Trump tanks the dollar: Biggest drop since the early 1970s

The dollar is falling the fastest in history under Trump (archive photo by Getty Images)

The dollar is falling the fastest in history under Trump (archive photo by Getty Images)

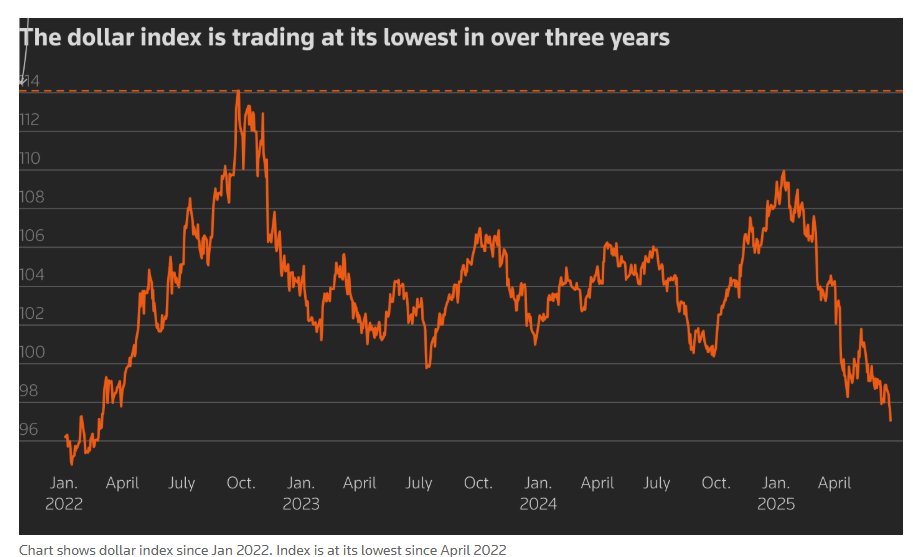

The dollar fell to a three-year low against global currencies. The rate of decline over six months is close to the highest in recent history, reports Reuters.

The dollar sell-off continued after The Wall Street Journal reported that US President Donald Trump wants to announce the replacement of Federal Reserve Chair Jerome Powell by September or October. Powell's term expires in May 2026.

This has led to the dollar dropping by more than 10% over the year. If this continues in the coming days, it will be its biggest drop in the first half of the year since the early 1970s, the era of free-floating currencies.

The euro jumped 0.6% to $1.173, its strongest since 2021.

No good way out for the dollar

“The striking thing on the dollar trend of the last six weeks is that in almost any market regime the dollar is struggling to appreciate,” said Michael Metcalfe of State Street.

According to him, it seems that there is some kind of structural decline, and investors are now the most negative about the dollar.

Euro traders were also encouraged by the outcome of the NATO summit, where the alliance member states agreed to spend 5% of GDP on defense, 3.5% of which will be spent on troops and weapons, and 1.5% on softer defense-related measures.

The Swiss franc strengthened to a ten-year high, while the Japanese yen also strengthened again to below 144 per dollar.

Expectations are growing that the Fed will soon cut interest rates in the US again after recent mixed data, but Trump's criticism of the Fed for not acting fast enough is also growing.

“I think it’s a given that Trump's pick to succeed Powell, when it comes, will be one that sits at the highly dovish end of the spectrum and will support Trump's agenda of lowering interest rates,” said Tony Sycamore, market analyst at IG.

The problem is that it will again raise questions raised earlier in the year about the Fed's independence, which undermines confidence in the Fed and the US dollar.

The dollar index and oil

The dollar index, which measures the US currency against six other currencies, is now at its lowest level since March 2022 after its plunge this year.

On the commodities front, oil prices rose after a sharp drop that followed the Trump-brokered ceasefire earlier this week between Israel and Iran. Brent crude futures rose 0.37% to $67.9 per barrel.

The rise in the euro led Ukrainian banks to raise their selling rate above 49 hryvnia per euro.

On the interbank market, the euro rose to 48.56-48.60 UAH/euro. As a result, the official NBU exchange rate may update its historical high today.