Bitcoin jumps over $45,000, highest point since April 2022

Bitcoin jumps over $45,000 (Getty Images)

Bitcoin jumps over $45,000 (Getty Images)

Bitcoin has reached its highest point since April 2022, stopping at $45,922 and marking a remarkable 156% gain in the previous year, according to Reuters.

It is the world's biggest cryptocurrency's best performance since 2020, but still a way off its record high of $69,000 in November 2021. On December 2023, bitcoin surpassed the $40,000 mark for the first time in 2023.

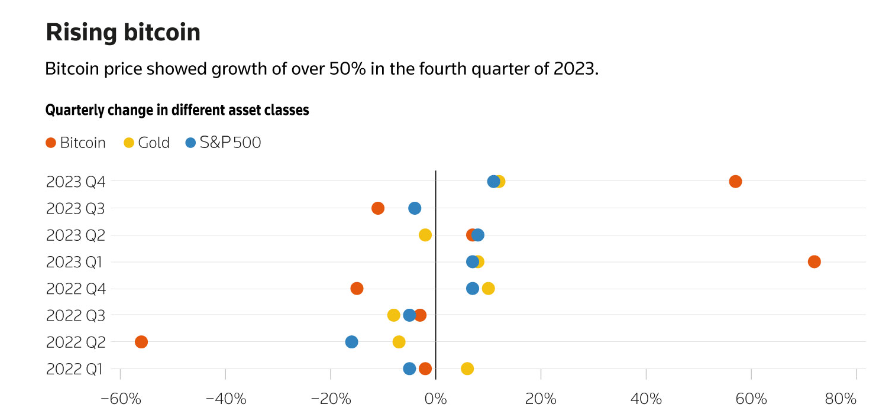

Bitcoin surge (LSEG Workspace, LSEG Datastream/ Reuters)

The second-largest cryptocurrency, ether, also saw a 1.2% increase, reaching $2,386.50 after a 91% surge in 2023.

Surge in stocks

Stocks related to cryptocurrencies, mirroring bitcoin's movements, experienced a surge. Companies like Riot Platforms, Marathon Digital, and CleanSpark saw gains between 7% and 10% following significant drops on the last trading day of 2023. Software firm MicroStrategy, known for investing in bitcoin, saw a 13.4% increase, and the ProShares Bitcoin Strategy ETF, tracking bitcoin futures, added 7.8%.

U.S. approving bitcoin exchange-traded fund

Investors are growing more optimistic about the U.S. Securities and Exchange Commission approving a bitcoin exchange-traded fund as it could open up the market to millions of new investors and attract significant investments. Traders express excitement over the possibility of an ETF approval in the United States. However, opinions among cryptocurrency analysts vary on the issue.

"Some analysts from cryptocurrency trading platforms believe that even if the ETF is approved, bitcoin may not immediately experience a significant rally," said Ryan Lee, chief analyst at Bitget Research.

Cryptocurrencies have also benefited from rising expectations of major central banks cutting interest rates this year. This positive trend has helped overcome the uncertainty after the failures of FTX and other crypto businesses in 2022.

Looking ahead, there are optimistic expectations for crypto markets in 2024. Markus Thielen, founder of digital asset research firm 10x Research, notes a correlation with bitcoin's halving cycles in 2012, 2016, and 2020.