Trump's trade war is out of control: What awaits global economy

Photo: Donald Trump's tough policies leading to a global recession (Getty Images)

Photo: Donald Trump's tough policies leading to a global recession (Getty Images)

Donald Trump has been waging a trade war with the entire world for more than a week. The main opponent – China – is not giving in so far and is preparing for a prolonged struggle. What consequences Trump’s tariff policy has already brought to the global economy – in the RBC-Ukraine's material below.

Main points:

-

Why did Trump put the confrontation on pause?

-

How did global stock markets survive the first week of war?

-

Why is Trump paying such attention specifically to tariffs?

-

Why is China the biggest headache for the US?

-

Does Beijing plan to give in, and what could it do next?

-

Why does an economic crisis threaten the world?

Pause in Trump’s confrontation with the whole world

US President Donald Trump started a trade war against the world on April 2. He announced tariffs against most countries, with China being hit the hardest – 34% (from the existing 20%, it became 54%).

Official Beijing responded symmetrically and imposed a 34% tariff on American goods, which outraged Trump, and on April 8 he raised his tariff to 104%. This triggered a new round of confrontation. As a result, China raised its tariff to 125%, while the US tariff for China reached 145% (taking into account the previous 20% tariff, which the White House linked to fentanyl trafficking).

On April 12, it became known that smartphones, computers, and chips would be excluded from the list of tariffs for Chinese products.

The confrontation with China is the sharpest problem in Trump’s trade policy. A simpler case – the countries that agreed not to apply counter-tariffs and decided to enter into negotiations. For them, the White House took a pause, the essence of which is that for 90 days, high tariffs will not be applied to these countries, only a basic one, 10%. Minimal tariffs were received, for example, by the EU and China’s neighbors – Japan, Vietnam, South Korea, and Taiwan. During the three months, they can negotiate with Washington and make a deal.

.jpg)

Tariffs above 100% lead to a reduction or halt in trade (infographic by RBC-Ukraine)

Trump said on April 9 that "more than 75 countries" wanted to make a deal with the United States, when he announced a pause in the application of the “tariff wall” – that’s what today’s confrontation is called in the White House, avoiding the phrase “trade war.” There, they also want to make 90 deals in 90 days.

Consequences of the first week of the US trade war

The initial high tariffs, which were to come into force for most countries on April 9, over a week, led to a shock collapse of stock markets in the US, Europe, and Asia. The Dow Jones Index, which includes shares of the 30 largest US companies, from April 2 to 8 lost 11% and fell to the level of January 2024 – 37,645 points. After news about the easing of tariffs, the index began to recover only on April 9.

A similar dynamic was shown by the second indicator of the American stock market – the S&P 500 index, which represents a basket of shares of 500 American companies with the largest capitalization. To understand the scale of the fall, CNBC reported that on the first day of the trade war alone, seven companies with the highest capitalization on the New York Nasdaq Stock Exchange lost more than 1 trillion dollars. Commenting on the turbulence on the stock exchanges, Trump said that the market “was sick,” and its reaction was temporary.

The events on Wall Street have given the Democratic Party representatives grounds to accuse Trump of insider trading. The implication is that Trump could have bought shares when they became cheap (after he announced the tariffs) and sold them after the rate rose (against the backdrop of his own decision to pause).

Traders in London and Shanghai also had reasons to worry. The key index FTSE 100, which presents a basket of shares of the 100 largest companies on the London Stock Exchange, during April 2–9 fell by 11% to 7,679 points. During the same period, the key index of the Shanghai Stock Exchange, the Shanghai Composite, dropped by 6% to 3,136 points.

Why Trump raises tariffs

Despite the decline of indicators of the state of the American economy, the White House continues its hardline course. Trump explains the reason for his policy by stating that the USA has had a trade deficit with many countries of the world for many years. This means that countries sell more goods to Washington (in monetary terms) than it does to them. Thus, trade partners receive more funds from the USA than American companies receive from them. Moreover, according to Trump, a number of these countries have applied high tariffs against the USA.

Trump commented on the trade situation on April 9, saying that the United States had been robbed by almost every country for 35 years, that balancing the trade balance should have been done long ago, and that the U.S. had been treated very badly for many years, adding that Americans themselves had allowed this to happen.

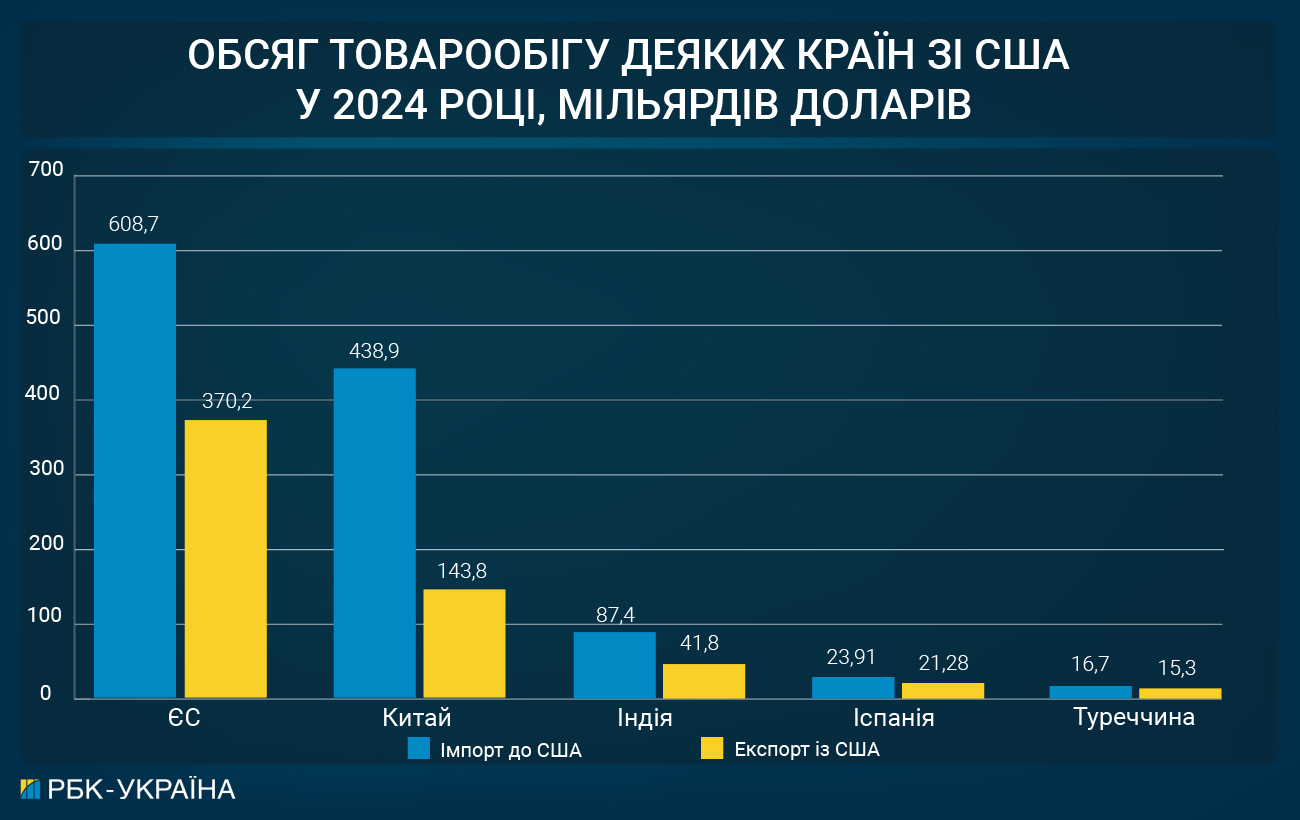

According to data from the Office of the United States Trade Representative, in 2024, goods worth $41.8 billion were sold to India, and $87.4 billion were purchased. Thus, the US trade deficit with this country amounted to $45.6 billion. The US trade deficit with the EU last year was $235.6 billion, but the biggest pain for Washington's trade balance is, of course, China, with which the deficit is the largest – in 2024 it amounted to $295.4 billion. That is, China sells to the USA goods worth three times more than the value of imports from the USA, and this trend has not changed for many years.

Foreign trade deficit – the main reason for Trump’s trade war (infographic by RBC-Ukraine)

“China is the most unbalanced economy in the history of the modern world and they are the biggest source of the U.S. trade problems,” said US Treasury Secretary Scott Bessent on April 9.

To balance the trade deficit, according to Trump’s logic, it is enough just to raise tariffs on imported goods and use the funds from these taxes to compensate for the losses from unequal trade.

Why did Trump decide to use tariffs? According to the US Trade Expansion Act, Section 232, the president has the right to independently impose tariffs in the event of a situation that threatens national security. Trump does not need to coordinate these decisions with Congress, so he uses this provision with particular zeal.

How China and the EU reacted to Trump’s tariffs

Official Beijing reacted sharply to the start of the tariff war on the part of the USA. Immediately after Trump’s speech on April 2 in the White House Rose Garden with a price tag board for the whole world, the Chinese Ministry of Commerce stated that there are no winners in trade wars and called on the USA to immediately cancel the tariffs. On April 8, the Chinese government strengthened its diplomatic position and stated that it would fight to the end.

To support its exports, the Celestial Empire took a typical step, for which it had been repeatedly criticized in the past – devaluation of the yuan. On April 10, the People’s Bank of China moderately lowered the key interest rate, indicating that the regulator is ready to gradually weaken the yuan to support exports.

On April 11, during a visit to Spain, Chinese leader Xi Jinping stated that the PRC is not afraid of unjust pressure from Trump. In a conversation with Spanish Prime Minister Pedro Sánchez, he said that going against the world means isolating oneself. Xi Jinping also proposed that the EU join efforts in confronting Washington.

The Communist Party of China may enter into a long-term confrontation and consciously tolerate losses for its economy. “In China, there is a command-administrative economy, and there is no choice, including for business. Things will be as the party decides,” said an RBC-Ukraine interlocutor from the international equipment market for energy needs, who has experience working in the Chinese and European markets.

The European Union took a less belligerent position, but still, on April 9, EU member states supported the European Commission’s proposal to introduce reciprocal measures in customs policy against the USA. This was a response to the tariffs that Washington imposed on European steel and aluminum back in March.

However, this decision looked more like a warning or a subject for diplomatic bargaining, as stated in the European Commission's announcement, it was to come into force only on April 15 (after passing bureaucratic procedures) and under the condition that an agreement could not be reached.

Photo: Ursula von der Leyen took a constructive position on US tariff policy (Getty Images)

On April 10, European Commission President Ursula von der Leyen welcomed Trump's decision for a pause and stated that the EU was also suspending its countermeasures for 90 days. “We want to give negotiations a chance. If the negotiations do not satisfy us, our countermeasures will take effect,” she said.

Consequences of the trade war for the world and the USA

A global trade war will primarily lead to the disruption of supply chains for many goods because today it is almost impossible to find a product whose components are produced in one country. The same American market depends on the supply of foreign components, raw materials, energy resources, etc.

“To manufacture a car, metal is obtained in one country, the engine is assembled in another, in the third – the entire car, and in this way, world trade services a significant part of production and commercial processes. Trump's policy not only disrupts some exchange proportions, but also commercial chains,” commented to RBC-Ukraine the Chairman of the Board of the Institute for Economic Research and Policy Consulting, Ihor Burakovskyi.

The expert added that the trade war will exacerbate existing economic problems for China and the USA. According to him, the import tariff on Chinese goods to the USA is not paid by the manufacturer (the Chinese factory), but by the supplier who buys the goods at this factory and brings them to the American port on the Pacific Ocean.

To offset the impact of the tariffs, the supplier will ask the factory to lower the price (a loss for China), but at the same time, he will raise the price for the American consumer (a loss for the USA).

“The tariffs are always a two-sided weapon. If you close yourself off from a certain good, then, firstly, you punish your consumers, because they cannot consume what they would like at a lower price. Secondly, you provoke inflation (in the USA – ed.),” said Ihor Burakovskyi.

Tariffs rates at the level of 100% or more theoretically should raise the price of the good on the US market twofold, but practically – this is impossible, because no one will buy a product at such a price. According to a source of RBC-Ukraine in the plastic products market, such high duties essentially equal the halting or significant restriction of trade. Supporting this idea, on April 9, the World Trade Organization stated that the volume of trade between the USA and China may fall by 80%.

Photo: The first consequence of Trump's trade war was alarming signals of a decline in the global economy (Getty Images)

Another consequence of Trump’s sharp policy will be a crisis of trust in the USA as a reliable partner, especially from the EU. “Optimism about future decisions in economic policy is undermined. There is no guarantee that this won’t happen again (another tariff increase – ed.). Good relations and ties are no longer guaranteed that you won’t be affected. The corresponding risks are already being factored into calculations and analyses,” said Oleh Ustenko, a RBC-Ukraine economist and former advisor to the president.

Trump’s actions are essentially aimed at breaking the entire global trade system. The Deputy Director of the National Institute for Strategic Studies, Yaroslav Zhalilo, expressed such an opinion to RBC-Ukraine. He noted that up until now, global trade was based on minimizing tariff and non-tariff restrictions, and Trump has taken the path of strict protectionism.

“Moreover, this protectionism is built not on an economic but a political principle. The introduction of duties, differentiated for different countries, is a purely political approach, no matter what economic arguments are used to justify it,” he said in a comment to RBC-Ukraine, adding that the main result Trump has already achieved is undermined trust.

It is unknown whether Trump will succeed in eliminating the trade balance deficit. Still, it is already clear that such a policy will hit all countries of the world (including the USA) and will cause new and additional economic problems. Evidence of this is the forecasts of leading investment banks on Wall Street, which are already openly talking about a global economic recession and a global crisis in the near future.