Oil prices surge as Israel-Iran tensions flare: What's next?

Photo: Oil prices have risen sharply (Getty Images)

Photo: Oil prices have risen sharply (Getty Images)

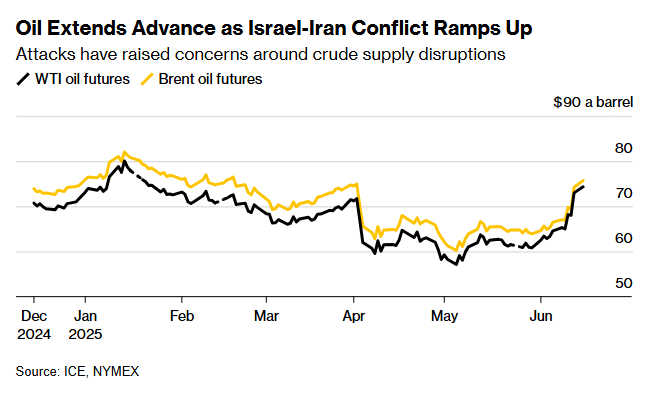

Oil prices rose after Israel and Iran continued their attacks on each other over the weekend. The market is preparing for an escalation that could disrupt supplies from the region, which accounts for about a third of global crude oil production, Bloomberg reports.

Oil prices rise after Israeli attacks

6Brent jumped by 5.5% at the opening of trading, then cut back to $75 per barrel. West Texas Intermediate was trading around $74. The reason for the sharp movement was Israel's attack on Iran's largest gas field, South Pars.

After a series of attacks on Iran's nuclear facilities and military leadership last week, Israel struck at the infrastructure, which led to a halt in production at the platform.

Strait of Hormuz threat worries markets

While the destruction of gas production infrastructure is worrisome in itself, the main focus of the oil market is on the situation around the Strait of Hormuz.

Through this narrow sea route, Middle Eastern countries transport about a fifth of the world's total daily oil production. Any attempts by Iran to block the route would threaten global supplies and could lead to a new round of price increases.

Analysts restrained, but fears remain

According to analysts, further growth in oil prices will be possible only in the case of blocking the Strait of Hormuz or the activation of the Houthis in Yemen. Robert Rennie, head of commodities and carbon research at Westpac Banking Corp, said that the current volatility remains within the expected range.

He emphasized that the price of Brent is likely to remain below $80 per barrel if the situation does not worsen.

Financial markets under stress

The deteriorating situation in the Middle East has caused a wave of panic in the markets. On Friday, oil prices spiked by more than 13%, but later adjusted downward. Investors began to move capital into safe-haven assets such as gold and Treasury bonds.

Amid the escalation, Iran canceled the talks with the United States scheduled for Sunday, which were to take place in Oman.

Explosion and fire in South Pars

According to Iran's Tasnim news agency, an Israeli strike caused a massive explosion and subsequent fire at a processing plant associated with South Pars. The gas produced at this field is mainly used domestically, and its exports are limited. However, the production process also produces so-called condensate, which Iran actively exports abroad.

Economic consequences for Iran

Attempts to block the Strait of Hormuz could have serious consequences for the Iranian economy itself. China is the largest importer of Iranian oil, and any interruptions in supply will hit Tehran's budget.

According to Kpler analyst Muyu Xu, closing the strait does not make economic or political sense and would be an extremely risky move.

Prices recover yearly losses

Although the oil export infrastructure has not yet been affected, the tensions have already affected quotations. Oil prices have almost completely recovered the positions lost since the beginning of the year.

At the same time, the market is taking into account the impact of factors such as former President Donald Trump's trade policy and a possible increase in production under the OPEC+ deal.

Signals from market point to long-term risks

Futures markets have seen an increase in indicators reflecting expectations of future supply. The gap between the two closest December contracts reached $1.29 per barrel, reaching $3.48.

This indicates growing fears among market participants about possible long-term instability in the region.

Trump's statement on possible deal

US President Donald Trump has suggested that Israel and Iran could theoretically agree to end the conflict. However, he noted that the parties could continue the armed confrontation first. "Sometimes they have to fight it out, but we’re going to see what happens," he told reporters at the White House.

Possible blockade of Strait of Hormuz is the main risk factor

Mukesh Sahdev, an analyst at Rystad Energy, said that a potential blockade of the Strait of Hormuz by Iran remains a key risk for oil markets. He emphasized that such a scenario could lead to unprecedented destabilization. At the same time, he said, there are no signs that Iran is ready for such a radical step.

The main factor that affects the price of gasoline and diesel fuel in Ukraine is global oil prices, as Ukraine has been importing almost all of its fuel since the beginning of Russia's full-scale invasion of Ukraine.

Read more about the impact of the conflict on Ukraine in RBC-Ukraine's article.