Trump's victory shakes euro: Will it fall below dollar?

Photo: Donald Trump has crashed the euro (Getty Images)

Photo: Donald Trump has crashed the euro (Getty Images)

The euro fell to a one-year low, renewing speculation that the currency could hit $1. Donald Trump's victory in the US election raises the possibility of higher tariffs, which could deal a new blow to the eurozone economy, Reuters reports.

The euro/dollar is the most actively traded currency pair in the world. The euro fell by 6% to around $1.05, down from a more than one-year high in September, when the deteriorating economic outlook halted its growth.

Is it possible for euro to fall to parity?

A drop in the euro to $1 is possible. The euro is only 5% away from parity, and it has already traded below that level once in the early 2000s and again for several months in 2022 when US interest rates rose faster than in the eurozone as Europe struggled with soaring energy prices after Russia's full-scale invasion of Ukraine.

For traders, the $1 mark is a key psychological level. Therefore, a fall below this level could increase negative sentiment toward the euro, leading to a further decline in the rate.

Major banks, including JPMorgan and Deutsche Bank, believe that a drop to parity could occur depending on the size of the tariffs. Tax cuts could also lead to inflation in the US and limit Federal Reserve rate cuts, making the dollar potentially more attractive than the euro.

What this means for businesses and households

A weak currency usually increases the cost of imports. This can lead to higher prices for food, energy, and raw materials, which increases inflation.

Since inflation reached double digits two years ago, it has fallen rapidly, so the hit to prices from currency weakness should not be a big problem at this point. Most economists expect inflation to return to the 2% target next year after some volatility in late 2024.

Conversely, the depreciation of the euro makes exports cheaper - good news for European automakers, industrial companies, and luxury goods retailers, for example, as well as for individuals or investors with foreign income.

This is particularly positive for Germany, which has long been considered the engine of European exports.

Does euro stand out from other currencies?

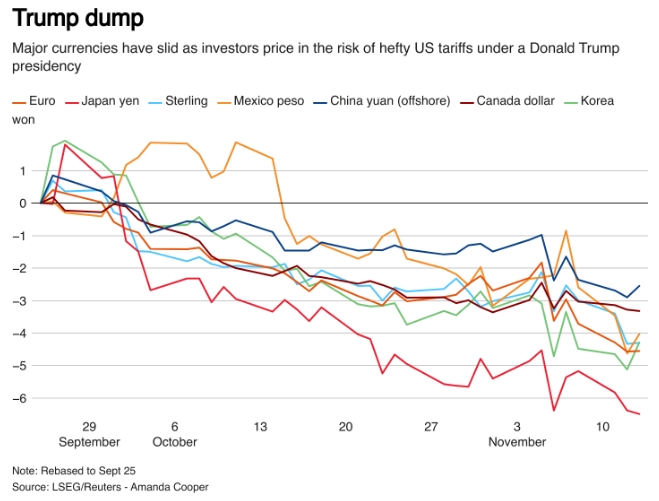

Many of the currencies of the United States' main trading partners have been hit hard over the past six weeks due to tariff concerns.

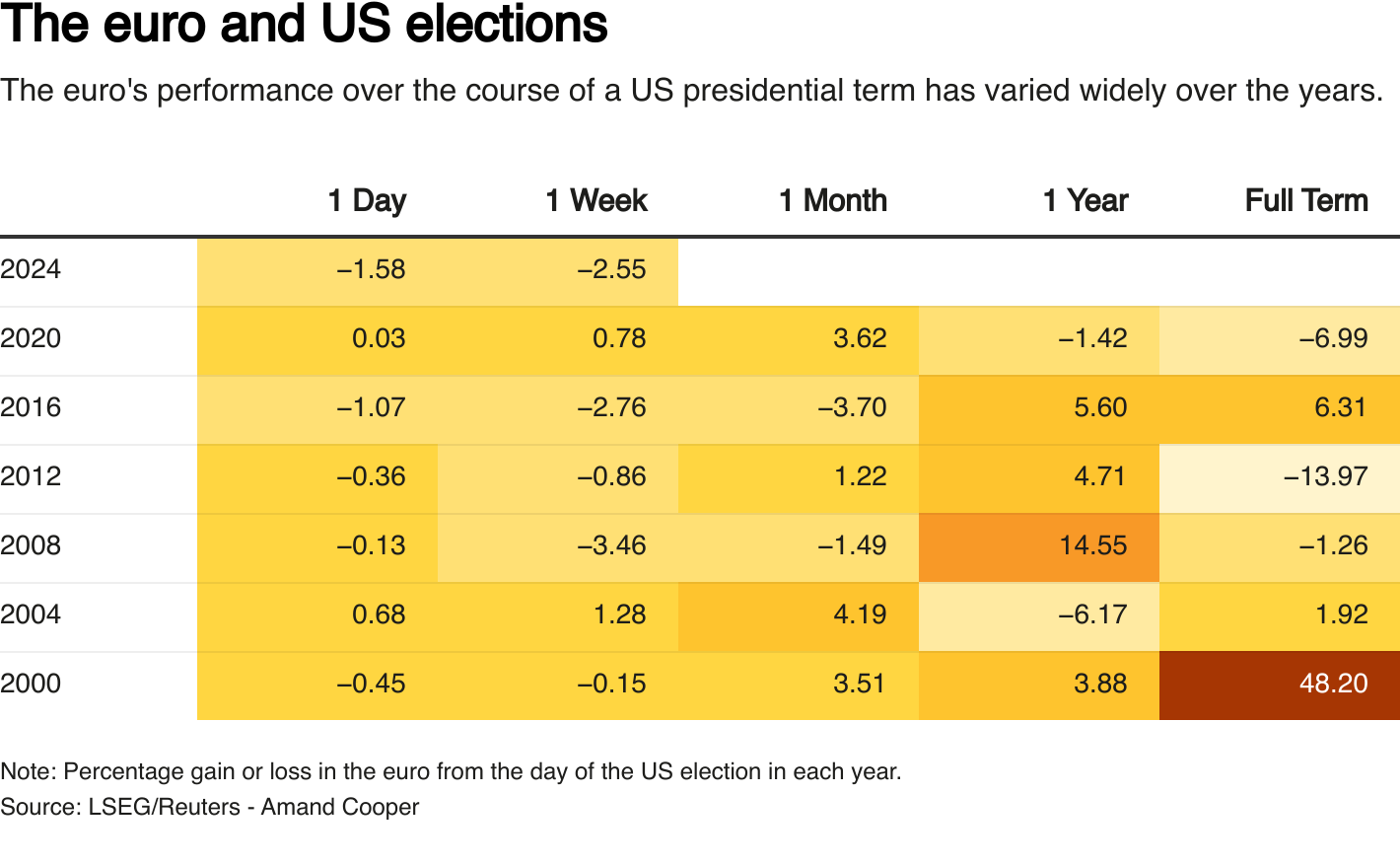

The euro has lost more than 4.5%, while the Mexican peso has lost 6% and the Korean won has fallen 5.4%. The euro rose 6% during Trump's last term but fell nearly 6% in the six weeks following the 2016 results before recovering.

The Japanese yen is down almost 10% against the dollar this year.

Photo: Reuters

Is it really that bad?

Many banks believe parity is possible, but not necessarily likely. Faster interest rate cuts by the European Central Bank (ECB) than in the United States would be negative for the euro, but on the other hand, easing could also support the currency in the long run by boosting economic growth prospects.

The eurozone economy grew by 0.4% in the third quarter compared to the previous three months, which is positive for the euro. The collapse of the German government, which potentially paves the way for growth-boosting spending next quarter, could also provide support.

“Everyone is gloomy on Europe and we understand the gloominess but we could have some positive surprises,” said Benjamin Melman, chief investment officer at Edmond de Rothschild, adding that he doesn't see a significant decline in the euro from here.

Photo: Reuters

Photo: Reuters

Earlier, Goldman Sachs predicted that the euro could fall by 10%, which implies a drop below $1. According to Goldman Sachs, this will happen if Donald Trump imposes large-scale tariffs and cuts domestic taxes after winning the election.