US could profit from Ukraine’s strikes on Russian oil infrastructure – Reuters

Photo: Burning Russian oil refineries will bring profits to America (Russian media)

Photo: Burning Russian oil refineries will bring profits to America (Russian media)

The latest series of Ukrainian drone attacks on Russian oil refineries and export facilities could boost global refining margins. This is particularly true for companies in the US, where fuel demand remains high even after the end of the summer season, according to Reuters.

According to Reuters' calculations, the strikes temporarily disabled facilities accounting for at least 17% of Russia's oil refining capacity, or 1.1 million barrels per day.

The Ust-Luga terminal on the Baltic Sea and the Druzhba oil pipeline, which supplies oil products to Belarus, Slovakia, and Hungary, were also attacked.

Moscow's violation of agreements

These strikes marked a significant escalation of the war, which had been going on for more than three years. Kyiv is targeting the Kremlin's main source of income, while US President Donald Trump is trying to push through a ceasefire agreement.

Earlier in March, the parties agreed to refrain from attacks on energy facilities. However, Russia violated this agreement and launched strikes on Ukrainian energy infrastructure, including drone attacks on power plants in the north and south of the country, writes Reuters columnist Ron Bousso.

Consequences for Russia

The decline in domestic refining volumes forced Moscow to increase oil exports from western ports in August by 200,000 barrels per day, or 11%. The additional volumes came from underutilized Russian refineries.

At the same time, a number of regions in Russia began to experience gasoline shortages, despite the ban on its export, which came into effect on July 28. Repairing the damaged plants could take weeks or months, leading to fuel shortages in domestic and global markets ahead of winter.

Growth in refining margins

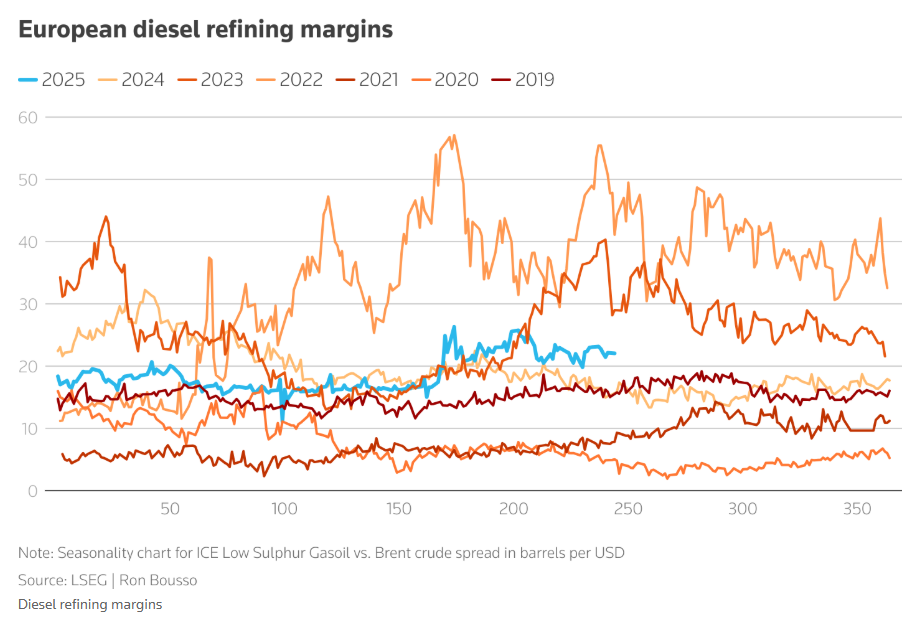

Global oil refineries are already enjoying high profits thanks to steady demand for diesel. European marginal revenues from diesel refining are $23.5 per barrel, which is 40% higher than a year ago, according to the article.

A decline in Russian diesel exports could increase pressure on global supplies and boost refining profitability, especially at refineries on the US Gulf Coast. In August, Russian diesel exports by sea fell to 744,000 barrels per day, down from 828,000 in July.

Sanctions and new risks

Until 2022, Europe purchased 40% of its imported diesel from Russia. But from 2023, the EU and the UK have completely abandoned these supplies, switching to India and the Middle East.

In July, the EU adopted an 18th package of sanctions banning imports of fuel produced from Russian oil. The ban will take effect in 2025 and will affect India, which has become the second-largest buyer of Russian oil after China.

US President Donald Trump has said he is ready for the next phase of sanctions against Moscow, which could extend to Brazil. This will increase supply instability and benefit refiners outside Russia, according to Reuters.

In June, German Galushchenko, who served as Ukrainian energy minister, said that Russia had resumed large-scale attacks on Ukraine's energy infrastructure.

Ukraine launched a series of strikes on Russian oil refineries, knocking out at least 17% of oil refining capacity.