Markets wary of a too resilient US economy as global oil prices rise

Markets wary of a too resilient US economy as global oil prices rise (Photo: Getty Images)

Markets wary of a too resilient US economy as global oil prices rise (Photo: Getty Images)

Last week, the markets continued to operate in the 'good economic news - bad news for markets' mode. The reason for the stability of this mode is the dominance of the high-interest rate factor of the Federal Reserve on investors' agenda. Since inflation remains high, and slowing it down will not be conducive to an overheated economy. Therefore, the central bank will have to keep interest rates high or even raise them again to cool down the economy. This threatens the markets with a reduction in their vital liquidity and the possibility of the economy weakening beyond the regulators' control. More details on this can be found in the weekly financial market overview from the Head of Corporate Research at ICU Group, Olexander Martynenko.

The bad news for the markets last week was good news for the highly active American services sector in August and far fewer than expected claims for unemployment assistance. These two indicators managed to spoil the rosy impression investors had from the August employment data in the US, which showed an ideal picture of a moderate labor market cooling that could help reduce inflationary pressure. Both indicators currently lack trend stability, and it is quite possible that they may deteriorate soon. However, they made a significant contribution to the deterioration of market sentiment.

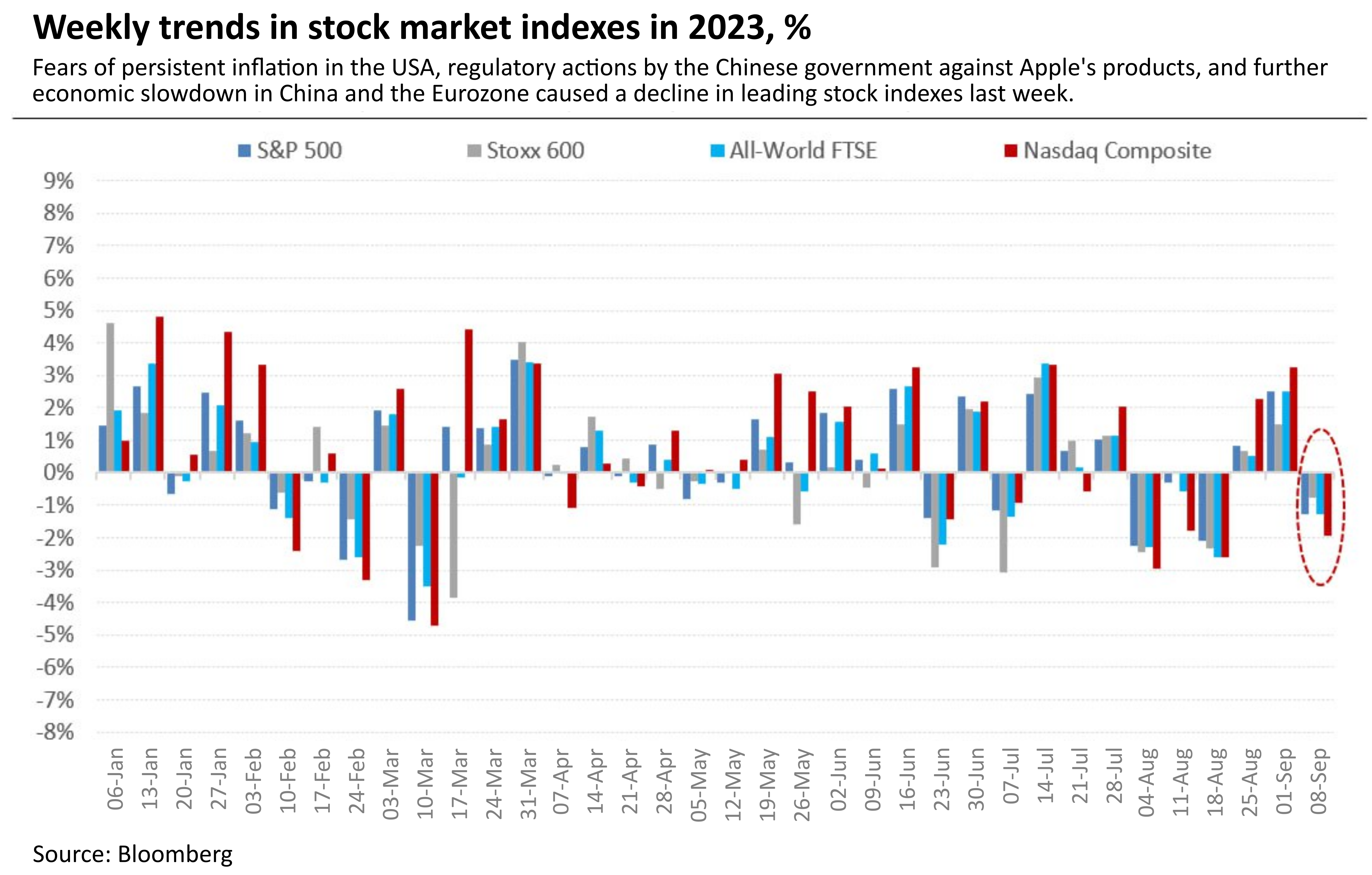

Another significant blow to the American stock indexes came from the Chinese government's decision to ban central government officials from using iPhones. Fears that this is just the beginning led to a decline in Apple's shares, as well as its suppliers Nvidia and Qualcomm, dragging down the technology sector index Nasdaq Composite, and the broader S&P 500. Both indexes lost 1.9% and 1.3%, respectively, last week.

Signs of a reasonably good state of the American economy contrasted with the depressed situation in two other key regions of the world: similar PMI indexes showed further slowing of business activity in the Eurozone and China. Investors were further discouraged by a yearly drop in August import and export volumes by an impressive 7% and 9%, respectively, although forecasts were somewhat worse. Therefore, the global All-World FTSE fell by 1.3% last week. European Stoxx 600 has been falling for the eighth consecutive week, this time by 0.8%. Regional economic disparities and high yields on US Treasury bonds contributed to the further strengthening of the US dollar, which rose 5.5% against a basket of other currencies since mid-July and reached a six-month high.

Signs of a reasonably good state of the American economy contrasted with the depressed situation in two other key regions of the world: similar PMI indexes showed further slowing of business activity in the Eurozone and China. Investors were further discouraged by a yearly drop in August import and export volumes by an impressive 7% and 9%, respectively, although forecasts were somewhat worse. Therefore, the global All-World FTSE fell by 1.3% last week. European Stoxx 600 has been falling for the eighth consecutive week, this time by 0.8%. Regional economic disparities and high yields on US Treasury bonds contributed to the further strengthening of the US dollar, which rose 5.5% against a basket of other currencies since mid-July and reached a six-month high.

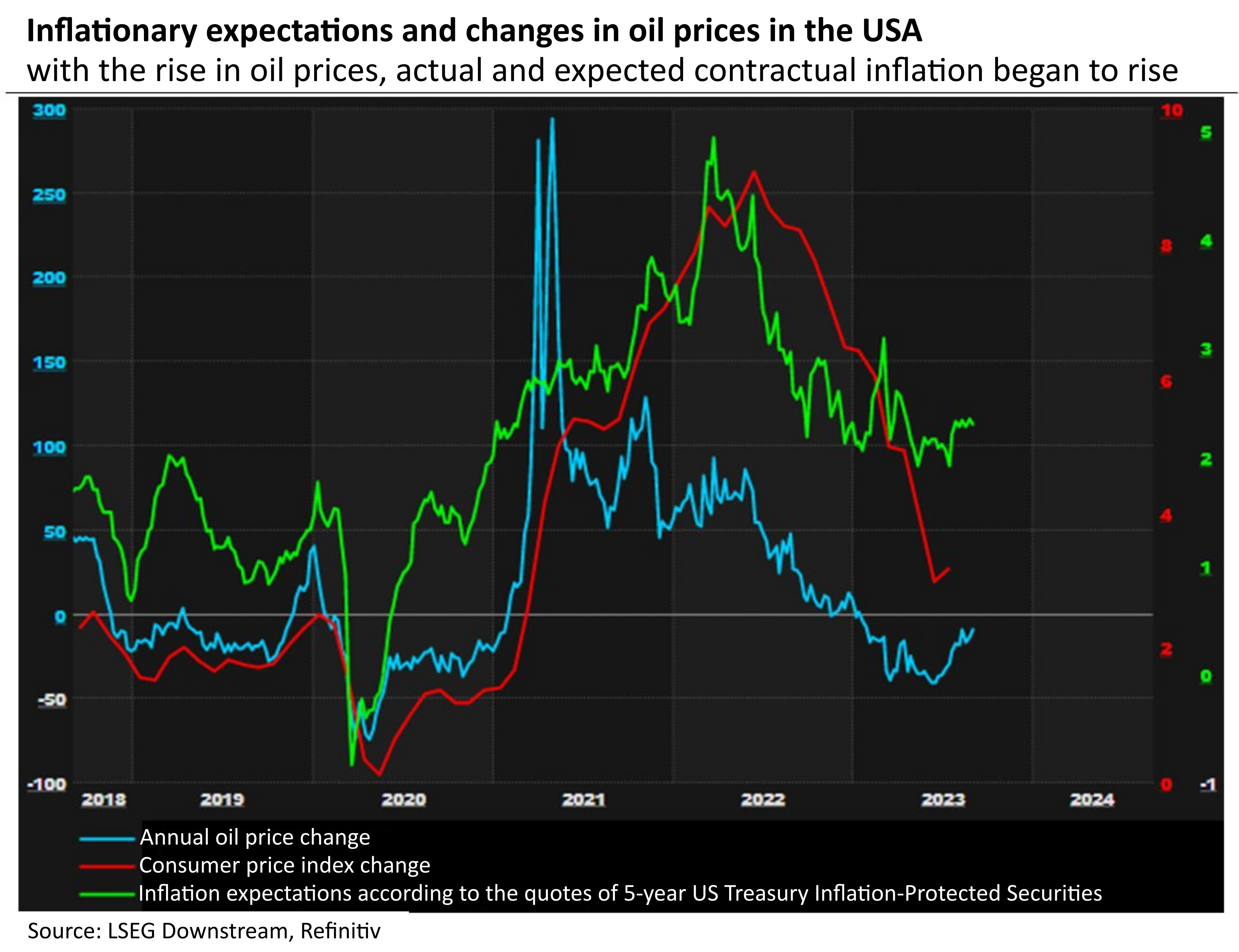

The worsening sentiment in financial markets also affected commodity markets, pushing down commodity prices and strengthening the US dollar. However, oil stood out from the general trend after Saudi Arabia and Russia announced on Tuesday the extension of production and export restrictions on their oil until the end of the year. Much anticipated, this move nevertheless gave new impetus to oil prices, which crossed the $90 per barrel mark for the first time this year last week. Since mid-year, oil prices have already risen by 27% and threaten to give a second wind to inflation, which markets fear. Retail fuel prices in the US have already risen by 10% since June and will continue to rise as oil refineries are forced to process increasingly expensive oil. Consequently, inflation expectations are rising, currently justifying one of the main fears of the markets - persistently high-interest rates.

Despite unfavorable global markets, last week's decline in Ukrainian Eurobonds prices stopped, and they slightly increased by nearly 4% to 28-34 cents per dollar by the end of the week. It is most likely that news of the White House's efforts to expedite congressional approval of a new aid package for Ukraine provided support for Ukrainian sovereign bond prices. GDP-linked warrants increased by 10% in a week to over 50 cents per nominal dollar. Both primary and secondary foreign investors also became more active on the domestic bond market, increasing their investments in hryvnia government bonds by almost a billion hryvnias last week.

Despite unfavorable global markets, last week's decline in Ukrainian Eurobonds prices stopped, and they slightly increased by nearly 4% to 28-34 cents per dollar by the end of the week. It is most likely that news of the White House's efforts to expedite congressional approval of a new aid package for Ukraine provided support for Ukrainian sovereign bond prices. GDP-linked warrants increased by 10% in a week to over 50 cents per nominal dollar. Both primary and secondary foreign investors also became more active on the domestic bond market, increasing their investments in hryvnia government bonds by almost a billion hryvnias last week.

The cash exchange rate of the hryvnia in systemically important banks weakened slightly last week by a few kopecks, reaching 37.4-38.2 UAH/USD on average. The foreign exchange market has already stabilized somewhat after the National Bank of Ukraine allowed larger purchases of non-cash currency for the population. The need for banks to provide the population with currency has decreased, as has the need to meet the demand of corporate clients. However, the demand for currency on the retail market still exceeds supply.

Meanwhile, annual inflation in Ukraine continued to slow down rapidly in August, reaching 8.6% and pleasantly surprising analysts. The main factor pushing down consumer prices is a good harvest of cereals, vegetables, and fruits, along with a relatively stable exchange rate of the hryvnia. Therefore, the National Bank of Ukraine has more reasons to further reduce the discount rate this month.