Highest and lowest pensions in world: Pension index 2023

Illustrative photo (Photo: Getty Images)

Illustrative photo (Photo: Getty Images)

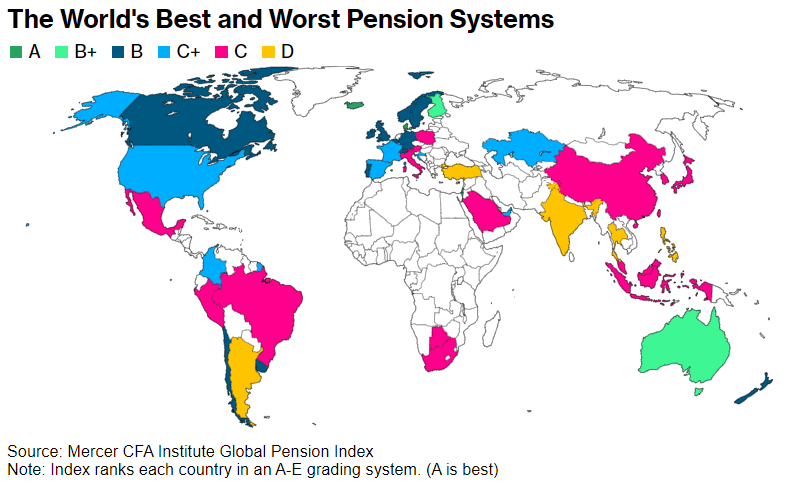

Annually, the Mercer CFA Institute conducts a study of pension systems in different countries to determine the Global Pension Index. In 2023, 47 countries from around the world were included in the ranking.

Where the best and worst pensions are, is explained by RBC-Ukraine based on the Institute's report.

How pension systems were evaluated

To assess the pension systems, experts selected three criteria:

- Adequacy: state support, savings, pension growth, and more.

- Sustainability: demographics, government spending, national debt, economic growth.

- Integrity: regulation, management, protection, communication, operational costs. Ratings were given from A to E, where A is the best, and E is the worst.

Screenshot

Which countries have the best and worst pensions

The Netherlands, Israel, Denmark, and Iceland are in Class A. The pension systems of these countries are described as first-class and reliable systems that provide comfort and stability.

Average results were demonstrated by Kazakhstan, South Africa, Hong Kong, UAE, Colombia, France, Spain, Croatia, Saudi Arabia, Poland, Japan, Italy, Malaysia, Brazil, Peru, China, Mexico, Botswana, South Africa, Taiwan, Austria, Indonesia, South Korea.

The worst performance was recorded in Nil. The system of this country was described as very poor and unstable.

Pension sizes in European countries

Finally, it can be difficult to thoroughly examine this issue, so we provide approximate amounts that retirees receive in different countries around the world:

Poland - $460

France - $1,200

Japan - $2,000

Germany - $1,500

Spain - $1,050

USA - $1,500

Israel - $1,500

China - $150

Based on the above ranking and pension sizes, it can be concluded that the Netherlands, Denmark, and Iceland provide their retirees with payments equal to or exceeding $1,500.