Gold market in turmoil: Reasons behind this week’s market shake-up revealed

Bank gold (Illustrative photo: Getty Images)

Bank gold (Illustrative photo: Getty Images)

Gold is falling again as traders shift focus from safe-haven assets to US-China trade talks and potential credit risks in the US banking system, according to Вloomberg.

By the end of Friday, gold had lost more than 1.7% in a single day - its sharpest drop since May. Silver fell even more sharply, down 4.3%, instantly cooling nine weeks of market euphoria.

Traders are now observers, not profit hunters.

US President Donald Trump’s statement that a deal with Beijing is possible sharply reduced demand for safe-haven assets. If Washington and Beijing make progress in negotiations, gold and silver could temporarily lose their status as stress-relief assets purchased amid fear.

But the optimism is not without clouds. Market concerns are spreading after Zions Bancorp and Western Alliance Bancorp reported problematic loans, potential fraud, and upcoming earnings releases - which could reveal whether US banks are hiding a new wave of toxic debt.

Current market situation

What’s happening right now:

- Spot gold price: $4,238.96 per ounce (–0.3%);

- Bloomberg Dollar Index: +0.1%;

- Silver: stable after a record drop;

- Platinum and palladium: down.

Experts warn that if US-China trade talks produce tangible results, gold could temporarily lose ground. However, any crack in the US financial system or disruption of trade agreements could quickly push the market back into a rush to gold phase.

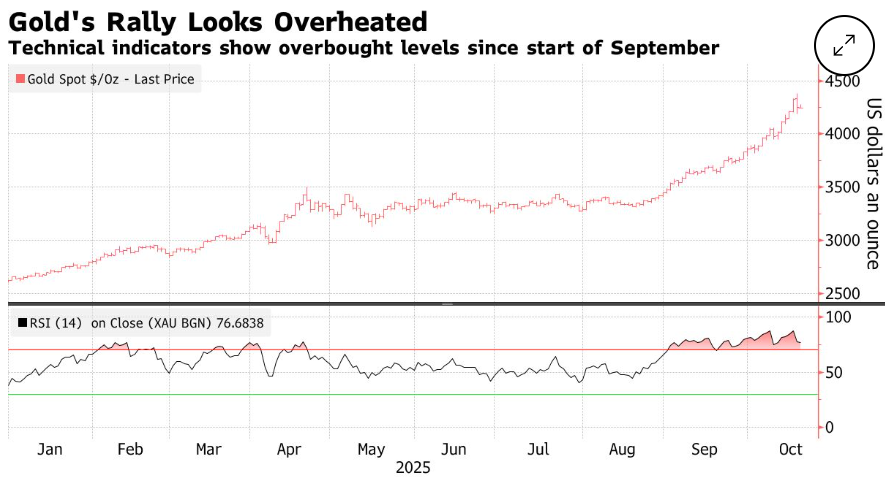

Since the beginning of 2025, gold has risen more than 65%, driven by geopolitical tensions, central bank purchases, and the ongoing process of dedollarization.

Silver has surged even more sharply, by 80%, and now traders from London to New York are literally hunting for physical metal. London’s stocks are shrinking, and over the past two weeks, more than 20 million ounces have been withdrawn from Comex, further fueling market tension.