing of gas contracts with Azerbaijan was released, the price of gas on the market instantly dropped by 7%. And someone made good money on this price fluctuation.

TTF screenshot

TTF screenshot

It cannot be ruled out that information about progress in discussions on gas supplies to the EU will appear periodically until the end of the year when the transit contract expires. However, it is unlikely that supplies will continue in 2025, especially under a standard transit contract.

Most likely, if an agreement is reached, the option of buying out Ukraine's transit capacities by European companies will have to be used. In this case, Ukraine will be able to refuse to provide transportation services at any time, ceasing to put its GTS capacities up for tender.