Russian authorities accept ruble fall to 100 per dollar - Bloomberg

Photo: The ruble will fall to 100 to the dollar (GettyImages)

Photo: The ruble will fall to 100 to the dollar (GettyImages)

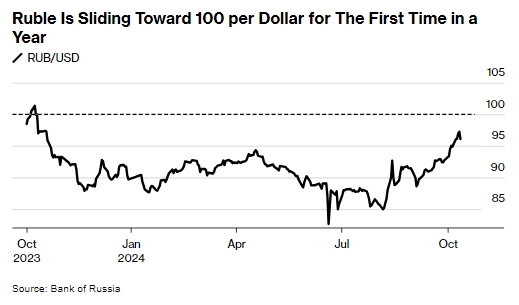

The Russian ruble is falling to the 100-per-dollar mark, but this time the authorities seem to have accepted that they will allow it to reach a level that previously triggered a strong political response, according to Bloomberg.

The agency notes that the weakening of the ruble is not currently a concern, and it will benefit the state budget amid plans to increase spending next year, according to two anonymous sources familiar with the situation. Officials are ready to allow the ruble to reach 100 per dollar.

The Bank of Russia has relied on interbank operations to calculate the ruble exchange rate since the Moscow Exchange halted trading in dollars and euros after the US imposed sanctions on this group in June. The punitive measures exacerbated the shortage of foreign currency, and central bank data shows that the ruble is now about 9% weaker. The deadline for companies wishing to exit exchange operations passed on October 12.

"In the current situation, 100 rubles per dollar isn’t so scary, although it does have a certain inflationary effect," said Oleg Vyugin, a former senior official at the Bank of Russia.

The ruble has also declined over the same period against the Chinese yuan, which has become the main alternative to what the Kremlin considers "toxic" currencies since President Vladimir Putin's invasion of Ukraine in 2022 triggered large-scale sanctions from the U.S. and its allies. The Russian currency has fallen 11% against the yuan on the Moscow Exchange to 13.26, the lowest level since May.

Last year, the ruble twice broke through the 100-per-dollar mark. The central bank responded by raising the key interest rate by 350 basis points at an emergency meeting in August. Then, in October, the government imposed stricter capital controls, requiring 43 exporter groups to repatriate 80% of their foreign currency earnings and sell almost all of it for rubles on the domestic market.

Forecasts from the Ministry of Economy show that the government is planning for a weaker currency: officials expect an average exchange rate of 96.5 rubles per dollar in 2025, compared to 91.2 rubles this year.

Payment issues

Dmitry Polevoy, investment director of the Moscow-based Astra Asset Management company, said the recent weakening of the ruble reflects difficulties with foreign trade payments faced by importers and exporters.

With the growing threat of secondary US sanctions in June against the banks of Russia's key trading partners, businesses face increasing difficulties with payments. They now receive less foreign currency and have more problems repatriating it to Russia from countries like China and Turkey.

The government responded by easing measures that had supported the ruble. The mandatory conversion of export revenue was halved from 50% to 25%. This followed decisions to reduce the repatriation requirement to 60% in June and 40% a month later.

"The government is forced to accommodate exporters," said Natalia Milchakova, an analyst at Freedom Finance Global in Kazakhstan.

According to the Bank of Russia, foreign currency sales by major Russian exporters in September fell by 30% compared to the previous month due to the increase in the share of ruble-denominated settlements.

Immediately after the start of the war, the ruble weakened to about 120 per dollar but quickly recovered as the central bank urgently raised the key rate more than twice to 20% and then gradually eased it.

Now, the rate is again at 19%, and it may return to this peak next week as the central bank seeks to cool Russia's overheated military economy and curb accelerating inflation, which is more than double the target rate of 4%.

According to analyst Milchakova, the bank will have to use monetary policy to offset the collateral damage from the weak ruble, which is high inflation. Vyugin said a low exchange rate is always advantageous for the budget.