Russian economic growth hits zero amid Trump tariffs - The Economist

Photo: Donald Trump and Vladimir Putin (Getty Images)

Photo: Donald Trump and Vladimir Putin (Getty Images)

Donald Trump may have a good attitude towards Vladimir Putin, but it is his tariff wars that have kicked him in the teeth, according to The Economist.

Russia's economy slows down sharply

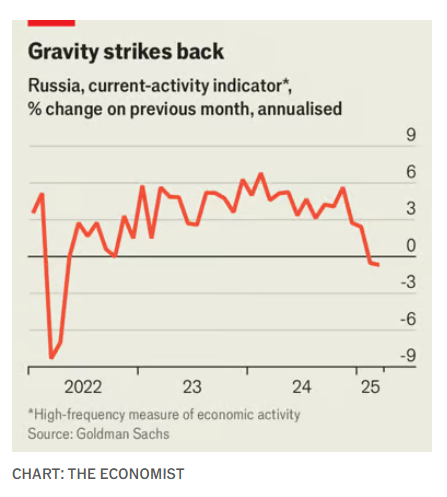

Since the end of last year, the Russian economy has seen a sharp decline. According to a high-frequency index compiled by Goldman Sachs, the annual GDP growth rate fell from about 5% to zero. Similar trends are recorded by the VEB, the Russian Development Bank. Sberbank's business activity indicator also shows a decline.

Although the authorities are being cautious, they recognize the problems: in early April, the central bank noted that many industries have seen a decline in output due to a sharp drop in demand.

After growth, a sharp deceleration

The downturn comes after a period during which Russia's economy was growing despite sanctions and war. This was facilitated by generous budgetary injections, high commodity prices, and the militarization of the economy.

After Russia's full-scale invasion of Ukraine in 2022, analysts predicted a drop in GDP of up to 15%, but the actual decline was only 1.4%. In 2023 and 2024, the economy grew by 4.1% and 4.3%, respectively. Consumer confidence reached record levels.

As it appeared that Trump might give Putin what he wanted to end his war with Ukraine, some expected Russia's economy to accelerate even further in 2025, The Economist writes.

Factor one: completion of structural transformation

The first is related to what the Russian central bank euphemistically calls the structural transformation of the economy.

Russia, which has turned from West to East, has invested enormous resources in restructuring: building military factories, creating logistics chains for trade with China and India, and import substitution. By mid-2024, real investment in fixed assets increased by 23% compared to the end of 2021. Now, according to the Central Bank, this stage is completed.

Military spending is also stabilizing: according to SIPRI analyst Julian Cooper, it will increase by only 3.4% in real terms - a sharp slowdown compared to last year’s 53% growth. This reduces incentives for growth.

Factor two: high inflation

The second factor is high inflation and the central bank’s response. Since the end of 2023, inflation has exceeded the target level of 4%, and in February and March, it exceeded 10%. The reasons are the increase in military spending, mobilization, and the outflow of skilled personnel. In 2023, nominal wages increased by 18%, which forced businesses to raise prices. In response, the Central Bank tightened policy, leaving the key rate at 21% on April 25 - the highest since the early 2000s.

High rates strengthen the ruble, make imports cheaper, and reduce inflation expectations (from 14% to 13%). However, the flip side of this is a fall in consumption and investment. People prefer to save rather than spend. Businesses are reluctant to invest due to the high cost of borrowing.

Factor three: external economic blow

If the matter were limited to the first two factors, the Kremlin could consider the situation manageable. But the third factor - the deterioration of external conditions - has become decisive. The escalation of the US trade war has led to a decline in global growth forecasts and a decline in oil prices. China, the largest buyer of Russian oil, is particularly worrying: the IMF has lowered its GDP growth forecast for 2025 from 4.6% to 4%.

Cheap oil hits budget and markets

The decline in oil prices has already hit the stock market - the Moscow Exchange index has fallen by 10% from its peak, and export revenues have begun to decline. In March, oil and gas tax revenues fell by 17% compared to last year. On April 22, Reuters reported, citing government documents, that a sharp decline in oil and gas sales is expected in 2024.

Notably, the World Bank projects that weaker global growth, driven in part by trade shocks, will push global commodity prices down 12% in 2025 and a further 5% in 2026 to their lowest levels since the 2020s in real terms.

Commodity prices will fall to their 2015-2019 average over the next two years, marking the end of a price boom driven by the post-COVID-19 economic recovery and Russia’s invasion of Ukraine in 2022.

Brent crude is forecast to average $64 per barrel in 2025, down $17 from 2024, and just $60 per barrel in 2026, amid ample supply and falling demand. Oil is currently trading at $63.