EU cuts Russian oil price cap to $47.60 - Now in effect

Photo: The EU lowered the price cap for Russian oil from September 3 (Getty Images)

Photo: The EU lowered the price cap for Russian oil from September 3 (Getty Images)

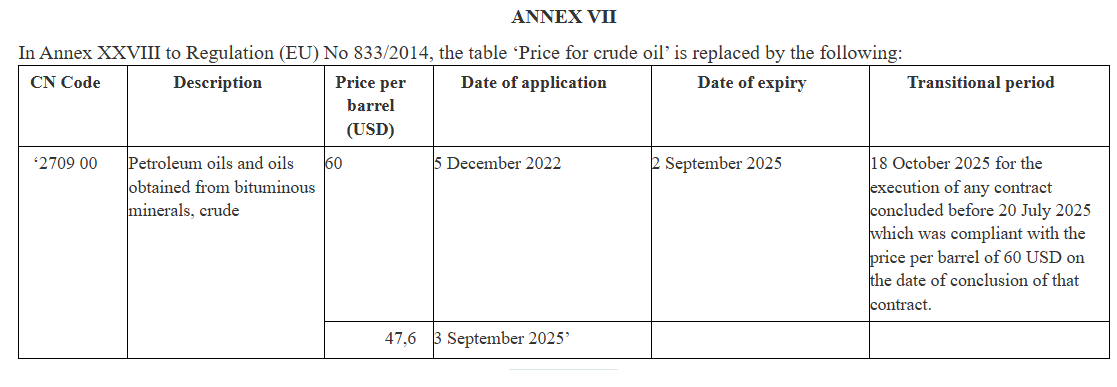

The European Union, as part of its 18th sanctions package against Russia, has lowered the price cap on Russian oil from $60 to $47.6 per barrel. The decision came into effect on September 3, the official website of the European Union reports.

A transition period has been set until October 18, 2025, for the fulfillment of any contracts concluded before July 20, 2025, which were based on a $60-per-barrel price at the time of signing.

18th package

On July 18, EU member states approved the new sanctions package against Moscow, including a cap on the minimum price for Russian oil.

According to EU High Representative for Foreign Affairs and Security Policy Kaja Kallas, the EU is lowering the maximum price for crude oil from $60 to $47.6 per barrel to align it with current global oil prices. The EU is also introducing an automatic, dynamic mechanism to adjust the oil price cap and ensure its effectiveness.

“Oil exports still account for a third of the Russian government's revenues,” Kallas added.

How price cap works

The price cap on Russian oil sets the maximum price at which countries can purchase it from Russia. Transport and insurance companies cannot provide their services for deals where the oil price exceeds the cap.

Previously, the G7 countries had set a $60-per-barrel cap in December 2022.

The EU price cap will be automatically reviewed at least twice a year based on market prices. It will be calculated as the average oil price over the past three months minus 15%.

To maintain oil exports, Russia may either lower its oil prices or use a so-called shadow fleet - older tankers not subject to strict oversight or tankers registered in countries with looser shipping regulations, such as Panama or Liberia. Russia also uses tanker fleets from Greece, Malta, and Cyprus for oil transport.

However, access to the shadow fleet will become more difficult. The 18th sanctions package extends restrictions to dozens of ships providing such services and to several companies managing them.

The Presidential Office of Ukraine believes that, due to the new sanctions, Russia could lose between $15 and $30 billion in oil revenues by the end of 2025.