Sanctions don't work: Petrodollars flow into Kremlin's coffers growing - Bloomberg

Sanctions against Russia have failed to block flow of petrodollars (Photo: Getty Images)

Sanctions against Russia have failed to block flow of petrodollars (Photo: Getty Images)

Sanctions by the West on the export of Russian oil cannot deprive the Kremlin of revenues to finance the war in Ukraine, meaning that these measures are not achieving one of their main goals, according to Bloomberg.

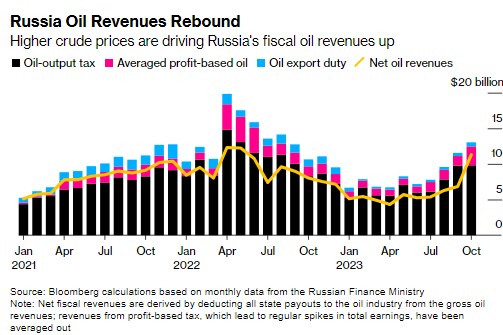

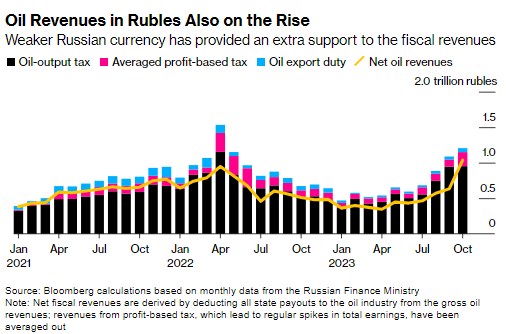

The Russian Ministry of Finance data, whether in dollars or rubles, net or gross, shows that money flow to the state treasury has increased for several months.

As the agency notes, these figures raise questions about whether the Group of Seven countries, especially the United States and Europe, will have to take more aggressive actions if they want to deprive Moscow of oil dollars.

The critical tool for curbing this financing was price restrictions, which prevented Western companies from assisting in transporting Russian oil if it cost more than $60 per barrel. However, this week's research showed that almost every sea shipment exceeded this threshold last month.

According to Bloomberg's calculations based on Ministry of Finance data, Russia's gross income from the three primary tax sources of oil dollars almost doubled from April to October, totaling over $13 billion last month. October revenues exceeded profits for any individual month in 2021 before the invasion of Ukraine caused unprecedented volatility in exports.

Even after deducting significant subsidies to the country's oil refining industry, which jumped to $2-3 billion in August and September, a sharp increase is evident. In October, Russian oil refineries did not receive subsidies for fuel supply to the domestic market, contributing to a significant jump in Russia's net oil revenues for the month.

A representative of the U.S. Treasury stated that while the first phase of price restrictions focused on reducing the amount of income, Russia receives from oil sales, the second phase will focus on increasing the costs Russia must pay to maintain supplies.

To achieve this, the ministry began imposing sanctions on shipping companies and vessels transporting oil sold above the threshold and started looking for ways to increase Russia's expenses for using its shadow fleet.

Initial blow

In December of last year, the European Union practically halted maritime purchases of Russian oil and simultaneously joined other members of the Group of Seven in setting a price limit on the country's exports.

Although the initial blow led to a $25 billion budget deficit in Russia at the beginning of the year, the consequences sharply disappeared.

To counteract Western restrictions, Russia abandoned Western transport and services. This was done using a large shadow fleet of tankers whose ownership rights and insurance status were unclear.

In private, E.U. officials acknowledge that price restrictions are not working correctly. As early as September, U.S. Treasury Secretary Janet Yellen admitted that this approach was losing its edge.

Revenue in rubles

For the Russian government, revenues and expenditures in ruble equivalent are crucial. This determines how easily the country can finance its budgetary expenses, including massive military expenditures due to the war with Ukraine and increased social obligations ahead of the presidential elections in March. And the news for the West is not promising.

The three main levies are the oil extraction tax, the export duty on crude oil and fuel, and the profit tax, which partially replaced the extraction tax for some deposits. The proceeds from these increased to 1.2 trillion rubles in October, the highest level since April 2022. It also exceeded any individual month in 2021.

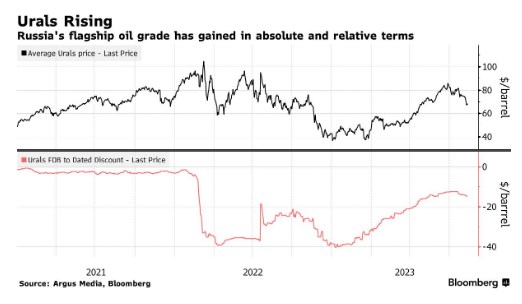

Russia's increased income is happening alongside the rise in the price of Russian barrels in absolute terms and concerning the international benchmark Brent. The ruble's sharp depreciation in recent months has also contributed to increased revenue from the sale of oil denominated in foreign currency.

The Group of Seven price limit prohibited Western companies from providing transportation, insurance, and other services for Russian oil sold above $60 per barrel. According to the Russian Ministry of Finance, the discount on national oil to Brent reached a historic high - over $34 per barrel at the beginning of 2022.

Reducing discount

As clients, especially in China and India, have become accustomed to using the shadow fleet, discounts between flagship Russian barrels Urals and international prices have decreased. Currently, it is approaching $10 per barrel, and Russia expects the gap to fall by another approximately $5.

As part of its effort to increase Russia's expenses, the U.S. Treasury recently imposed sanctions on five tankers for violating the price limit. It also contacted shipping companies for information on approximately 100 tankers transporting Russian oil. It is unclear whether these measures will contribute to a reduction in shadow oil trading.

The European Union is also trying to complicate the sale of tankers beneficially owned by Europeans to the shadow fleet. This could be a problem for the Greek fleet, even though many vessels have already been transferred.

According to data from the Kyiv School of Economics (KSE), almost 30% of Russian oil supplies in October were associated with any organization of the Group of Seven. According to a detailed analysis of exports, almost all Russian maritime cargoes in October were purchased beyond the limit.

Pressure on Russia persists

Seeking to reduce budgetary expenses and save more oil dollars, the Russian government attempted to halve subsidies to oil refineries but faced resistance from the industry.

Total payments were reinstated in October, and oil refineries will start receiving them in November, continuing to exert pressure on Russia's net oil income and affecting the Kremlin's financial flexibility.

The U.S. and its allies also claim that their sanctions had a broader impact on Russia.

According to a statement from the U.S. Treasury last month, the Kremlin spent billions on its fleet, insurance, and overall "alternative ecosystem to sell oil without G7 involvement." "The costs associated with this avoidance keep stacking up," said Eric Van Nostrand from the Treasury.

So far, the Group of Seven does not plan to change the upper limit, and the European Union is considering the possibility of stricter monitoring of the existing threshold as the alliance works on the 12th package of sanctions against Russia.

According to the Ministry of Economic Affairs, due to the overall decline in global oil prices, the average price of Russian oil fell to $80.66 per barrel in October. Nevertheless, it still significantly exceeds the limit of $60 set by the Group of Seven.

In October, Moscow received $18.34 billion from the export of crude oil and petroleum products. Russia's monthly income from oil sales abroad remains near the highest since October 2022.