Russia takes emergency measures after ruble's crash

The Russian Central Bank has sharply raised interest rates during an emergency meeting convened after the ruble plummeted to 100 against the dollar. The decision comes following criticism of the central bank from the Kremlin, Bloomberg writes.

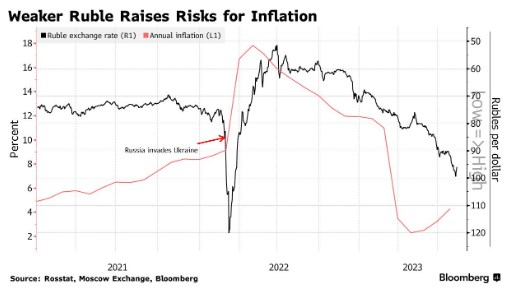

The central bank lifted the benchmark to 12% from 8.5%, the second straight increase and the sharpest since the immediate aftermath of Russia’s invasion of Ukraine almost 18 months ago. The ruble appreciated after the rate announcement before reversing gains and trading weaker against the dollar. It’s still among the three worst performers in developing economies this year with a loss of over 24%.

The decision on Tuesday took a page from a playbook that Elvira Nabiullina, the head of the central bank, used in the past when the ruble foundered. This decision comes after Vladimir Putin's economic advisor, Maksim Oreshkin, attributed the devaluation to the central bank's "soft policy."

Oreshkin criticized the central bank, blaming it for allowing rapid credit growth to flood the economy with money and called for a "strong ruble" to aid Russia's adjustment. The ruble's decline poses a threat to social stability, leaving Russia vulnerable at a time when the war against Ukraine persists and international sanctions have hit trade.

While Oreshkin stated that the Bank of Russia "has all the necessary tools to normalize the situation in the near future," its options are limited, aside from maintaining high rates and tightening capital controls.

With the majority of the central bank's reserves already frozen due to sanctions, policymakers are unlikely to intervene in the currency market with direct interventions if the ruble comes under pressure again.

Ruble crash

On August 14, the Russian ruble breached the significant level of 100 against the dollar for the first time since March 2022.

The Russian currency has fallen in value by nearly half compared to last year's peak, driven by increased state spending, declining energy revenues, and Russians' inclination to park funds in foreign accounts.

The negative trend has persisted even after Russia's Urals crude oil surpassed the price threshold set by the G7 countries last month.