SWIFT confirms dollar's dominant role in global trade

Photo: The dollar's share of global trade surpassed 50% for the first time (Getty Images)

Photo: The dollar's share of global trade surpassed 50% for the first time (Getty Images)

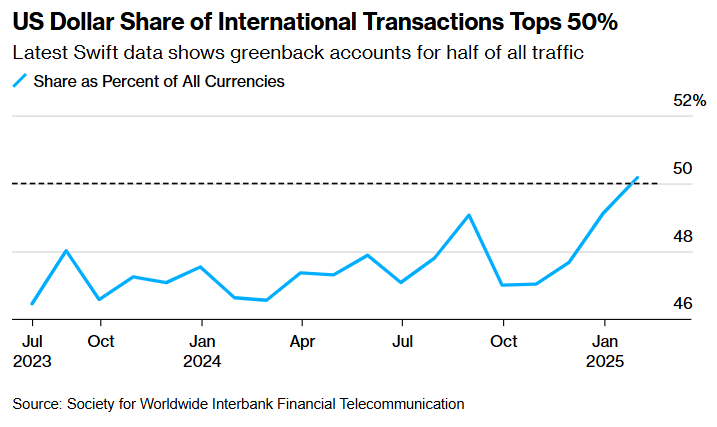

In January 2025, the position of the US dollar in global trade strengthened. Dollar-denominated transfers exceeded 50% of all international currency traffic sent via the Society for Worldwide Interbank Financial Telecommunication (SWIFT) for the first time, Bloomberg reports.

The share of payments worldwide involving the dollar rose to 50.2% in January, compared to 49.1% the previous month. This is the highest level since the Belgium-headquartered consortium revised its method of collecting transaction data in mid-2023.

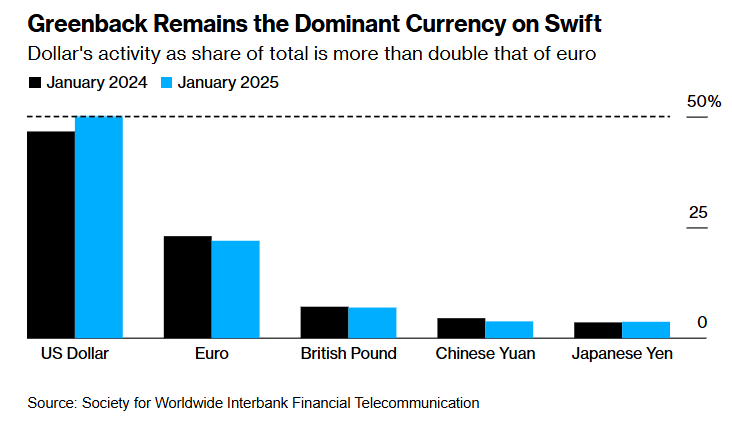

As the world’s primary reserve currency, the dollar continues to account for the largest share of traffic on SWIFT. Over the last approximately 18 months, it has represented about 48% of the total global traffic on average. The second-largest currency, the euro, holds an average share of about 23%, followed by the British pound with 7.1%.

Data on currency exchange rates highlight the economic realities underlying the dollar’s central role in international trade, as debates intensify about finding ways to avoid using the US currency.

“If there’s going to be an alternative to the dollar, it can’t just be as good as the dollar. It has to be better,” said Mark Chandler, Chief Market Strategist at Bannockburn Global Forex.

SWIFT system

SWIFT is used by global banks to send messages to each other while managing currency deals. SWIFT began collecting data in 2010, but figures from July 2023 reflect a technical adjustment in how it tracks figures based on recently revised trade reporting standards.

Of course, not all of the $7.5 trillion-a-day foreign exchange transactions are sent through SWIFT, which in 2022 removed several major Russian banks from the service following the invasion of Ukraine. However, the data shed light on the enormous money flows that drive trade.

According to the latest annual review, published in June 2024, around 11.9 billion trade instructions were sent via SWIFT in 2023. This is more than the 11.2 billion sent the previous year.

BRICS’ failed attempts

In recent years, more and more challengers have been seeking ways to trade without using the dollar or US financial institutions, partly due to Russia’s desire to develop its economy amid harsh sanctions.

These debates have largely revolved around the BRICS bloc, a group of emerging-market economies that includes Russia and China, as well as Brazil, India, and South Africa. The yuan now ranks fourth in the share of total payment traffic on SWIFT, accounting for nearly 3.8% - roughly twice as much as it did ten years ago. The South African rand made up about 0.3% of the total last month. The currencies of Brazil and India did not make it into the top twenty, according to the SWIFT report.

US President Donald Trump focused attention on the role of the dollar in international markets, repeating threats of 100% tariffs for the BRICS group if they shift to their own currency. Although tariffs became a central element of the new administration’s policy, only a few significant actions have taken effect.

Earlier, the National Bank of Ukraine stated that the currency structure of foreign exchange transactions in the Ukrainian market confirms the status of the US dollar as the primary exchange rate-forming currency. Meanwhile, in the segment of bank transactions with customers, the share of euro-denominated transactions in the total volume has been increasing. In particular, in foreign exchange purchases by clients, the share of euro transactions remains above 40%.