American pension funds help Putin's gas project

Illustrative photo (Getty Images)

Illustrative photo (Getty Images)

Russia needs to increase its liquefied natural gas (LNG) exports to replenish the Kremlin's coffers and finance the war against Ukraine. Western pension funds may unintentionally lend a helping hand, according to Bloomberg.

Data collected by consulting firm Data Desk and the Anti-Corruption Data Collective show that state pension funds, including those managed by Washington, New York, and California, have indirectly invested in specialized ice-class vessels servicing Russia’s Yamal LNG project—the country’s largest operating gas export terminal and a crucial part of its efforts to replace lucrative trade with Europe.

The Yamal project, led by PJSC Novatek in the Arctic, is not under sanctions. Nevertheless, amid heightened scrutiny of financial institutions, including from their investors, this connection between American investors and one of Moscow's key income sources highlights the ongoing opacity of the global financial system. It also exposes the difficulties in cutting off key revenue streams for President Vladimir Putin, more than two years after the invasion.

In this case, the link between American workers, retirees, and Russia is facilitated through New York-based alternative investment manager Stonepeak and its $14 billion Infrastructure Fund IV. To date, the fund has invested $6 billion in 10-15 assets, including Seapeak LLC, a major LNG vessel owner and former LNG unit of US shipping company Teekay Tankers.

Stonepeak's purchase of Seapeak in January 2022—shortly before the invasion—included ownership stakes in dozens of tankers, among them six of the 16 ice-class vessels that exported fuel from Yamal this year. Of the 160 shipments from Yamal in 2024, more than a third were on Seapeak-owned tankers.

"Without these vessels, Novatek, and by extension Russia, would be unable to export LNG from the country's largest project," said Malte Humpert, founder of the Arctic Institute, a Washington-based think tank. "These icebreaking LNG carriers were specifically designed to carry Russian LNG from the Arctic to Europe and Asia. There's no other market or purpose for them."

One vessel, Seapeak's Eduard Toll, left Russia and arrived at a terminal in China's Fujian province earlier this month, according to ship tracking data. This was the first shipment from Yamal to China this year via the northern trade route, which will become increasingly important for Moscow.

Seapeak transports LNG under long-term charter agreements signed a decade ago and serves European buyers who take a significant portion of Yamal's gas, said an anonymous source familiar with the company. According to them, the company does not receive revenue directly from Russia or Russian companies.

Europe remains one of the largest buyers of Russian LNG. According to ship tracking data, France, Spain, and Belgium are among the top five importers of Russian LNG this year.

The persistent connection is a reminder that while efforts to limit hydrocarbon revenues continue, Western countries and companies have not severed all financial ties with Russian gas. For example, TotalEnergies SE remains a shareholder in the Yamal project. Additionally, European insurers continue to underwrite the sector, even as the EU implements measures to restrict supplies from Russia.

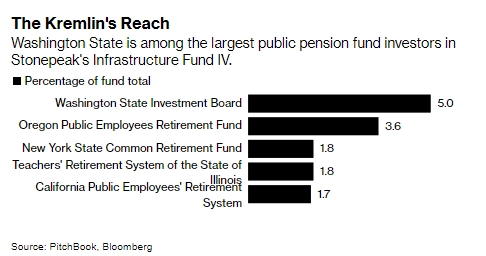

American pension funds

The California Public Employees’ Retirement System, known as Calpers, is one of Stonepeak's investors and in response to Bloomberg's inquiry said that it has already raised concerns with the general partner.

"We believe that Russian investments pose a material risk to our long-term investment success and have taken actions, consistent with our fiduciary duty, to remove these assets from our portfolio," John Myers, chief of Calpers' public affairs office, said in a statement.

The Washington State Investment Board, Oregon Public Employees Retirement Fund, New York State Common Retirement Fund, and Illinois Teachers' Retirement System declined to comment.

Stonepeak, a signatory to the UN-supported Principles for Responsible Investment and a member of the world’s largest green finance coalition, the Glasgow Financial Alliance for Net Zero, or GFANZ, also declined to comment on this article, as did GFANZ. A PRI spokesperson said each investor is responsible for monitoring their portfolio, while their own mission is to promote best practices in sustainable investing.

The uncomfortable connection is already prompting calls for greater clarity so that investment funds can conduct more thorough due diligence.

Ana Maria Jaller-Makarewicz, a leading energy analyst at the Institute for Energy Economics and Financial Analysis, a research organization focused on accelerating the energy transition, noted that in this case, Stonepeak positions its fund as investing in North American infrastructure assets. The question is how well pension funds and ultimately contributors are aware of this.

"We need more transparency from these funds," said Jaller-Makarewicz.

Earlier, Bloomberg reported that Russia is creating a shadow fleet for LNG exports. The details are remarkably similar to maneuvers for creating a shadow oil fleet, including the use of opaque companies and ships so old that they would normally be retired under ordinary conditions.