Global dollar's role in international payments rises to a record level - SWIFT

The dollar has updated its record for transaction count (Photo: Getty Images)

The dollar has updated its record for transaction count (Photo: Getty Images)

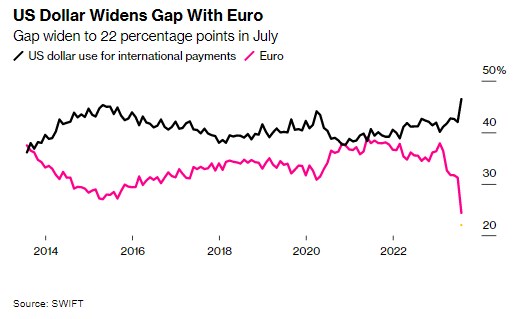

In July 2023, the percentage of the dollar in international payments increased to 46.46%, compared to just over a third a decade ago, according to Bloomberg.

The dollar remained the top currency by transaction count, followed by the Euro at 24.42%, the British Pound at 7.63%, the Japanese Yen at 3.51%, and the Chinese Yuan at 3.06%.

Global banks use SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, to communicate with each other and facilitate interbank currency transactions.

The information collected by SWIFT, such as around 200 million annual confirmations of currency transactions, provides insights into global flows since the consortium began collecting them in 2010.

While SWIFT's data does not cover the entire currency market, it confirms the notion that the role of the dollar in international finance remains stable—even as some efforts towards greater diversification emerge, such as from the BRICS countries.

The increase in the dollar's share in SWIFT transactions primarily occurs at the expense of the Euro, whose share peaked at 46% in 2012. Last month, the percentage of the European single currency in operations was at its lowest in the history of observations.

www.bloomberg.com

SWIFT data also shows an increasing frequency of transactions involving the Yuan as the Chinese currency gradually becomes more integrated into global currency flows. In July, over 3% of SWIFT instructions were Yuan-related for the second time in history, compared to around 0.03% in 2010.

BRICS' efforts to weaken the dollar's role

The leaders of the BRICS group of major third-world countries will focus on reducing dependence on the dollar at their summit in Johannesburg.

The share of BRICS countries' currencies on a global scale is small. According to IMF data, 60% of international currency reserves are held in US dollars. This is less than the roughly 70% in 2000, but still much higher than any competitor. The Euro follows next (around 20%), followed by the Yen and the British Pound.

Seven years after the International Monetary Fund added the Yuan to its basket of reserve currencies, its share remains a tiny portion at 2.6%.