Low gas, tight budget: How Ukraine's bracing for winter and who's stepping in to help

Photo: Ukraine's Naftogaz is actively importing gas to fill underground gas storage facilities for the winter (Getty Images)

Photo: Ukraine's Naftogaz is actively importing gas to fill underground gas storage facilities for the winter (Getty Images)

Ukraine ended last winter with historically low gas reserves. Naftogaz — Ukraine's national oil and gas company — needs to import significant amounts of gas to prepare for the next one. All the necessary infrastructure is in place, but the only question is money. RBC-Ukraine analyzes where Naftogaz plans to get the funds to purchase gas.

Key questions

- Why is there not enough gas for winter?

- How much gas needs to be purchased, and where?

- How much gas can be imported from Europe?

- Is it possible to buy American gas?

- Where will Naftogaz obtain funds?

Reasons for gas shortage

Ukraine is looking for gas for next winter. In early June, President Volodymyr Zelenskyy announced negotiations with the Norwegian government to find financing or, in fact, gas for the next heating season. Due to Russian strikes on Ukraine's gas infrastructure this winter, problems arose with accumulating sufficient gas resources to get through next winter. The President has already suggested the possibility of a gas shortage for the fall-winter period of 2025-2026.

Why did this problem arise? In previous years, no additional gas was imported, and accumulated reserves from domestic production were used. As Ukraine's Prime Minister Denys Shmyhal reported, Ukraine got through the 2023-2024 heating season without importing gas. This was achieved thanks to a significant drop in consumption due to the loss of a number of large industrial consumers and relatively warm weather.

The same plan was in place for the winter of 2024-2025. But in January-February 2025, Russia conducted the most significant strikes on Ukraine's gas production facilities since the start of the full-scale invasion of Ukraine, resulting in a 40% drop in production. To resolve the situation, gas withdrawals from storage facilities were significantly increased, and Naftogaz began to import gas on an emergency basis. Gas production companies actively restored damaged equipment, but have not yet been able to restore production to previous levels.

Ukraine ended the last heating season with its lowest gas reserves in 11 years – 5.4 billion cubic meters, of which about 0.67 billion cubic meters was active gas. The rest of the gas (4.7 billion cubic meters) is buffer gas, which is necessary for the normal operation of underground storage facilities and must remain there permanently, meaning it cannot be withdrawn. For comparison, in 2022-2024, gas reserves at the end of the withdrawal season amounted to 8-9 billion cubic meters, and in 2020-2021, more than 15 billion cubic meters.

Amount of resources needed for winter

Currently, according to ExPro Consulting, there are already 7 billion cubic meters of gas in underground storage facilities. According to RBC-Ukraine's interlocutors who are familiar with the situation, it is necessary to pump another 6 billion cubic meters into storage facilities to reach a level of 13 billion by mid-October to early November. This volume of gas will be sufficient to get through the winter and be able to confidently withdraw gas from storage facilities until the end of the heating season, provided there are no massive attacks on the gas infrastructure.

Of the desired 6 billion, a significant portion — about 1.5 billion cubic meters — will be needed for electricity production. "In addition to the 4.5 billion cubic meters that everyone is talking about, another 1.3-1.7 billion is needed," says Oleksandr Kharchenko, director of the Center for Energy Research.

Naftogaz is currently restoring the operation of many combined heat and power plants (which produce heat and electricity) that were transferred to its management, noted Daria Orlova, an electricity market analyst at ExPro Consulting. According to her, the gas balance also needs to take into account maneuverable gas generation, which has already been built or is under construction to produce electricity and provide services to the energy system operator, NEC Ukrenergo.

"In 2024, according to government information, 1 GW of distributed generation was installed, but this includes renovated CHPs. For 2025, large companies planned to install another 1.5 GW of new generation, including projects by Naftogaz, OGTSU, Ukrnafta, and Ukrzaliznytsia and other state-owned and municipal enterprises, but the volumes may be slightly lower due to lower demand, as there are almost no power cuts," adds Daria Orlova.

Gas imports from Europe

The required volume of gas in underground storage facilities will be accumulated through imports and domestic production. Today, the total capacity of the gas transmission system on the border with the EU and Moldova is about 66 million cubic meters per day, says gas market analyst Mykhailo Svischo of ExPro Consulting.

The greatest opportunities for gas imports are available at the border with Slovakia – 42 million cubic meters per day, with Hungary and Poland accounting for 9.8 and 12.4 million cubic meters, respectively. Incidentally, the Polish route was doubled (from 6.4 to 12.4 million cubic meters) on June 13. Recently, the possibility of transporting gas to Ukraine from Greece has also opened up – the Trans-Balkan route with a capacity of up to 3 million cubic meters per day.

Photo: Liquefied gas terminals in southern Europe – another route for supplying resources to Ukraine (Getty Images)

Photo: Liquefied gas terminals in southern Europe – another route for supplying resources to Ukraine (Getty Images)

Currently, Hungarian and Polish routes are the most widely used, as they are cheaper than the Slovak route. Through the Polish gas transmission system, Ukraine has access to liquefied natural gas (LNG) terminals on the Baltic Sea and even to Norwegian gas, which is supplied to Poland via the Baltic Pipe gas pipeline. The Trans-Balkan route is not yet of much interest to market participants, who say that the cost of using it needs to be reduced.

According to ExPro Consulting, Naftogaz has already imported more than 1.5 billion cubic meters of gas from Europe to Ukraine since the beginning of the year. For example, Naftogaz buys gas from the Polish oil and gas company Orlen, which imports gas through LNG terminals on the Baltic Sea – Świnoujście in Poland and Klaipėda in Lithuania. The Polish partner buys gas on the global liquefied natural gas market, regasifies it at terminals, transfers it to the Polish gas transmission system, and Naftogaz buys it there. Thus, Orlen takes on all the difficulties of working in the LNG market.

Through a Polish intermediary, Naftogaz imports 100-120 million cubic meters of gas per month, which roughly corresponds to the volume of one LNG tanker. In April-May, Naftogaz imported two ships' worth of gas, and a third will arrive in June. All LNG terminal capacity in Poland and Lithuania has already been booked (by Orlen), so Naftogaz cannot purchase it and buy liquefied gas on its own.

Today, gas prices on the European market (€39 per megawatt-hour as of June 16) are higher than in the same season in previous years. For example, in mid-June 2023, the price was €32, and in mid-June 2024, it was €35 per megawatt-hour.

Liquefied gas from the US

In general, contracting liquefied gas on the world market, for example, in the US, and transporting it to terminals in the Baltic or Greece, and then to Ukraine, is not a simple matter; it requires careful planning. According to LNG market traders interviewed by RBC-Ukraine, the average duration of long-term contracts for the purchase of liquefied gas is 14-18 years, meaning that most of the resource has already been purchased well in advance. The situation is the same with LNG terminal capacities.

"The capacities of terminals that have logistical connections with Ukraine (Poland, Lithuania, Greece, Germany) are booked years in advance. Therefore, the solution may be to purchase spot LNG shipments and place them in free slots at terminals that appear on the secondary market (when terminal capacity is resold - ed.)," explains a source at a trading company.

Photo: In recent years, the EU has been importing a lot of liquefied gas (Getty Images)

Photo: In recent years, the EU has been importing a lot of liquefied gas (Getty Images)

According to him, the economy is currently conducive to concluding a long-term contract for the import of liquefied gas from the US to Ukraine. The cost of American LNG delivered to Ukraine is €29-34 per megawatt-hour (€307-360 per thousand cubic meters). This resource can be sold on the domestic market for €46.5 per megawatt-hour (€493 per thousand cubic meters - the market price of gas for industry).

Several RBC-Ukraine interlocutors in the gas market also consider it quite realistic for Naftogaz to purchase not one large batch of liquefied gas, but to join a third-party contract.

"It (the scenario, ed.) requires coordinated planning on the part of all participants. It is necessary to determine in advance the routes, terms, payment methods, and supply volumes to book all logistics elements promptly — from loading at the plant to transportation through Europe to Ukraine," adds one of the interlocutors.

Gas production resource

Gas production remains an important source of replenishment for underground gas storage facilities. According to Artem Petrenko, executive director of the Association of Gas Producers, both state-owned and private gas production companies are doing everything possible to restore gas production to the level it was at before the winter Russian strikes.

"Production is being restored as much as possible," he says in a comment to RBC-Ukraine. However, the total volume of gas production has not yet reached the level of January this year, adds analyst Mykhailo Svyshcho.

DTEK, Ukraine's largest private gas production company, reported that in the first quarter of 2025, the company's facilities were attacked twice, three facilities were damaged, and the amount of damage is estimated at €30 million.

"It will take at least a year to fully restore the facilities to their original condition and production capacity. These deadlines are because certain equipment needs to be specially manufactured abroad," DTEK tells RBC-Ukraine.

Increasing gas production depends not only on the restoration of damaged infrastructure but primarily on the drilling of new wells. "Companies continue to invest actively, despite the risks and the war, and are even setting records. In 2023, producers laid 150 new wells, and in 2024, they started drilling 143. In 2025, they laid about 55 new wells," Artem Petrenko says.

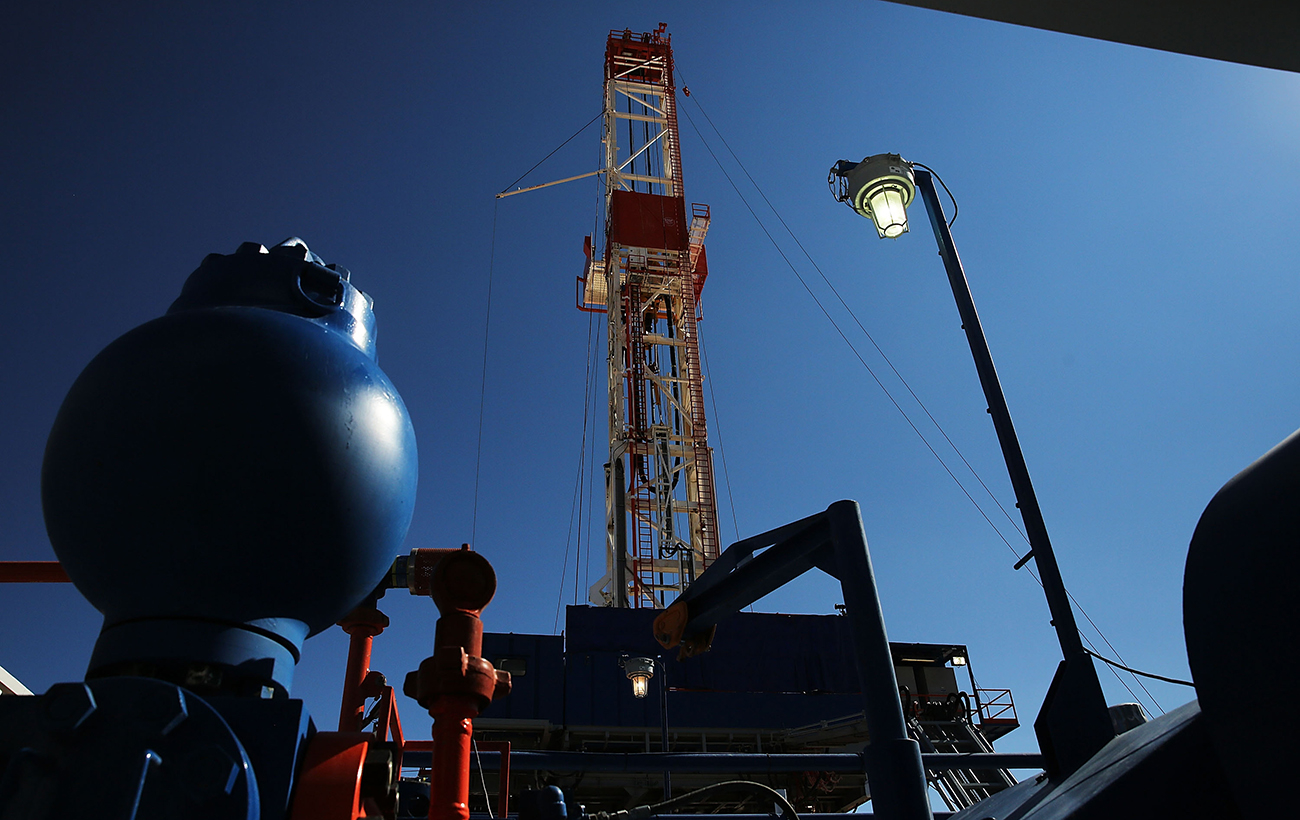

Photo: Gas production companies are making every effort to resume gas production and drill new wells (Getty Images)

Photo: Gas production companies are making every effort to resume gas production and drill new wells (Getty Images)

Drilling gas wells is a fairly expensive investment. According to Oleksii Zaiets, CEO of Smart Energy Group, drilling a single well to a depth of 5,000 meters requires an investment of about $13 million. He also stressed the importance of resuming production in central and eastern Ukraine, in the Poltava and Kharkiv regions (these regions account for 90% of the country's total gas production).

"We especially need to increase production in the Kharkiv and Poltava regions. Why? Because there are network limitations in the gas transportation system, it is impossible to transport gas very quickly from the west (where most of the underground gas storage facilities are located—ed.) to the east. Our gas transportation system works differently," explains the head of Smart Energy Group.

The government recently improved Naftogaz's gas balance by adding new gas produced by Ukrnafta. Since April this year, the Cabinet of Ministers has obliged the company to perform so-called special duties on the gas market and sell the gas it produces to Naftogaz.

Money for gas purchases

The existing capacity of the gas transmission system on the western border is sufficient to import the necessary volumes of gas. There will always be resources on the market for those who are willing to pay the market price for them. Therefore, all the necessary infrastructure and resources are in place for gas imports, and the main issue remains money.

Currently, Naftogaz uses a €270 million loan from the European Bank for Reconstruction and Development and a €140 million grant from the Norwegian government to purchase gas. With the price of gas on the Dutch TTF hub, which is indicative for the European market, at €38 per megawatt-hour (€403 per thousand cubic meters), the available external funds will be sufficient to purchase about 1 billion cubic meters of gas.

According to RBC-Ukraine sources, Naftogaz is currently negotiating additional credit resources of €1.3 billion (€500 million from the EBRD, €500 million from the Norwegian government, and €300 million from the European Investment Bank). If new loans are obtained, Naftogaz will be able to purchase an additional 3.4 billion cubic meters of gas. The company also has its funds. As a result, Naftogaz already has or is negotiating the attraction of financial resources that will allow it to purchase about 4.5 billion cubic meters of gas.

Photo: Naftogaz must find billions to buy gas for the winter (Getty Images)

Photo: Naftogaz must find billions to buy gas for the winter (Getty Images)

Thus, Naftogaz still needs to find money to purchase another 1.5 billion cubic meters of gas. According to RBC-Ukraine's sources, other state-owned companies, in particular the Ukrainian Gas Transmission System Operator, will also import gas in addition to Naftogaz. In response to an RBC-Ukraine request, the state holding company did not comment on the financial resources for gas purchases or the status of negotiations to attract new funds.

***

Positive factors for solving the gas shortage problem include rising prices on the domestic gas market, which will encourage not only Naftogaz but also private companies to import gas. Their volumes will be able to replenish reserves in underground storage facilities.

Today, Naftogaz has picked up the pace of gas imports and pumping into underground storage facilities. According to the European gas storage information platform Aggregated Gas Storage Inventory, in May, gas reserves in Ukrainian storage facilities increased by 1.1 billion cubic meters to 2 billion cubic meters. At the same time, the average daily volume of gas injection was 35 million cubic meters. In June, total reserves increased by 0.65 billion cubic meters to 2.7 billion cubic meters, while the pace of gas injection increased to 44 million cubic meters per day. This dynamic could ensure an increase in gas reserves of 1.3 billion cubic meters each month.

If Naftogaz can agree on the necessary credit resources and maintain the pace of gas imports and injection, then between June and September, it will be possible to add the desired 6 billion cubic meters to underground storage facilities and accumulate the necessary amount of gas before the start of the next heating season.