Europe buys Russian gas as much as China - Bloomberg

Europe buys Russian gas as much as China (Photo: Getty Images)

Europe buys Russian gas as much as China (Photo: Getty Images)

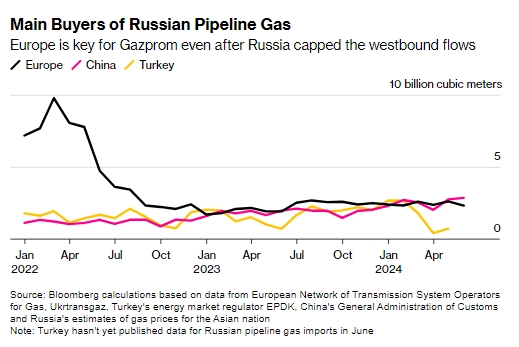

Europe is still competing with China for the title of the main buyer of Gazprom's pipeline gas, even two years after Russia's invasion of Ukraine led to a reduction in energy supplies to the West, according to Bloomberg.

The agency notes that even after many rounds of international sanctions, Russia still supplies significant volumes of gas to certain European countries, and this year the volumes have even increased. However, Moscow has not concluded any new agreements to accelerate its sales growth to China beyond what was already planned before the collapse of its largest export market.

According to Bloomberg calculations based on flows through Ukraine and the Turkish Stream, Gazprom's pipeline gas supplies to its remaining clients in Europe reached 14.6 billion cubic meters from January to June. This is significantly lower than the annual sales of about 130-175 billion cubic meters observed before the invasion.

However, this is comparable to the 15.2 billion cubic meters that Gazprom supplied to China in the first half of this year.

Calculations show that by the end of 2024, Europe and China alternately became the largest buyers of Russian pipeline gas.

After the invasion, most EU countries found alternatives after Russia restricted flows to the region in response to support for Kyiv. Norway now supplies 30% of the bloc's gas, but for some countries, including Austria, Hungary, and Slovakia, Gazprom remains a critical and growing energy source. Pipeline supplies to the region increased by more than 26% in the first half of the year compared to the previous year, according to Bloomberg calculations.

However, these flows are at risk. About half of the gas passes through Ukraine, and Gazprom's five-year transit agreement with Ukraine expires in December 2024. Kyiv has repeatedly stated that it will not extend the agreement, but European officials are negotiating to keep the gas flowing through the country, the agency notes.

Turning to China

Russia has long claimed that it plans to expand sales to China, but shortly, this Asian country will not come close to the size of Gazprom's European market before the invasion. Average prices for eastern exports are much lower.

Gazprom's gas supplies to China via the Power of Siberia pipeline are expected to reach a full capacity of 38 billion cubic meters per year in 2025, and another 10 billion cubic meters per year will be available via the so-called Far Eastern route from 2027. So far, the Kremlin has tried but failed to sign a third contract with China for a pipeline through Mongolia.

Recall that at its peak in 2018-2019, Gazprom's annual gas flow to the EU reached 175 to 180 billion cubic meters. In 2022, Russia supplied about 63.8 billion cubic meters of gas to Europe via various routes. In 2023, the volume decreased by another 55.6% to 28.3 billion cubic meters.

In 2023, Gazprom posted a net loss of $7 billion, the first occurrence since 1999.