India to cut Russian oil significantly after US sanctions — Bloomberg

Photo: India to stop buying Russian oil after US sanctions (Getty Images)

Photo: India to stop buying Russian oil after US sanctions (Getty Images)

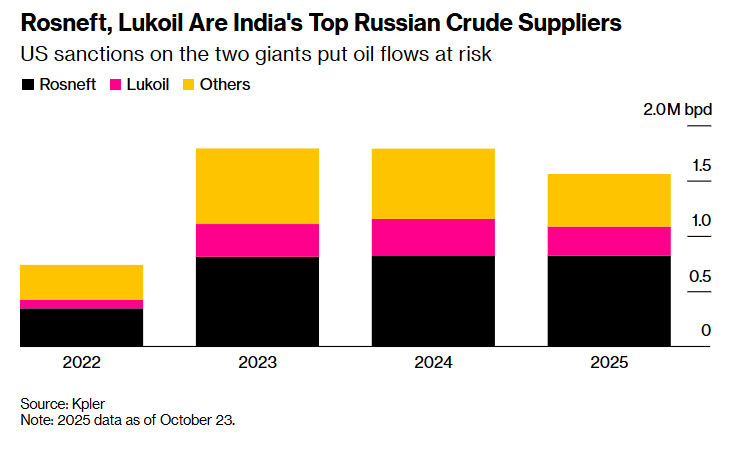

Russian oil flows to India, which rose sharply after Russia invaded Ukraine, will soon be reduced to almost zero. This will occur after the US imposes sanctions on Rosneft and Lukoil, according to Bloomberg.

Executives at Indian refineries said that the new restrictions announced by Washington would effectively make further deliveries impossible.

Senior executives say that after the blacklisting of Russia's largest producers, it will be extremely difficult to continue imports.

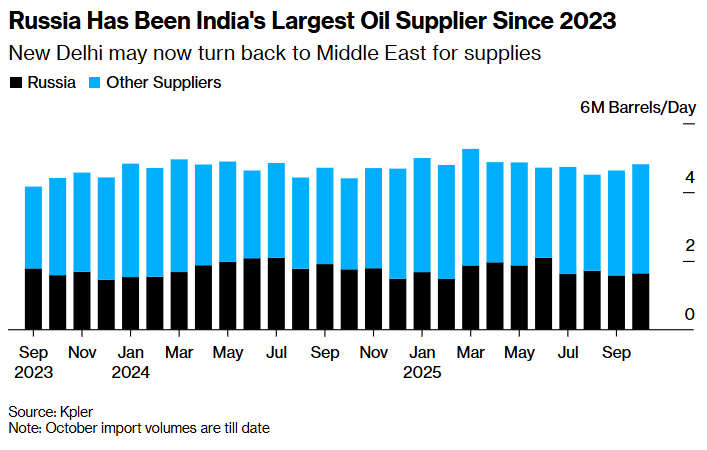

Since the beginning of the year, Russia has accounted for more than 36% of all oil supplies to India, according to the analytical company Kpler. This irritated President Donald Trump and became an obstacle in trade negotiations after the introduction of increased tariffs in August.

How India became the largest buyer of Russian oil

Historically, India has purchased almost no oil from Russia, preferring supplies from the Middle East. However, the situation changed in 2022 after Russia invaded Ukraine and the introduction of a price cap of $60 per barrel by the G7 countries.

The restrictions were intended to reduce the Kremlin's revenues but maintain supplies to the world market. India refused to buy oil from Iran and Venezuela, which are under US sanctions, while Russian oil remained permitted and cheap, leading to a sharp increase in imports.

Washington's decision and exception for Nayara Energy

The new decision by the Trump administration, which had previously avoided sanctions against Moscow, has now directly hit the main oil flows from Russia. This halts trade at a time when Indian oil companies have just returned to work after the Diwali celebrations.

The only exception may be Nayara Energy, an Indian oil refining company backed by Rosneft. After the EU sanctions came into force in July, it operated exclusively on Russian raw materials.

In the short term, the sanctions mean that orders planned for the coming week will now be placed mainly with other suppliers. Negotiations on Urals shipments have been stalled since mid-October, when Trump said that Prime Minister Narendra Modi had promised to stop buying Russian oil.

India seeks new sources of supply

"With this sanctions move, the Indian refiners may have to pull back way faster," said Vandana Hari, founder of Singapore-based analytics firm Vanda Insights. According to her, it will be easier for India to adapt than China, as it did not purchase Russian oil until 2022.

India remains the largest buyer of Russian seaborne oil, but Washington's new measures have already caused turmoil in the Chinese oil industry.

"This is definitely one of the more meaningful measures the US has taken, but I think it will be blunted by the widespread use of illicit financial networks," said Rachel Ziemba, an analyst at the Center for a New American Security. "So it really comes down to whether China and India are afraid of further escalation in secondary sanctions."

Who will be affected by new restrictions

State-owned companies Indian Oil Corp., Bharat Petroleum Corp., Hindustan Petroleum, and Mangalore Refinery did not respond to Bloomberg's inquiries. They usually buy oil on the spot market.

The largest private player, Reliance Industries, which has a long-term contract with Rosneft, also declined to comment. Representatives of Nayara Energy, which accounts for 16% of Russian oil imports to India this year, did not respond to journalists' inquiries.

The US has imposed tough sanctions on Russian oil companies Rosneft and Lukoil.

After the sanctions were imposed, Brent crude futures rose 3% to $64.5 per barrel. Oil is currently significantly cheaper than it was for most of 2025.