Exchange rate, prices, salaries: What awaits Ukrainians and economy by year-end

Sergii Marchenko, Denys Shmyhal, Andriy Pyshnyy (collage: RBC-Ukraine)

Sergii Marchenko, Denys Shmyhal, Andriy Pyshnyy (collage: RBC-Ukraine)

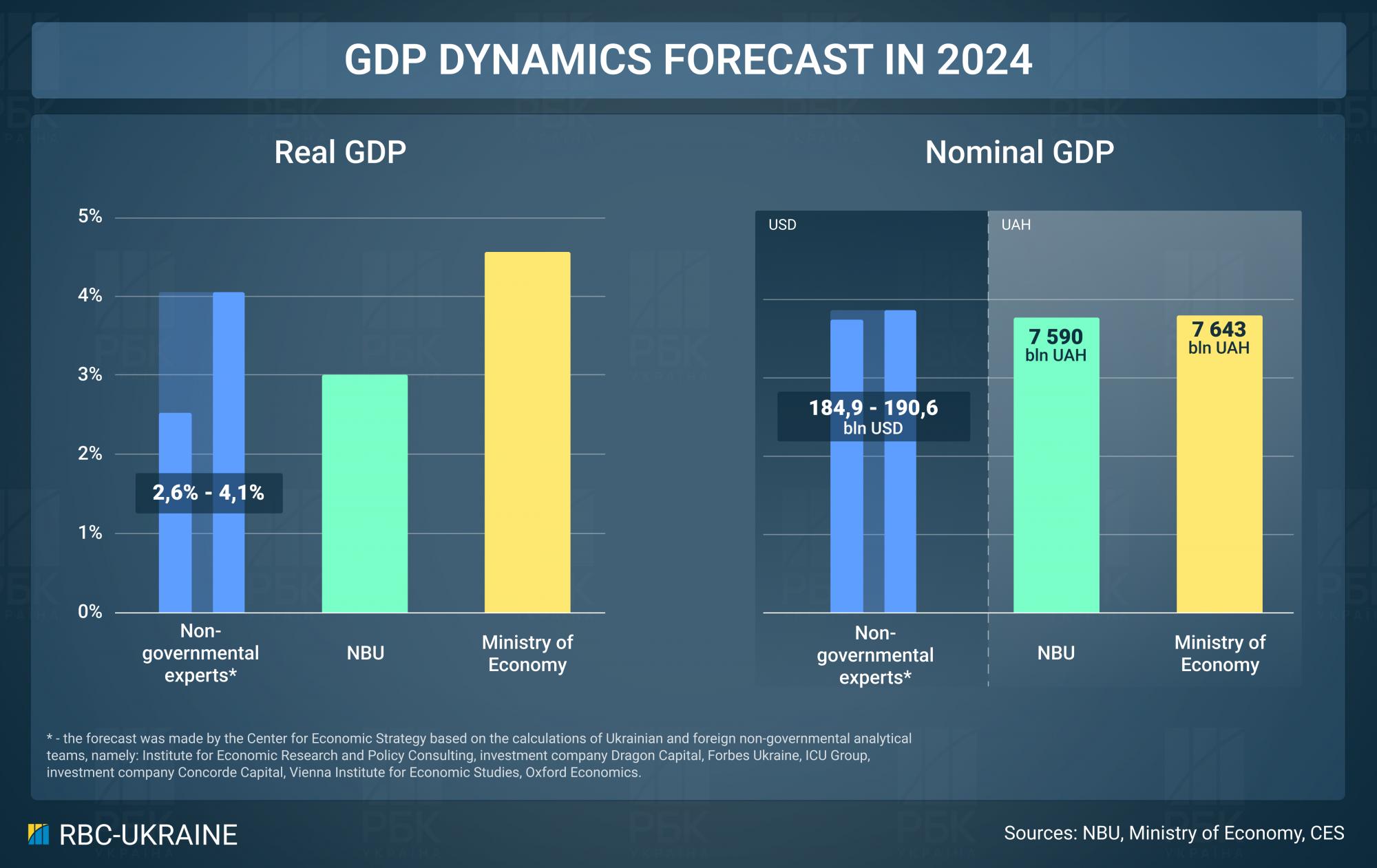

What will happen by the end of the year to the hryvnia exchange rate, Ukrainian salaries, food prices, public finances, business, taxes, economic reforms, and corruption, and what impact will have the war - read in the expert forecasts compiled by RBC-Ukraine.

Contents

- Hryvnia exchange rate, prices, and incomes

- Taxes and business

- Currency restrictions and foreign currency inflows to Ukraine

- Budget deficit

- Real sector

- Investments and war risk insurance

- Banks, loans, deposits, and government bonds

- Public debt and its payments

- Economic reforms and their impact on Ukrainians

Economic forecasting in the uncertainty of war does not seem to be very reliable. RBC-Ukraine tried to add certainty to the future of all Ukrainians for the next six months by collecting exclusive and public expectations of experts and forecasts of the National Bank (NBU).

Hryvnia exchange rate, prices, and incomes

The NBU traditionally does not make exchange rate forecasts, although maintaining the stability of the foreign exchange market remains its task. The NBU aims to ensure that the exchange rate does not threaten to keep inflation at a moderate level in 2024 (despite the expected acceleration), with its further decline to 5%.

The accumulation of a significant level of reserves, positive developments in maintaining US financial support, and the successful completion of the fourth review of the IMF program, the G7 political statement on allocating funds to Ukraine secured by Russia's immobilized assets, and the signing of a loan agreement to the Ukraine Facility strengthen the NBU's ability to ensure a controlled situation in the foreign exchange market.

The NBU will continue to cover the structural shortage of foreign currency in the market to ensure that the exchange rate fluctuates in both directions: not only devaluating but also revaluating.

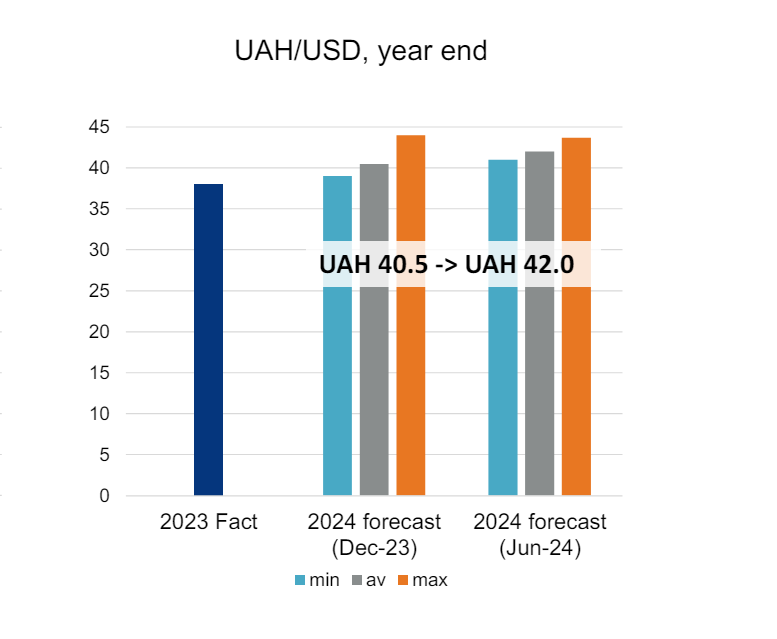

According to Yaroslav Zhalilo, Deputy Director of the National Institute of Strategic Studies, the exchange rate will remain within the expected range. A sufficient inflow of foreign aid will stabilize devaluation expectations and cover the negative balance of foreign trade. Optimistic harvest forecasts plus expected positive trends in the transportation of goods across the Black Sea will increase exports in the second half of the year, which will improve supply on the foreign exchange market, and the traditional wave of devaluation in the fall may be weaker or absent.

A positive trend in recent months is the moderate and controlled devaluation of the hryvnia. It is necessary to reduce the extremely high foreign trade deficit, explains Vitaliy Vavryshchuk, Head of Macroeconomic Research at ICU Group. He forecasts the exchange rate by year-end at 42.3 UAH/USD.

Expert* expectations of UAH/USD exchange rate by the end of 2024

Source: ces.org.ua

* The forecast was made by the Center for Economic Strategy based on the calculations of Ukrainian and foreign non-governmental analytical teams, namely: Institute for Economic Research and Policy Consulting, investment company Dragon Capital, Forbes Ukraine, ICU Group, investment company Concorde Capital, Vienna Institute for Economic Studies, Oxford Economics.

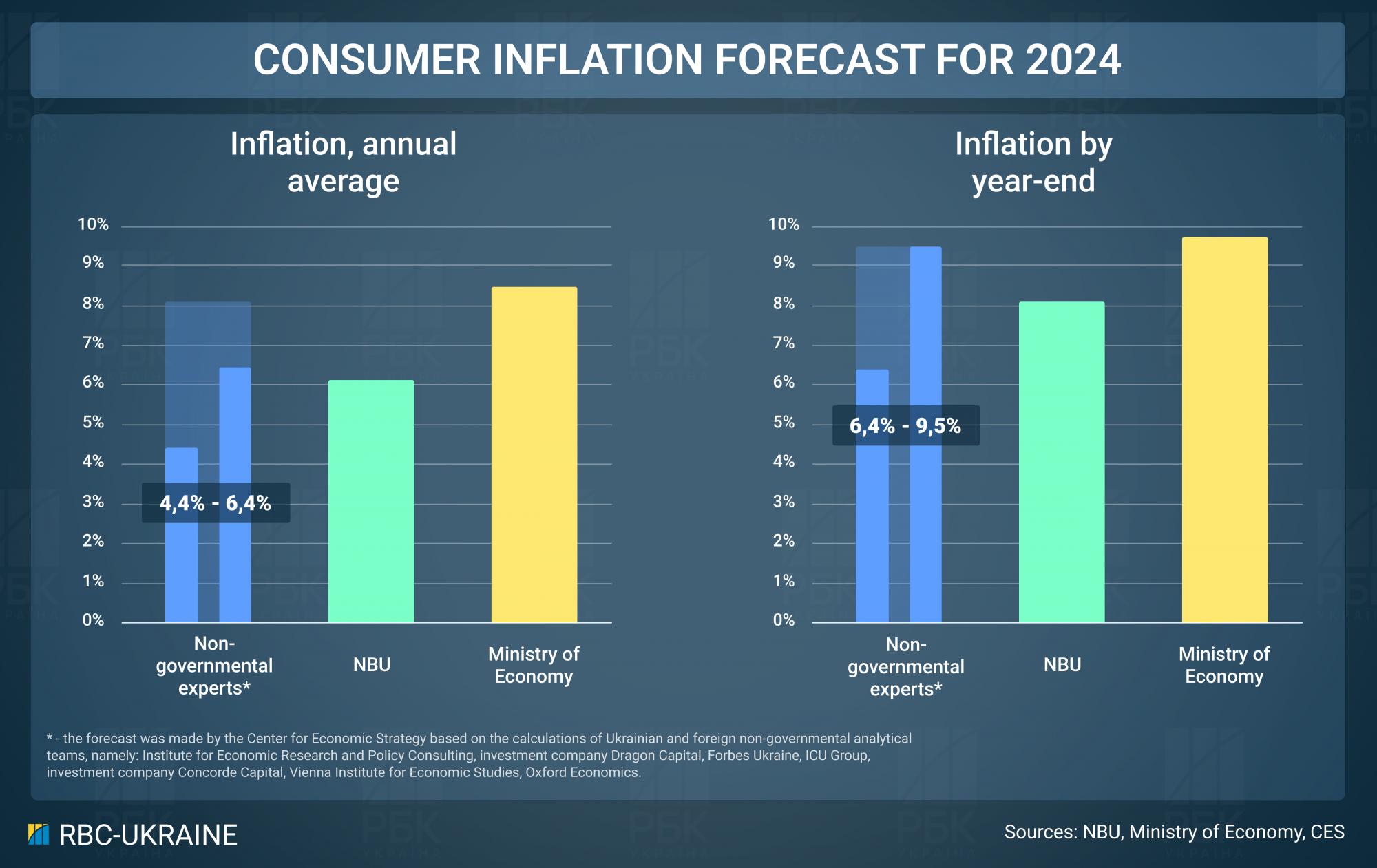

The NBU predicts that inflation will accelerate in the second half of the year. There are objective reasons for this: pressure on business costs amid the war, likely lower harvests this year, wage growth to prices correlation, and higher electricity tariffs. At the same time, the NBU's policy and the moratorium on raising most housing and utility tariffs will limit price growth.

The NBU's April macroeconomic forecast predicted an increase in inflation to 8.2% by the end of the year. Since its approval, new pro-inflationary and disinflationary risks have emerged. For example, a potential increase in indirect taxes and excise duties could have an impact on inflation. On the other hand, positive scenarios may materialize, such as the G7's decision on a new financing instrument for Ukraine based on immobilized Russian assets.

According to Yaroslav Zhalilo's forecast, price growth may accelerate due to additional costs associated with the need to strengthen the energy sustainability of businesses. The effect of rising electricity tariffs and derivative increases in water prices, and possibly heating services, will also be added. Given the limited purchasing power, the growth of regulated prices will limit the possibility of price increases in the market segment.

Vitaliy Vavryshchuk reminds that a positive surprise in the first quarter of 2024 was a sharp slowdown in annual inflation. However, inflation may rise to 6.4% by the end of the year. Low inflation combined with the stability of the foreign exchange market means that there is potential for lower interest rates on loans and deposits.

The NBU states that the economy is recovering, and businesses are stepping up their search for new employees. The number of vacancies on job search sites has been growing rapidly since the beginning of the year, while the number of resumes has declined slightly. In some industries, there is an average of less than one resume per vacancy. According to business surveys, the most critical shortage of workers is in blue-collar jobs, logistics, and retail.

Finding skilled workers is becoming more and more difficult, considering the effects of the war, especially migration and mobilization. The experience, skills, and needs of candidates often do not match the vacant positions. As a result, competition for skilled workers is growing, and businesses are raising salaries.

Because of the war, the tense situation in the labor market will continue for a long time. As the country rebuilds, businesses will compete even more actively for new employees. As a result, unemployment will decline (from 14.2% in 2024 to 11.9% in 2025 and 10.6% in 2026), while wages will grow. In 2025 real wages will exceed pre-war levels.

According to Yaroslav Zhalilo's forecast, the further dynamics of incomes will be moderate, and wage differentiation will increase. As a result, the purchasing power will stagnate. With a slow recovery in economic activity (for example, with widespread power outages), it may decline.

Tymofiy Mylovanov, President of the Kyiv School of Economics and former Minister of Economic Development (2019-2020), states that the labor market is showing signs of gradual recovery, but is still far from pre-war levels. The number of new vacancies has stabilized at around 90% of the 2021 average, and the unemployment rate, although declining, remains high at 15.3% in May 2024. It is expected to decline to 14-14.5% over the next six months.

Personal incomes are showing nominal growth: the average salary in June 2024 amounted to UAH 20,500, which is 23% higher than in 2023. By the end of the year, it is expected to grow to UAH 22,000-23,000. However, real purchasing power remains under pressure due to inflation, which still has a strong impact on real incomes, although forecast to reach 6.4% in 2024 (compared to 12.9% in 2023). The economic difficulties are also evidenced by the fact that 17.4% of the population is forced to save on food.

According to Oksana Kuziakiv, Chief Executive and head of the Сenter for Contemporary Society studies at the Institute for Economic Research and Policy Consulting, the labor market shortage will continue and is likely to increase. Today, this is not yet a dramatic problem for business and the state, as the economy has shrunk. But over time, if the economy starts to grow at a faster pace, the staff shortage may become a large problem. A shrinking economy can also lead to a decline in innovation.

Nevertheless, business sentiment toward the end of the year is surprisingly positive. Business leaders plan to grow and increase production. The rate of growth may slow down, but it will be growing.

Taxes and business

Ukraine is preparing for changes in the tax system because it needs additional funding for the military. The government plans to increase the military tax from 1.5% to 5%, extend it to individual entrepreneurs, and raise VAT by 2-3%. These changes could bring the budget up to UAH 200 billion a year (2.5-2.7% of GDP), but this is not enough to cover military spending, estimated at UAH 400-500 billion. The new tax rates are not expected to take effect until September 2024.

The tax hike is part of Ukraine's commitments to its international partners under the Ukraine Facility plan, which could provide $3 billion in financing from the EU, the US, and the IMF. This is especially important given the projected decrease in international financial assistance to Ukraine in 2025, Mylovanov said. At the same time, the government plans to reform tax and customs authorities to limit their interference in business and restore taxpayer confidence.

Ukraine is facing a difficult choice between the need to increase budget revenues and the risk of an excessive tax burden on an economy that is still recovering from the effects of the war. An alternative to raising taxes is to issue hryvnia, but this is seen as a last resort due to the risks of accelerating inflation and hryvnia devaluation.

Businesses have demonstrated high adaptability and will continue to operate. The structure of economic dynamics drivers is likely to decrease the share of domestic consumption and increase the export factor, public administration spending in the form of military procurement and recovery investments. This will lead to changes in the economy, such as an increase in the share of the defense industry, construction materials production, and construction. Instead, the retail segment and the service sector may decline, Yaroslav Zhalilo predicts. This will be facilitated by the distribution of energy and human resources between sectors.

Physical danger remains the biggest obstacle to doing business in Ukraine, says Oksana Kuziakiv. Surprisingly, there is no deterioration in business sentiment amid the danger. Businesses have obviously adapted to the risks of war.

Medium and large businesses feel best. Small and micro businesses are having a harder time, but there are positive expectations here as well.

Currency restrictions and foreign currency inflows to Ukraine

The NBU notes that currency liberalization remains one of the regulator's priorities. The introduction of currency restrictions and fixing the exchange rate at the beginning of a full-scale war were important decisions that prevented panic and kept the financial system running smoothly. At the same time, such measures are effective for a short period. That is why the NBU has consistently emphasized that these measures are temporary.

Last year, together with IMF experts, the NBU developed a Strategy for easing FX restrictions, moving to greater exchange rate flexibility, and returning to inflation targeting.

The strategy includes a three-stage Roadmap for easing FX restrictions. So far, most of the steps of the first stage of easing restrictions have been completed: the multiplicity of exchange rates has been minimized, the opportunities for business trade operations have been increased, and the ability to repay new loans and partially repatriate new dividends has been ensured. But some transactions are only possible within the limits. Thus, the first stage is still being implemented.

The NBU has launched the second stage of currency liberalization. The regulator has provided opportunities for businesses to partially service old loans received from non-residents, as well as to transfer funds abroad under leasing/rental agreements.

.jpg)

The NBU notes that further liberalization steps will take into account the phasing set out in the Roadmap for easing FX restrictions.

According to Yaroslav Zhalilo, the trend of currency liberalization launched by the NBU is difficult to stop, as it is tied to the obligations to the IMF. Improvement in the situation with external revenues will allow the NBU to maintain the necessary level of interventions to stabilize the exchange rate even in the face of increased demand for foreign currency due to liberalization.

Foreign exchange earnings in Ukraine are expected to be unstable in the short term, but with positive short-term forecasts, states Tymofiy Mylovanov. After a sharp drop in foreign aid to $20 million in May 2024, which was the lowest since the start of the full-scale invasion, the situation has now improved greatly. The receipt of a €1.9 billion tranche from the EU and the expectation of a $2.2 billion IMF disbursement in the near future should temporarily stabilize the country's financial situation.

However, the overall picture remains challenging. Ukraine's need for external financing for 2024 is $38 billion, of which only $11.8 billion has been received as of the end of May. This indicates the need for continued and substantial support from international partners.

In the long term, one can expect changes in the structure of foreign exchange earnings. A likely decrease in grant aid and an increase in the share of loans may lead to an increase in the debt burden.

International aid inflows will remain a key factor underpinning macroeconomic stability, says Vitaliy Vavryshchuk. After the US aid package is approved, Ukraine can expect to receive the necessary resources that will allow the NBU to increase its reserves and make it possible to fully offset any risks in the foreign exchange market.

Yaroslav Zhalilo states that the deficit financing by the proceeds from partners is secured this year. Thanks to the decision to use the proceeds from the seized Russian assets, a financial cushion is being formed for 2025. Instead, funds from labor migrants will continue to decline after families who were recipients left abroad. Currently, the inflow is maintained thanks to volunteer aid, which is also unlikely to grow. The outflow of funds to pay for expenses from card accounts of Ukrainians abroad will probably decrease. The reason is a clarification of the feasibility of social benefits and fewer opportunities to work remotely abroad. Although one can assume an increase in transfers to families of military personnel, whose numbers and incomes are growing.

The NBU notes that the situation with external financing currently looks much better compared to April, given the successful fourth revision of the IMF program and the approval of the G7 political statement on allocating EUR 50 billion to Ukraine secured by Russia's frozen assets.

The signing of the loan agreement to the Ukraine Facility will make it possible to attract up to EUR 27 billion in 2024-2027 to support the state budget out of the total amount of EUR 50 billion of this EU instrument.

The NBU expects that Ukraine will receive a total of about $38 billion from international partners this year. As of June 24, about $11.9 billion has been received. International reserves are projected to reach $42-43 billion by the end of 2024.

Budget deficit

Yaroslav Zhalilo predicts that there will be no problems with financing expenditures. Especially since the "devaluation tax" has improved the possibility of financing expenditures with foreign aid. Revision of the expenditures is likely to be required due to additional defense spending. However, if the economic situation develops positively, this can be accomplished while maintaining the budget deficit target, which may still be underperformed at the end of the year.

Real sector

Currently, the agricultural sector is showing good performance, says Zhalilo. However, the rise in price and difficulty in access to energy may lead to a decrease in production in the fall and winter periods - in livestock, greenhouse farming, etc. Construction, and production in the defense industry and related sectors for the needs of the Defense Forces will grow. Energy-intensive sectors such as metallurgy and chemicals will be in a difficult position. However, their production has already fallen to a great extent due to the effects of the war.

For two months in a row, there has been a certain revival in the production of construction materials, says Oksana Kuziakiv. The future trend will depend on the policies of the state and local municipal authorities. At the moment, we are not talking about investment construction, but primarily about restoration at public expense.

The textile industry is doing well.

One can expect that industries focused on domestic demand, such as the food industry, will continue to be prioritized.

At the same time, uncertainty over the energy situation will continue to harm business. Medium-sized businesses will suffer the most.

Ukraine is expected to see significant growth and diversification of military production, Mylovanov predicts. Substantial investments in the industry are planned: in 2024, Ukraine intends to spend about $1.4 billion on the purchase and development of weapons domestically, which is 20 times higher than the pre-war period. Funding for research and development will increase 8-fold to $1.3 billion.

Cooperation with international partners is expected to expand. Five joint defense enterprises have already been established with Western arms manufacturers, and it is planned to increase this number to dozens. Companies such as Rheinmetall and Baykar are building factories in Ukraine, and other Western manufacturers are considering similar deals. This will facilitate technology transfer and production modernization.

Ukraine seeks not only to increase production but also to develop new types of weapons, including NATO-standard ammunition. Although there are certain limitations related to access to raw materials and technology, experts predict a potential boom in domestic arms production. In the long run, this could turn Ukraine into an important arms supplier for NATO countries, especially given the unique combat experience gained during the war.

Goods exports in 2024 are slightly higher than forecast thanks to higher shipments of grains and oil amid strong demand from China and India. Merchandise exports are expected to grow by 16% to $40.2 billion in 2024, primarily thanks to increased shipments of ore and metals as logistics routes are set.

Imports of goods, like exports, exceeded expectations primarily thanks to higher demand for machine-building products. Among other reasons is the shelling of energy infrastructure. Imports of goods are expected to grow by 8% to $68.3 billion in 2024. This growth will be driven by a wide range of goods as domestic consumer and investment demand grows.

Investments and war risk insurance

Ukraine is actively working to create favorable conditions for attracting foreign investment. The key instrument in this direction is the Ukraine Investment Framework under the EU's Ukraine Facility program with a budget of EUR 9.3 billion. This initiative demonstrates the country's intentions to attract foreign capital, says Mylovanov.

New investor support mechanisms are expected to be introduced shortly, including grants, lower interest rates, and special programs for critical infrastructure and de-occupied regions. Particular attention will be paid to project financing, support for startups, and expanding opportunities for medium-sized investment projects.

Despite the current threats posed by the war, the prospects for attracting foreign investment to Ukraine look encouraging.

The dynamics of foreign direct investment will significantly depend on the security situation in Ukraine, says Yaroslav Zhalilo. However, investor interest will grow, primarily in the defense industry, reconstruction projects, energy engineering, and manufacturing. Storage and processing of agricultural raw materials are potentially interesting for investment.

Further development of insurance is possible through the expansion of international insurance programs. This year, the Export Credit Agency's ability to insure investors' war risks is limited by the agency's budget funding.

Banks, loans, deposits, and government bonds

The NBU assures that banks in Ukraine maintain financial stability and customer trust, boost lending to businesses and households, and are increasingly involved in financing the budget deficit. Although there is still room for market rates to decline, this trend will be more gradual in the future.

Sustained profitability helps banks build up capital. Key inherent risks in banking remain moderate, and capital and liquidity buffers guarantee the continuity of the banking system's operations even in the face of a protracted war.

Lending has not stopped since the first days of the full-scale war, and the loan portfolio has been growing over the past year. Lending conditions are improving, including cheaper loans: over the year, the interest rate on new business loans decreased by almost 4 percentage points to about 16%. The quality of the loan portfolio is improving.

Banks expect growth in lending to businesses and households over the next 12 months and predict an improvement in loan portfolio quality.

Despite the positive trends, banks have not yet fully adapted lending to the conditions of the war economy. Demand for loans is depressed as business expectations have deteriorated due to the higher intensity of hostilities, the destruction of energy infrastructure, and a lack of staff.

A significant need for domestic borrowing will remain, and pro-inflationary trends will encourage the NBU to continue to support the pyramid of certificates of deposit, Zhalilo said. This will ensure a good level of income for the banking system but will keep banks' interest in lending to the economy low. While the NBU's attempts to limit the scope of the 5-7-9 program may be successful, a synchronized increase in market lending should not be expected.

When making its June decision to cut the key policy rate by 0.5 pp to 13%, the NBU took into account that banks' nominal deposit rates would also continue to decline. The regulator expects that interest rates on hryvnia time deposits and government bonds will continue to exceed inflation. This means that households will be able to protect their savings from inflationary depreciation.

In light of a possible acceleration in inflation, the NBU is unlikely to cut the key policy rate significantly, Zhalilo said. This will keep the yields on securities fairly high, as well as the cost of loans, which may curb the downward trend in deposit interest rates.

Vitaliy Vavryshchuk expects the NBU to revise the key policy rate to 11.5-12% by the end of the year. Profits on domestic government bonds will also react and may fall below 14% on one-year securities by the end of the year.

Public debt and its payments

Ukraine is facing the difficult task of restructuring its $20 billion external debt. The current agreement to suspend debt payments expires in August 2024, and without a new agreement, the country risks being on the verge of default, says Tymofiy Mylovanov. The situation is complicated by the need to balance the IMF's demands for debt restructuring with maintaining access to international capital markets. Bilateral allies, including the G7, are providing great financial support, but do not want these funds to be used to pay off debts to private creditors.

The future of the sovereign debt will depend on the outcome of negotiations with creditors, further international support, and the country's ability to rebuild its economy in the face of the ongoing conflict. This situation will have long-term implications for Ukraine's financial reputation and its ability to attract investment in the future. Bondholders, however, are optimistic about Ukraine's financial stabilization, citing increased foreign aid and record-high foreign exchange reserves.

Economic reforms and their impact on Ukrainians

Economic reforms in Ukraine will continue in several key areas, Mylovanov expects. In the field of state property management, a significant reduction in the number of state-owned enterprises is needed - from more than 3,000 to about 100 - through privatization and liquidation. Strategic state-owned enterprises will implement the principles of corporate governance following OECD standards, including establishing independent supervisory boards.

The development of entrepreneurship involves expanding financial support for businesses through microgrant programs and Affordable Loans at 5-7-9%. It is planned to provide Ukrainian entrepreneurs with access to European business support instruments and to continue the digitalization of administrative services. The labor market is expected to launch a full-fledged system of compensation to employers for hiring vulnerable categories of the population, aiming to employ 60,000 people.

In the area of public procurement, the harmonization of legislation with EU requirements and the development of the e-procurement system will continue. The reform of intellectual property rights protection envisages further adaptation of legislation to EU standards, reboot of the National Intellectual Property Authority, and launch of new mechanisms of copyright regulation.

Ukrainians are highly adaptable to the challenges of war. Therefore, the deterioration in consumer sentiment and expectations should not be significant, hopes Yaroslav Zhalilo. Similarly to last year, the bottom of expectations may fall in September-October. Real incomes of the majority of the population will not grow, and purchasing power will stagnate. This may worsen the quality of life of many ordinary Ukrainians. However, the proper functioning of the system of payments to public sector employees and social benefits, as well as the payments to the military, will limit negative trends in welfare.

Sources: public forecasts of the Center for Economic Strategy, as well as exclusive comments of experts of the National Bank, Deputy Director of the National Institute of Strategic Studies Yaroslav Zhalilo, President of the Kyiv School of Economics, former Minister of Economic Development Tymofiy Mylovanov, Chief Executive and head of the Сenter for Contemporary Society studies at the Institute for Economic Research and Policy Consulting Oksana Kuziakiv, Head of the Macroeconomic Research Department at the ICU Group Vitaliy Vavryshchuk.