Silver breaks 91 dollar per ounce for first time in history

Silver price rose to record levels (photo: Getty Images)

Silver price rose to record levels (photo: Getty Images)

A sharp rise in precious metal prices has been recorded due to lower interest rates in the United States and escalating geopolitical tensions, according to Comex and Bloomberg.

Record highs on the exchange

During morning trading on the New York-based Comex exchange, the silver price rose to a peak of 91.37 dollars per ounce (per 28.35 grams), 5.83% above previous levels.

A slight correction followed: as of 7:29 Kyiv time, the price was recorded at 90.49 dollars per ounce.

Reasons for the rise

According to assessments by Bloomberg analysts, precious metals market dynamics are currently driven by several key factors:

- US economic policy: reduction of interest rates by the Federal Reserve System.

- Geopolitics: overall increase in global tensions, prompting investors to seek safe-haven assets.

- Crisis of confidence: prices were influenced by the threat of criminal prosecution against Federal Reserve leadership.

Historical records in the metals market

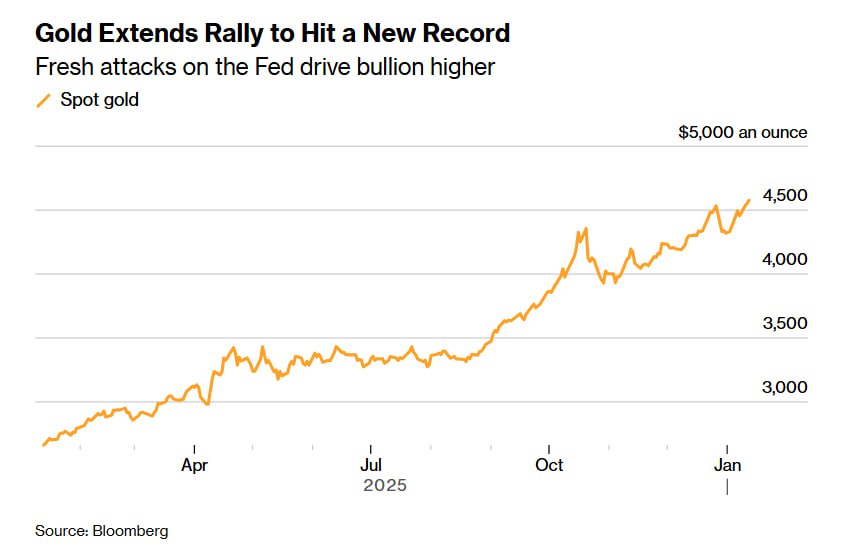

At the end of December 2025, the gold price set a new all-time high, showing the best annual growth in the past four decades.

At the same time, silver also reached record highs.

Mass protests in Iran, which resulted in human casualties, strengthened investor interest in precious metals as safe-haven assets. In addition, sharp price growth is driven by a severe global silver shortage.

Another trigger for the price surge was a US President Donald Trump order to block all tankers subject to sanctions. This move was aimed at isolating the Venezuelan regime, but it triggered concerns in global markets.

As a result, investors began to shift assets more actively into metals, using them as a safe haven amid Washington's tightening sanctions policy.