Russia expects drop in main source of income for warfare

Russia's oil and gas revenues will drop within three years (Getty Images)

Russia's oil and gas revenues will drop within three years (Getty Images)

The Russian government is forecasting a fall in revenues from oil and gas sales over the next three years due to falling energy prices and a more lenient tax regime for Gazprom, according to Bloomberg.

According to a draft three-year budget reviewed by the agency, this key source of Kremlin financing is expected to shrink by 14% between 2024 and 2027, impacting Russia's war against Ukraine and its growing military expenditures.

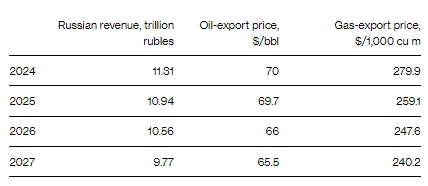

The government predicts that Russia’s oil and gas sector will contribute 10.94 trillion rubles ($118 billion) in taxes to the state treasury next year, which is 3.3% less than the forecast for 2024. Annual revenues are expected to continue falling over the following two years, reaching 9.77 trillion rubles by 2027, according to the documents.

Oil revenues have been helping the Kremlin sustain its military aggression against Ukraine for a third consecutive year, despite Western countries funneling billions of dollars in military aid to Kyiv and imposing multiple rounds of sanctions aimed at curbing Russia’s energy export revenues. Russia has circumvented these restrictions by assembling a shadow fleet of tankers to deliver oil and liquefied gas to new customers in Asia.

The latest forecasts of declining revenues reflect a weakening of global energy markets. The average export price of Russian crude oil is expected to drop below $70 per barrel next year, while the average contract prices for gas exports are also projected to fall through 2027.

https://www.bloomberg.com/

In the long run, oil may become even cheaper as demand shrinks and renewable energy sources gain popularity. The documents praise the efforts of OPEC+, led by Saudi Arabia and Russia, to restore balance to oil markets by cutting production.

Tax reductions

Another factor contributing to the anticipated reduction in Russian budget revenues from oil and gas sales next year is a plan to ease the additional tax burden on Gazprom, which has long been a primary source of funds for the government.

After the invasion of Ukraine, the Russian gas giant slashed most of its pipeline exports to Europe, previously its largest foreign market. This decision resulted in Gazprom's first net losses since the early 2000s in 2023. However, the government imposed a gas extraction tax on the producer, expecting to receive an additional 50 billion rubles per month from the company between 2023 and 2025.

Documents now show a plan to ease the tax burden on Gazprom. If adopted, the softer fiscal regime would reduce Russia's tax revenues from gas extraction by more than 30% compared to the previous year, down to just over 1 trillion rubles in 2025, according to Bloomberg’s estimates based on the draft.

However, the tax breaks could improve Gazprom’s financial performance, which began to recover earlier this year. If Gazprom resumes dividend payments, it could offset some of the lost state revenues, as the government is the company’s largest shareholder.

It’s worth noting that Russia plans to increase military spending by a quarter in 2025, reaching $142 billion. In 2025, spending on national defense and internal security will account for around 40% of the total Russian budget, more than the combined spending on education, healthcare, social policy, and the national economy.