Oil prices drop amid Trump's plans to launch trade wars on multiple fronts

Photo: Oil prices fall due to Trump's intention to unleash trade wars (Getty Images)

Photo: Oil prices fall due to Trump's intention to unleash trade wars (Getty Images)

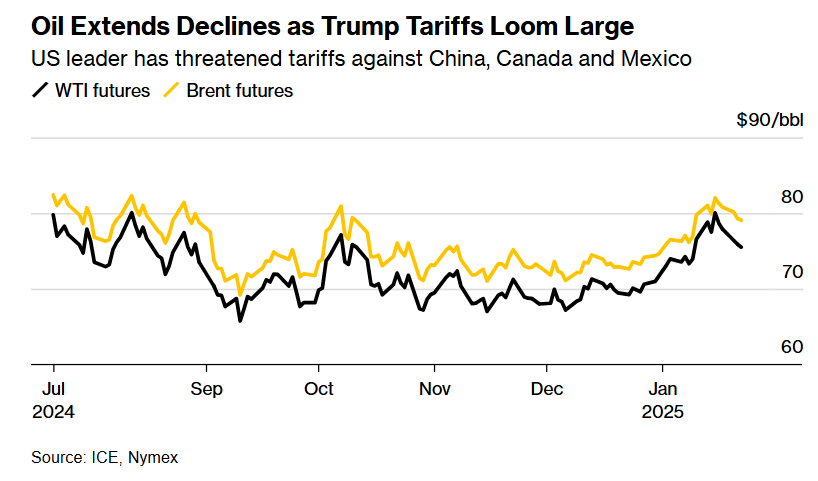

Oil prices have dropped following US President Donald Trump's threat to impose tariffs on China, sparking fears of trade wars on multiple fronts. Earlier, Trump announced plans to introduce tariffs on Canada and Mexico, Bloomberg reports.

Brent crude fell to nearly $79 per barrel, while West Texas Intermediate dropped below $76. Trump stated he is considering a 10% tariff on China in response to the flow of fentanyl from the country. Meanwhile, Canada has increased crude oil exports to the US to circumvent potential tariffs.

https://www.bloomberg.com/

Trump's first day in office began with sweeping executive orders, including a review of US energy policy and the threat of imposing tariffs of up to 25% on Canada and Mexico. Both countries are major exporters to the US, including crude oil processed in American refineries.

According to Rystad Energy, Canadian suppliers are trying to "push as much volume out of the market as possible" before the tariffs take effect. Goldman Sachs Group Inc. warned last year that the tariffs, which Trump suggested could be introduced as early as February 1, would lead to higher gasoline prices for US consumers.

Oil prices remain higher this year, bolstered by broad US sanctions against Russia that have disrupted physical oil and tanker markets. Trump stated he would likely impose additional sanctions on Moscow if Vladimir Putin refuses to engage in negotiations on Ukraine.

"The oil market's attention is slowly turning away from Russian sanction risks to the very real risk of an escalation in trade tensions," said Warren Patterson, Head of commodities strategy for ING Groep NV in Singapore.

The threat of tariffs also supports the US dollar, he added.

Oil prices

The World Bank forecasts a decline in commodity prices in 2025-2026.

According to the World Bank, the average price of Brent crude oil in 2024 is expected to be $80 per barrel - about 3% lower than the previous year but 40% higher than the 2015-2019 average.

Under its baseline scenario, Brent crude prices are projected to fall further, averaging $72 per barrel in 2025 and $71 per barrel in 2026.

The expected price decline will be driven by increased supply from non-OPEC+ countries, primarily Brazil, Canada, Guyana, and the US, combined with moderate growth in global oil demand due to slowing consumption in China and developed economies.

Since the start of the war, Ukraine has imported its entire gasoline supply, making fuel prices at Ukrainian gas stations largely dependent on global oil prices.